Choosing the Right Investment Vehicle for Your Nigerian Business

by Counseal Team

Updated July 22, 2024

Introduction

Selecting the optimal investment vehicle is a pivotal decision that can significantly influence the growth and sustainability of your business. With a plethora of options available, understanding the landscape of investment opportunities is essential for any business owner seeking to maximize returns and minimize risks.

This article will explore the various options available and their respective benefits and challenges, serving as a guide for entrepreneurs to make informed decisions that align with their investment size, risk appetite, and business goals. Let’s dive in.

The Importance of Choosing the Right Investment Vehicle

Choosing the right investment vehicle is like picking the perfect business partner—it can make or break your venture. It’s not just about potential returns; it’s about aligning those returns with your business’s vision, cash flow needs, and risk tolerance.

Consider a tech start-up. You need significant cash infusions, but also the freedom to pivot and innovate. Locking all your funds in real estate may not provide the liquidity or agility you need. Conversely, if you’re aiming for steady growth over time, bonds and dividend-paying stocks might be more suitable.

Case Study: JollofTech’s Successful Investment Journey

Imagine you’re leading JollofTech, a Nigerian start-up that grew from self-funding to angel investment, then venture capital, and finally went public through an initial public offering (IPO), capturing new markets.

Each funding stage was strategically selected to fuel growth and meet business goals, showcasing the importance of choosing investments that align with the company’s vision and needs.

As you navigate Nigeria’s investment waters, remember to choose a vehicle that not only promises a good return but also aligns with your business dreams. It’s about knowing what suits your venture’s unique needs.

Traditional vs. Alternative Investment Vehicles

When growing your hard-earned money in Nigeria, you’re faced with a diverse array of investment options. Before making a choice, it’s crucial to understand the flavors on offer. Let’s explore traditional investment vehicles and the emerging alternative investments shaking up the market.

Traditional Investment Options

Stocks, Bonds, and Real Estate

Stocks and bonds are classic investment staples. Stocks allow you to own a piece of a company, and when the company thrives, so do you. Bonds are essentially loans you provide to a company or government, with the promise of your money back plus interest.

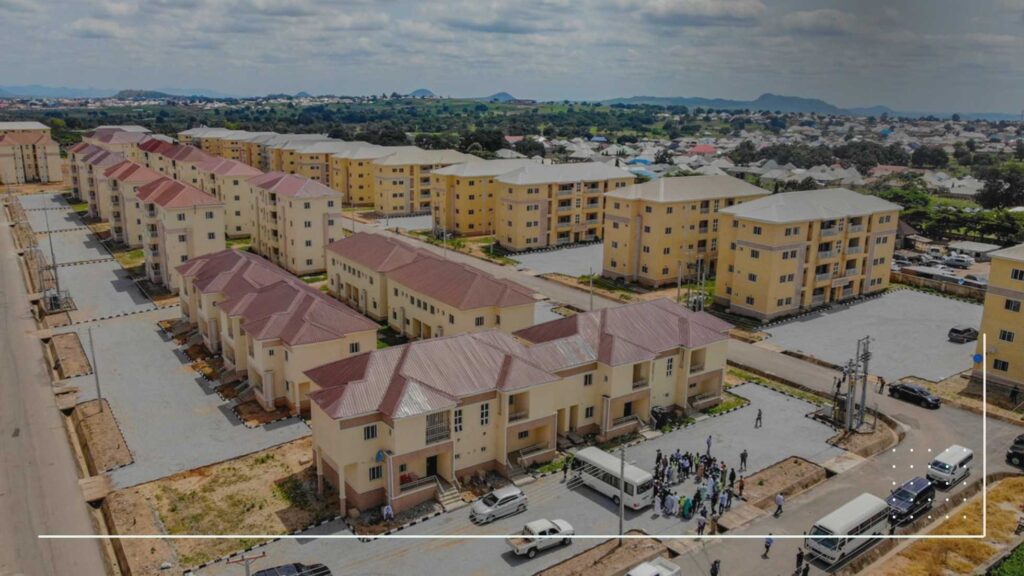

Real estate is another traditional option. Investing in property in Nigeria can be as rewarding as securing a prime plot in Lagos before a boom. However, it comes with its own set of challenges.

Pros:

- Liquidity: Stocks can be sold quickly.

- Income: Bonds offer regular interest payments, and real estate can generate rental income.

- Growth Potential: All three can appreciate in value over time.

Cons:

- Volatility: Stock prices can fluctuate wildly based on market conditions.

- Interest Rate Risk: Bonds can lose value if interest rates rise.

- Management Hassles: Real estate requires active management and maintenance.

Emerging Alternative Investment Vehicles

Nigeria’s investment landscape is evolving, with new opportunities that could spice up your portfolio.

Limited Liability Partnerships (LLPs)

LLPs are gaining popularity, offering the flexibility of a partnership with the protection of a limited liability company. This allows you to invest in a business without being personally liable for the company’s debts or legal issues.

Venture Capital and Private Equity

For the bold and brave, venture capital (VC) and private equity (PE) offer high-risk, high-reward opportunities. Nigeria’s vibrant start-up scene presents significant potential for substantial returns, but it’s not for the faint-hearted.

Tutorial: Evaluating Alternative Investments

Evaluating alternative investments requires careful consideration:

- Risk vs. Reward: Assess your risk tolerance against the potential reward.

- Track Record: Examine the past performance of the investment or management team.

- Market Conditions: Consider industry trends and timing.

- Diversification: A balanced mix of investments can help mitigate risk.

Remember, investing is a personal journey. What works for one entrepreneur might not suit another. Find the mix that aligns with your business goals and risk appetite. Take your time, research thoroughly, and consider consulting with a financial advisor to make informed decisions.

The Role of Venture Capital in Growth

Venture capital is more than just a buzzword—it’s a game-changer for startups. Think of it as a catalyst that transforms small, ambitious companies into giants like Jumia and Paystack. These success stories demonstrate how VC backing can propel a business to new heights.

Understanding the VC Model

Venture capital employs high-risk, high-reward investment strategies that can make or break a startup. VCs are the mavericks of the investment world, diving into uncharted waters where traditional financiers may hesitate. They’re not just providing funds; they’re investing in your vision.

Here’s a breakdown of the VC process:

- Seed Funding: VCs plant the initial financial seeds to help a startup sprout.

- Growth: With strategic guidance and additional funding, these startups can flourish.

- Exit Strategy: VCs eventually seek an exit, either through an IPO or acquisition, realizing the rewards of their foresight.

Examples of Successful VC-Backed Ventures

Nigeria has witnessed a surge of VC-backed triumphs. Companies like Flutterwave, Andela, and Kobo360 have raised millions and are redefining what’s possible in the African tech ecosystem, thanks to strategic VC partnerships.

Finding the Right VC Partner

Choosing a VC is akin to selecting a long-term business partner—getting it wrong can be costly. Consider the following criteria when evaluating potential VCs:

- Track Record: Have they successfully backed similar ventures?

- Industry Expertise: Do they understand your business sector?

- Network: Can they open doors and provide valuable connections?

- Alignment: Are your visions for the future in sync?

Securing venture capital is more than just funding—it’s about finding a partner who believes in your vision as much as you do. As you embark on this journey, focus on finding the VC that aligns with your goals and can help take your business to the next level.

Navigating the Legal Landscape

Nigeria’s legal landscape for investments can seem as intricate as a finely woven Aso Oke fabric. However, with the right guidance, it’s possible to unravel the complexities and secure your business interests with the law on your side.

Key Legal Aspects of Investment in Nigeria

Here are the crucial legal requirements to keep on your radar:

- Company Registration: Registering your business with the Corporate Affairs Commission (CAC) is essential for legal operations in Nigeria.

- Tax Compliance: Understanding and adhering to Nigeria’s tax regulations, including VAT, income, and corporate tax, is non-negotiable.

- Employment Laws: Familiarize yourself with the Labour Act when hiring a local team to ensure fair wages, working hours, and contract terms.

- Intellectual Property: Protect your brand and innovative products against copycats by leveraging Nigeria’s intellectual property laws.

Tutorial: Legal Checklist for Investors and Entrepreneurs

Here’s your cheat sheet for staying compliant with Nigerian law:

- Business Structure: Choose a structure that fits your venture, whether it’s a sole proprietorship, partnership, or limited liability company.

- Licenses and Permits: Obtain the necessary licenses and permits specific to your industry to operate legally.

- Contract Laws: Ensure your contracts with suppliers and customers are clear, fair, and legally binding.

- Environmental Regulations: Comply with relevant environmental laws to demonstrate your commitment to sustainability.

Case Studies in Legal Compliance

Let’s look at entrepreneurs who have successfully navigated Nigeria’s legal landscape:

- Ada, a tech startup founder in Lagos, secured her intellectual property rights early on, protecting her app from replication and attracting significant foreign investment.

- Chinedu’s agribusiness thrives thanks to his strict adherence to environmental regulations, resonating with eco-conscious consumers.

The Consequences of Legal Oversight

Overlooking legal requirements can lead to litigation, fines, or even business closure. Proper due diligence and legal compliance are essential for any investor or entrepreneur.

Whether you’re a local entrepreneur or an international investor, remember that the law, while complex, is your ally when approached correctly. Keep it legal, keep it smart, and watch your investment flourish.

Assessing Your Business Needs

When fueling your business’s growth, choosing the right investment vehicle is like selecting the perfect pair of shoes for a marathon—it can make or break your journey. So, how do you lace up for success?

Identifying the Right Investment Vehicle for Your Venture

Consider your business as a unique entity with its own set of needs and goals. There’s no one-size-fits-all solution. Factors like your industry, growth stage, and risk tolerance should guide your decision. For instance, a tech startup might thrive on venture capital, while a small retail business could benefit more from a traditional loan.

Pro Tip: Analyze your competitors and industry leaders. Their experiences can provide valuable insights, even if you don’t copy their strategy verbatim.

Tutorial: Aligning Investment with Business Strategy

Let’s break it down into actionable steps:

- Define Your Business Objectives: Are you aiming for rapid expansion or steady growth? Your goals will dictate the type of investment to pursue.

- Evaluate Your Financial Health: Determine how much capital you need and what you can afford in terms of repayments or equity sharing.

- Understand Investment Types: Research the pros and cons of various options, from angel investors to crowdfunding.

- Assess Risk: Consider your risk tolerance. Can you handle the volatility of the stock market, or are bonds more suitable?

- Consult with Financial Experts: Financial advisors can offer tailored advice that aligns with your business strategy.

By carefully assessing your business needs and aligning your investment strategy accordingly, you can set your venture on the path to sustainable growth and success.

The Future of Investing in Nigeria

Nigeria’s investment landscape is as dynamic as the bustling streets of Lagos. Staying ahead of the curve is crucial for making informed decisions.

Predictions and Trends

With the digital economy booming, fintech investments are on the rise. Cryptocurrencies and blockchain technology are gaining traction, despite regulatory hurdles. Sustainable and impact investing is also garnering interest, as it benefits both the planet and business.

The Potential Impact of New Investment Vehicles

Innovative investment vehicles are revolutionizing the Nigerian market. Peer-to-peer lending platforms and digital investment apps are democratizing access to capital, allowing small businesses to get in on the action.

These platforms often offer more than just funds; they provide a community and support system that can be invaluable for growing businesses.

For Nigerian entrepreneurs, this means a wealth of opportunities. However, it’s essential to conduct thorough due diligence and choose an investment path that aligns with your vision.

At counseal.com, we’re not just about providing facts; we’re here to guide you on your journey. So, lace up those shoes, and let’s get your business running towards its next milestone.

Recap and Final Thoughts

As we conclude this insightful journey, let’s distill the essence of what we’ve learned. This article has provided strategic insights and practical tips to empower Nigerian entrepreneurs in making informed investment decisions for their businesses.

Summarizing the Key Takeaways

- Market Research is King: Understanding your target market’s needs is crucial for making sound investment decisions. Always back your moves with solid data.

- Risk Assessment: Evaluate the risk versus reward of any potential investment. High returns often come with high risks.

- Diversify Wisely: A diversified portfolio can help you weather economic storms. Don’t put all your eggs in one basket.

- Local Knowledge: Leverage local expertise and networks for invaluable insights that global data might miss.

- Regulatory Compliance: Stay compliant with the law. Regulatory changes can significantly impact your investment’s viability.

Call to Action

Armed with this knowledge, what’s your next move? If you’re ready to dive into the investment pool, counseal.com is here to support you. Our team is prepared to assist you in navigating the complexities of business investments in Nigeria.

Remember, every investment journey is unique, but with the right guidance and resources, you can chart a path to success. At Counseal, we’re not just a resource; we’re your partner in growth. So, are you ready to take that leap and watch your business soar? Let’s do this together!