How to Buy Shares in Nigeria–Your Comprehensive Guide

by Counseal Team

Updated March 15, 2024

If you’re looking to make your money work for you in Nigeria, investing in shares can be an attractive proposition. But you might wonder, “How exactly do I buy shares in Nigeria?” Well, you’re in luck. We’ve curated this comprehensive guide to divulge all the ins and outs of buying shares in Nigeria.

What Are Shares and Why Are They Important?

Essentially, Shares give you a slice of a company’s profits and power. As a shareholder, you’ll have the right to dividends, a share in the company’s profits, and the potential for capital appreciation.

What does this mean for you? In simple terms, owning shares can be a great way to build wealth over time. But remember, it’s not always smooth sailing. The market can be volatile, so it’s important to do your homework before diving in.

Investing in shares can often feel like navigating a labyrinth, especially if you’re new to the Nigerian Stock Exchange (NSE), the country’s primary hub for buying and selling shares. But don’t worry, we are here to guide you through the basics.

What You Need to Know Before Buying Shares in Nigeria

So, you’re sold on the idea of investing in shares. But, how do you go about buying them in Nigeria? Here’s a step-by-step guide:

Investing in shares can be a rewarding way to grow your wealth. But, like any investment, it’s not without its risks. Ensure you do your due diligence before jumping in. Ultimately, the decision to invest should align with your financial goals and risk tolerance.

But before you start investing, let’s look at the types of shares you can invest in.

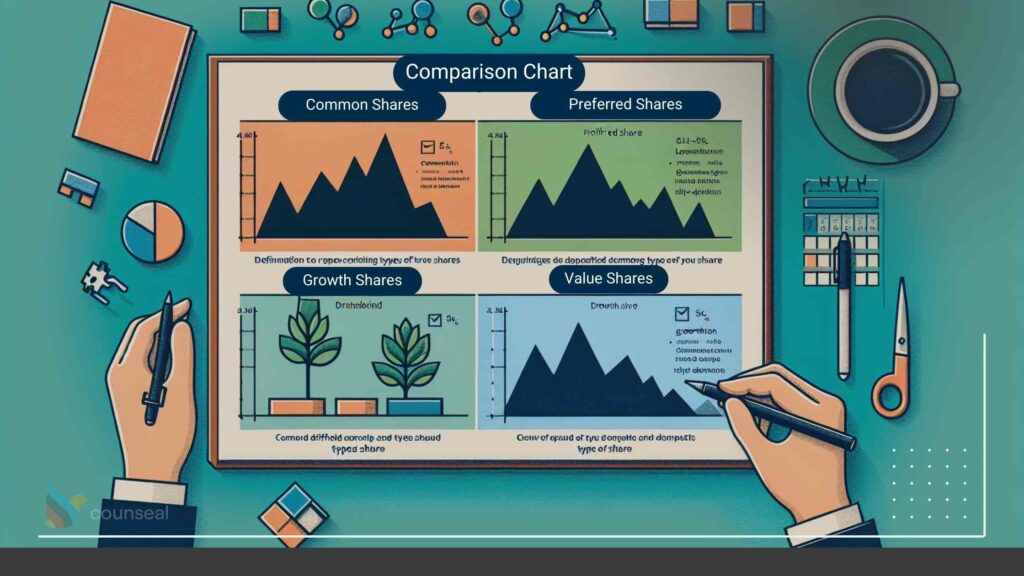

Types of Shares

In the world of investing, there are different shares you can invest in. Your options range from common shares or ordinary shares, preferred shares, growth shares, to value shares. But what does this mean?

- Common shares give you a vote at company’s meetings and a right to dividends.

- Preferred shares offer a higher claim on earnings and assets.

- Growth shares are the most exciting for many investors. These are shares in companies expected to grow at an above-average rate compared to other companies on the market.

- Lastly, value shares are stocks that are considered undervalued, a steal if you will, and are ripe for investment.

Choosing Shares: Factors to Consider

When choosing shares, there are four (4) factors you need to keep your eyes on. These include earnings, dividends, price, and valuation. How much is the company earning? How much dividends does it pay to shareholders? What is the current market price of the share? And is the share overvalued or undervalued based on its earnings?

The answers to these questions will give you a clearer view of the company’s financial health, its attractiveness to investors, and its potential for growth and profitability.

Investing in shares can offer high returns, especially if you buy shares in a company that grows and performs well.

Now that we have looked into the factors for considerations, we will look towards the legal regulatory framework governing shares.

Legal and Regulatory Maze

Before you can dive into the world of shares, you need to understand the legal and regulatory landscape. This is where the Securities and Exchange Commission (SEC), the Central Securities Clearing System (CSCS), and the Nigerian Inter-Bank Settlement System (NIBSS) come into play.

The SEC is the top dog, overseeing the capital market in Nigeria. The CSCS acts as the depository and clearing house for the NSE, while the NIBSS provides a platform for electronic payment and settlement.

Furthermore, you also need to be mindful of the tax, and fees associated with buying shares. These include stamp duty, VAT, and commission.

Pro Tips for Buying Shares in Nigeria

Now that you’re familiar with the terrain, it’s time to strategize. Start by setting your investment goals and objectives. Are you investing for the short-term or long-term? What level of risk are you comfortable with?

Next, do your homework. Research the market, the company, and the shares you’re interested in. Don’t put all your eggs in one basket. Diversifying your portfolio can reduce risk.

Monitor your performance regularly and, if needed, review your strategy. Lastly, don’t hesitate to seek professional advice and guidance. It can make a world of difference in your investing journey.

There you have it. The world of shares, demystified. Ready to take the plunge? Let’s delve into brokerage accounts.

Understanding Brokerage Accounts and Their Benefits

Think of a brokerage account as your gateway to the Nigerian Stock Exchange (NSE). It’s like getting the keys to a treasure chest, containing all the goodies the NSE offers. But how does it work?

In layman’s terms, a brokerage account is an account that lets you buy and sell shares via a broker. Here’s the fun part: A broker is a certified and registered intermediary who does the trading on your behalf in the NSE. It’s just like having a personal shopper, but for stocks and shares!

Owning a brokerage account isn’t just about buying and selling shares, it’s about funding your transactions and receiving your proceeds. It’s about having a direct line to the NSE. It’s about taking control of your financial future.

How to Open and Fund a Brokerage Account in Nigeria

Now that you’ve seen the value of a brokerage account, you’re probably wondering, “How do I get in on this?” Let’s break it down:

1. Choose a broker: The first step to opening your brokerage account is finding a broker who fits your needs and preferences. You need a broker who’s not just reputable, but reliable. Remember, they’re handling your money!

2. Application Process: Next, you’ll need to fill out an account opening form and submit the necessary documents. It’s like applying for a job, but this time, you’re hiring your money to work for you!

3. Identity Verification: Once your application is in, it’s time to verify your identity and activate your account. It’s a critical step to ensure your account’s safety and integrity.

4. Fund your account: After verification, it’s time to fund your account. You can do this via bank transfer, card payment, even USSD! The choice is yours.

5. Get Started: Finally, you’ll receive your account details and login credentials. Then, it’s time to dive into the world of trading!

Practical Examples: Opening and Funding a Brokerage Account in Nigeria

To make this process even clearer, let’s look at some examples.

1. Yochaa: Yochaa is known for its simplicity and user-friendly platform. To open an account, you need to fill out their application form, submit your documentation, and verify your identity. Once these steps are completed, you can fund your account and start trading!

2. Cordros: Cordros offers a broad range of investment opportunities. Just like Yochaa, you need to complete an application form, submit your documents, and verify your identity. After funding your account, you’re ready to trade!

3. GTI: GTI prides itself on providing excellent brokerage services. The process for opening an account with GTI is similar to the others. Once you’ve funded your account, you’re ready to dive into the world of investment!

Opening and funding a brokerage account in Nigeria can be as easy as 1, 2, 3! By following these steps, you’ll be on your way to becoming a seasoned investor. Remember, the key is to choose a reliable broker, verify your identity, and fund your account. Happy trading!

The Process of Stock Trading in Nigeria

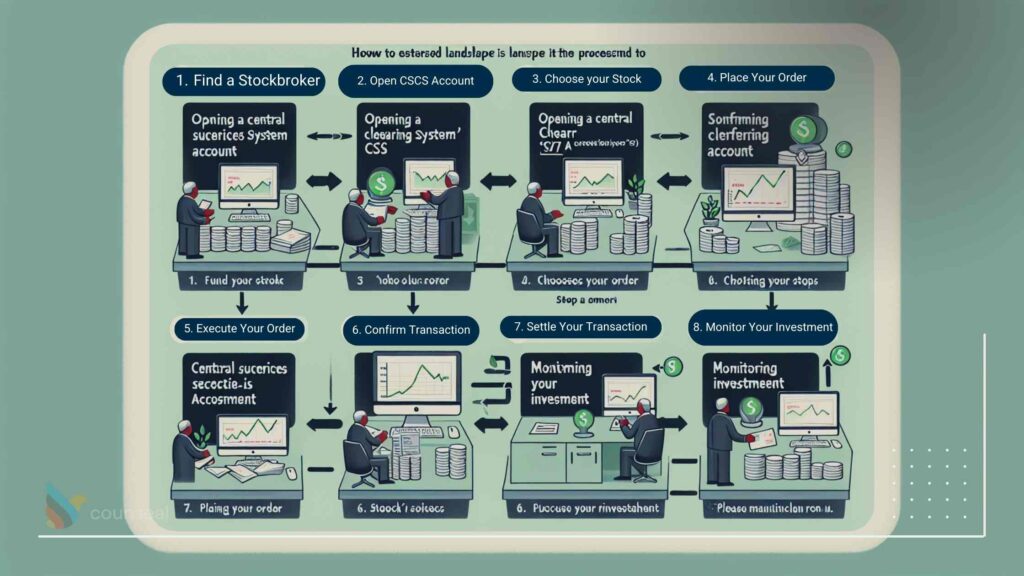

Ever wondered how to dive into the world of stock trading here in Nigeria? Fear not, because we’ve got you covered. Here’s your step-by-step guide on how to buy and sell shares in the Nigerian Stock Exchange (NSE).

How to Buy and Sell Shares in Nigeria

Step 1: Find a Stockbroker

First, you’ll need to find a reputable stockbroker. This is the person or company that will handle your transactions in the Nigerian Stock Exchange (NSE). Do your research and pick a broker that aligns with your investment goals.

Step 2: Open a Central Securities Clearing System (CSCS) account

Your broker should help you open a CSCS account. This is where all your shares will be held electronically. Think of it as your digital wallet for shares.

Step 3: Choose Your Stocks

Next, it’s time to do some research and choose the stocks you want to buy. Look at company performance, market trends, and industry outlooks. Or, if you’re feeling a bit overwhelmed, your broker can provide advice.

Step 4: Place Your Order

Once you’ve chosen your stocks, it’s time to place your order. This simply means specifying the quantity and price of the shares you’re interested in buying or selling. It’s like going to the local market to buy yams, only here, you’re dealing with shares. Just remember to be clear with your numbers, and you’re good to go.

Your broker will execute this for you in the NSE.

Step 5: Execute Your Order

After placing your order, the next step is to wait patiently for your order to be matched and executed in the NSE. This process could take a few minutes or a few hours, depending on market conditions. So grab a cup of tea, sit back, and let the NSE do its magic.

Step 6: Confirm Your Transaction

Once your order has been executed, you’ll receive a contract note and a trade alert confirming your transaction. This might sound technical, but it’s just a fancy way of saying “your transaction was successful”. So make sure you get this confirmation before you start celebrating.

Step 7: Settle Your Transaction

This involves paying or receiving the net amount of your transaction through the Central Securities Clearing System (CSCS) and the Nigeria Inter-Bank Settlement System (NIBSS). Think of it as the final handshake that seals the deal.

Step 8: Monitor Your Investment

The last step is to monitor your investments. Keep an eye on how your shares are performing and make adjustments as necessary.

Tools and Resources for Trading Shares

Now that you know the process, let’s talk about the tools of the trade. Whether you prefer trading online or offline, there are numerous platforms available to suit your needs.

Online platforms like websites, apps, and portals offer you the convenience of trading from the comfort of your home or office. On the other hand, offline platforms like phone, email, and SMS give you the luxury of a more personal touch.

In addition to these platforms, there are also resources like market data and information that provide you with prices, indices, news, and reports. As they say, knowledge is power, and in this case, it could also mean profit.

Finally, there are trading strategies and techniques that help you to trade effectively and efficiently. Think of them as your secret weapons in the world of stock trading.

Real-life Trading Examples

Still feeling a bit overwhelmed? Don’t worry, we’ve got some real-life examples to help you navigate the world of stock trading.

For instance, Yochaa is an online platform that allows you to buy and sell shares in Nigeria. With its user-friendly interface and simple process, buying and selling shares is as easy as ABC.

If you prefer a more traditional approach, Cordros offers offline trading options. They even provide you with a personal broker who guides you through the entire process.

And for those of you who like to play the long game, GTI offers trading strategies and techniques using technical analysis. This allows you to make informed decisions based on market trends and data.

So there you have it, a practical guide on how to buy and sell shares in Nigeria. Whether you’re a seasoned trader or a newbie, remember that the key to success is knowledge and practice. Happy trading!

Why Choose and Use Shares in Nigeria?

It’s no secret that choosing and using the right shares can be the key to achieving your investment goals. But why does this matter so much in Nigeria? Simple. The Nigerian Stock Exchange (NSE) is teeming with opportunities – if you know where to look.

The beauty of owning shares is that they help you maximise your returns while minimising risks. In addition to the earlier stated tips, here are some nuggets to equip you before you take that dive:

Assessing Your Risk and Return Profile

Before you can dive into the world of shares, you need to figure out your risk appetite and return expectations. Are you a risk-taker ready to dive into high-risk, high-return investments? Or, do you prefer playing it safe with low-risk, steady-return stocks? Your choice should reflect your investment style in playing it safe or risking it all.

Considering Your Investment Horizon and Style

Next, consider your investment horizon and style. Are you in it for the long haul, or do you prefer short-term trading? Your investment duration and approach significantly influence the kind of shares you should opt for.

What’s Your Investment Theme and Sector?

Now, let’s get specific. What sectors interest you? Are you drawn to the tech industry, or does the FMCG sector speak to you more? Your investment focus and preference help streamline the vast array of options on the NSE.

Looking at Share Performance and Potential

Finally, evaluate the share history and future potential. Past performance, though not a sure-shot predictor, can give you an idea about the company’s stability and growth potential. Below ia an overview of shares in Nigeria with high potentials:

- When it comes to long-term investment, heavyweights like Dangote Cement, MTN Nigeria, and Zenith Bank are excellent options. They have consistently proven their mettle in the market.

- For short-term traders, shares like Oando, Transcorp, and UACN are worth considering. These stocks are known for their volatility, providing ample opportunities for quick profits.

- If you are growth-focused, Seplat, BUA Cement, and Flour Mills are shares to keep an eye on. They are part of rapidly expanding industries and have shown promising growth.

- For value investors, Nestle, Nigerian Breweries, and Unilever are solid picks. These companies have a robust business model and a proven track record, making them a safe bet for steady returns.

Wrapping Up

Choosing and using the best shares in Nigeria is not just about picking the highest performing or most popular stocks. It’s about aligning your choices with your investment goals, risk profile, and sector preferences. So, take a step back, assess your investing style, and dive into the rewarding world of shares in Nigeria. Remember, every investment journey is unique – there’s no ‘one size fits all.’ So, take your time, do your research, and make informed decisions. After all, your financial future is in your hands!

So, are you ready to start your share buying journey in Nigeria? As always, we at counseal.com are here to help guide you through the process.

Thank you for spending your valuable time with us today. We look forward to guiding you on your investment journey.

Frequently Asked Questions

How much money do I need to start buying shares in Nigeria?

You can start buying shares in Nigeria with as little as N10,000, depending on the price and quantity of the shares you want to buy. However, you should also consider the fees and charges involved in buying and selling shares, such as brokerage commission, stamp duty, VAT, and NSE transaction levy. These fees and charges may vary depending on the stockbroker you choose and the amount of your trade.

How do I know if a share is undervalued or overvalued?

One of the common ways to determine if a share is undervalued or overvalued is to use the price-earnings ratio (P/E ratio), which is the ratio of the share price to the earnings per share (EPS). The P/E ratio indicates how much investors are willing to pay for each naira of earnings. A low P/E ratio may suggest that the share is undervalued, while a high P/E ratio may suggest that the share is overvalued. However, the P/E ratio should not be used in isolation, as it does not account for other factors such as growth potential, dividend yield, industry trends, and competitive advantage.

What are the best sectors and industries to invest in Nigeria?

The best sectors and industries to invest in Nigeria depend on your investment goals, risk appetite, and market outlook. However, some sectors and industries that have shown consistent growth and profitability in Nigeria are:

- Banking and financial services: This sector comprises banks, insurance companies, microfinance institutions, and other financial intermediaries that provide loans, deposits, payments, and other services to individuals and businesses. Some of the leading banks in Nigeria are Zenith Bank, GTBank, Access Bank, and First Bank.

- Telecommunications and information technology: This sector comprises companies that provide communication and data services, such as voice, SMS, internet, and mobile money. Some of the leading telecom and IT companies in Nigeria are MTN Nigeria, Airtel Nigeria, Globacom, and 9mobile.

- Consumer goods and services: This sector comprises companies that produce and sell goods and services that are in high demand by the Nigerian population, such as food, beverages, household items, personal care products, and entertainment. Some of the leading consumer goods and services companies in Nigeria are Nestle Nigeria, Dangote Sugar, Nigerian Breweries, and Unilever Nigeria.

- Oil and gas: This sector comprises companies that explore, produce, refine, and distribute petroleum and natural gas products. Nigeria is one of the largest oil and gas producers in Africa and the world, with abundant reserves and potential. Some of the leading oil and gas companies in Nigeria are Seplat Petroleum, Oando, Total Nigeria, and Mobil Nigeria.

How do I make money from buying shares in Nigeria?

You can make money from buying shares in Nigeria in two ways: capital appreciation and dividend income. Capital appreciation is the increase in the value of your shares over time, which you can realise by selling your shares at a higher price than you bought them. Dividend income is the portion of the company’s profits that is distributed to the shareholders, usually on a quarterly or annual basis. Dividend income is a passive and regular source of income that you can reinvest or spend as you wish.

How do I monitor and manage my share portfolio in Nigeria?

You can monitor and manage your share portfolio in Nigeria using various tools and platforms, such as:

- Brokerage platform: This is the online or mobile platform that you use to buy and sell shares through your stockbroker. You can access your portfolio details, such as your holdings, transactions, balances, and performance, on your brokerage platform. You can also place orders, modify orders, cancel orders, and view market data on your brokerage platform.

- NSE website and mobile app: This is the official website and mobile app of the Nigerian Stock Exchange, where you can find information and data on the listed companies, market indices, trading activities, and news. You can also access the NSE live feed, which shows the real-time prices and volumes of the shares traded on the NSE.

- Financial news and media: This is the source of information and analysis on the Nigerian and global economy, business, politics, and other relevant topics that may affect the share market. You can follow the financial news and media on various channels, such as newspapers, magazines, websites, blogs, podcasts, and social media. Some of the popular financial news and media outlets in Nigeria are Business Day, The Guardian, Nairametrics, Proshare, and The Cable.

What are the risks and challenges of buying shares in Nigeria?

Buying shares in Nigeria involves some risks and challenges, such as:

- Market risk: This is the risk of losing money due to the fluctuations in the share prices, which are influenced by various factors, such as supply and demand, company performance, industry trends, economic conditions, political events, and investor sentiment. Market risk is unavoidable and unpredictable, and it can affect the entire market or a specific sector or industry.

- Liquidity risk: This is the risk of not being able to buy or sell your shares quickly and easily at a fair price, due to the lack of buyers or sellers in the market. Liquidity risk is higher for shares that have low trading volumes, low market capitalization, or low public float. Liquidity risk can affect your ability to enter or exit the market at your desired time and price.

- Regulatory risk: This is the risk of losing money due to the changes in the laws, rules, regulations, and policies that govern the share market and the listed companies. Regulatory risk can arise from the actions or inactions of the government, the regulators, the courts, or the agencies that have the authority and jurisdiction over the share market and the listed companies. Regulatory risk can affect the operations, profitability, reputation, and valuation of the companies and the market.

How can I learn more about buying shares in Nigeria?

You can learn more about buying shares in Nigeria by reading books, articles, blogs, and reports on the topic, such as:

- How To Buy Shares In Nigeria: A Beginner’s Guide by Wale Marketer

- How To Invest In The NSE (Nigerian Stock Exchange) by Yochaa

- How To Buy Shares In Nigeria by AskTraders

- Best Nigerian Stock To Buy by GTI Research

- How To Buy Stocks In Nigeria by Traders Union

- How To Invest In Stocks And Bonds In Nigeria by Cordros Capital

- How To Buy Shares In Nigeria by Melting Pot Africa

- How To Buy Shares In Nigeria by Forex Broker

You can also learn more about buying shares in Nigeria by taking online courses, webinars, or workshops on the topic, such as:

- Stock Trading Course For Beginners by NSE Academy

- Investing In The Nigerian Stock Market by Udemy

- How To Invest In Nigerian Stocks by Coursera

- Stock Market Investing For Beginners by Skillshare

- How To Trade Nigerian Stocks by YouTube

You can also learn more about buying shares in Nigeria by joining online communities, forums, or groups on the topic, such as:

- NSE Investors Forum

- Nigerian Stock Market Discussion Group

- Stock Market Investors Club

- Nigerian Stock Exchange Traders

- Stock Market Nigeria