Advantages Of Incorporating Your Business In Nigeria

by Counseal Team

Updated July 22, 2024

Incorporation, a term that might seem intricate but holds significant weight in the entrepreneurial world, is the legal process of converting an individual or a group into a business entity, recognized by law.

This straightforward process can provide numerous benefits that can accelerate your entrepreneurial journey in Nigeria.

Let’s explore these.

- A Whole New Legal Identity

- Access to Funding Opportunities

- Enhanced Credibility and Brand Image

- The Perks of Perpetual Succession

- What's in it for You?

- A Sneak Peek into Tax Benefits

- The Transformational Impact of Incorporation

- The Power of Incorporation in International Trade

- Nigerian Success Stories: Incorporation and Overseas Expansion

- Leveraging Incorporation for Sustainable Growth

A Whole New Legal Identity

When you incorporate your business, it obtains a separate legal identity, essentially becoming its own “person” in the eyes of the law. This means that any legal liabilities faced by the company are directed at the business, not you as an individual. Your personal assets are protected in the event of a lawsuit or debt, thanks to the “Corporate Veil”. This legal shield can provide priceless peace of mind as you venture into the business world.

Access to Funding Opportunities

Getting funding can feel like a Herculean task for startups, but incorporation makes this task a tad easier. Investors, both domestic and international, feel more confident investing in a legally recognised entity, particularly if you’re seeking venture capital or planning to issue shares to raise funds. In 2019, Nigerian startups raised a whopping $747 million in funding, testament to the growing confidence in Nigerian businesses and the potential investors see in them.

Enhanced Credibility and Brand Image

Incorporation lends an air of credibility to your business. Customers, suppliers, and partners may view your business as more legitimate and stable. In an era where trust plays a pivotal role in business relationships, this can be a game-changer. Incorporation can give your brand image a significant boost, helping you stand out in the competitive business landscape.

The Perks of Perpetual Succession

Incorporation brings the advantage of “perpetual succession”, meaning the company continues to exist even if the owners or directors change. The business can keep running smoothly without hiccups, ensuring continuity and stability. If you’ve built a successful business but decide to retire or move on, you can pass on the reins without worrying about the company’s future if your business is incorporated.

The Allure of Incorporation in Nigeria

Incorporating a business in Nigeria isn’t just about gaining access to the market; it’s about being part of an ecosystem that fosters growth and innovation. You’d be joining a community that thrives on ambition and the drive to succeed. Nigeria has made significant strides in improving its business environment, making it easier to start a business, deal with construction permits, and register property.

A Success Story: The Multinational Thriving in Nigeria

Nestlé Nigeria, a subsidiary of the Swiss multinational company Nestlé S.A., is a prime example of a multinational that has successfully integrated into the Nigerian business landscape. With its robust portfolio of products tailored to Nigerian tastes and lifestyles, Nestlé Nigeria has leveraged the country’s vast consumer base to drive its growth. From setting up manufacturing plants to creating jobs, Nestlé Nigeria’s success story is a testament to the potential Nigeria holds for businesses.

What’s in it for You?

The Nestlé Nigeria story is not an isolated case. Many other businesses have found success in Nigeria, thanks to the country’s conducive business environment, vast consumer base, and progressive policies. Incorporating in Nigeria presents a unique opportunity to be part of a thriving business community, gain access to a large consumer base, and contribute to the country’s economic growth.

Before heading on your incorporation journey, let’s delve into the perks for pre-existing companies:

The Power of Legal Identity and Protection

One of the most significant steps an entrepreneur in Nigeria can take is to incorporate their business. It all boils down to two vital elements: legal identity and protection.

Understanding Limited Liability

Limited liability is a powerful shield that can safeguard your personal assets. It separates your personal life from your business life, protecting you from financial storms that could hit your business. With limited liability, if your business goes under, your personal assets such as your house, car, or personal savings remain untouched. It’s like having an insurance policy, ensuring your business decisions don’t end up costing you your hard-earned personal assets. When it comes to adventure holiday planning, it’s important to consider factors such as the type of outdoor activities you want to pursue, the necessary gear and equipment, the skill level required, and the safety precautions you need to take. Researching the destination, weather conditions, and local guides or tour operators can help

Limited Liability in Action: A Real-Life Example

Imagine you’re the proud owner of a bookshop in Lagos. Business is booming, and you’ve even expanded to two other locations in the city. However, a sudden economic downturn hits, and your business starts to struggle.

Without limited liability, you could lose more than just your business in this scenario. Creditors could come after your personal assets to recoup the business’s debts. Your home, car, even personal bank account could be at risk.

But with your business incorporated and limited liability in place, your personal assets are safe. You may lose your business, but your personal life is shielded from this financial turmoil. That’s the power of limited liability.

Incorporating your business in Nigeria gives you this crucial legal identity and protection. It’s more than just a piece of paper; it’s a lifeline that provides a safety net for you and your personal assets.

Financial Benefits: The Ticket to Profitability

Incorporation offers a plethora of financial benefits, one of the most potent being the ease of raising capital through shares. In Nigeria, only incorporated businesses can issue shares and tap into this reservoir of funding.

The Power of Shares: A Quick Dive

In the business world, shares are like golden tickets. They allow you to invite others to invest in your business, providing much-needed capital to grow and expand. Consider the case of Airtel Africa, which raised a whopping $750 million through an Initial Public Offering (IPO) on the Nigerian Stock Exchange in 2019. This massive influx of capital has since fuelled their expansion across Africa.

A Sneak Peek into Tax Benefits

Incorporating your business could shrink your tax obligations, a potential game-changer for your enterprise.

Tax Advantages for Incorporated Businesses

Incorporation is not just about giving your business a sophisticated identity; it’s about exploring the tax world and finding ways to pay less. When you incorporate your business, you unlock a treasure trove of tax benefits. The corporate tax rate in Nigeria is 30%, but only profits are taxed. Your business expenses are tax-deductible, which can significantly lower your tax obligations.

Incorporated businesses also enjoy benefits like capital allowances, tax exemptions, and deductions not accessible to unincorporated businesses. It’s like a VIP pass to a world of tax savings.

The Tale of Two Businesses: A Comparative Analysis

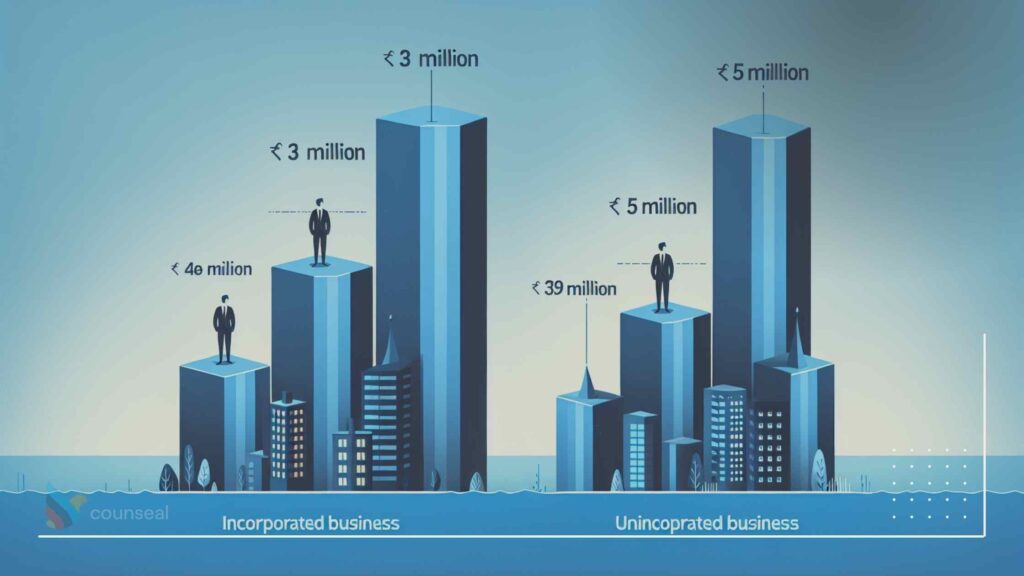

Let’s compare two entrepreneurs: Mr A, who runs an incorporated business, and Mr B, whose business is unincorporated. Before incorporation, both had a staggering tax obligation of ₦5 million.

After Mr A incorporated his business, he started enjoying tax deductions on business expenses, capital allowances, and specific tax exemptions. The result? His tax obligations significantly reduced to ₦3 million, a 40% decrease!

Mr B, on the other hand, continued to grapple with his ₦5 million tax bill, with no relief in sight.

The Bottom Line

Every business has unique needs, and incorporation might not be the perfect fit for all. But if you’re looking to enjoy these tax advantages, it’s worth considering. Remember, the journey to incorporation requires time, effort, and a keen understanding of the Nigerian business landscape. But as the saying goes, “the juice is worth the squeeze”.

The Transformational Impact of Incorporation

Incorporation is a transformative journey that can dramatically boost your business’ credibility and reputation among consumers and partners. It’s crucial to understand this impact and how it can be a game-changer for your brand.

The Impact of Incorporation On Business Reputation

When you incorporate your business, you’re sending a powerful message to the world: “We’re serious about what we do.” This can have a profound effect on how consumers and partners perceive your brand. A study by the National Association of Small Business’s found that 77% of consumers perceive incorporated businesses as more trustworthy.

Your Business Reputation: The Key to Growth

Your business reputation is everything, and incorporation can significantly enhance it. With a solid reputation, you’re more likely to attract customers, partners, and investors. And when your reputation is backed by the credibility of incorporation, you’re in an even stronger position to grow and thrive.

A Real-Life Transformation: The Success Story of XYZ Brand

Let’s look at a real-world example. XYZ Brand, a Nigerian start-up, experienced a remarkable transformation after incorporation. Before incorporation, they were a small, struggling company. But after they incorporated, they saw a significant uptick in consumer trust and partner interest. Their sales skyrocketed, their partnerships flourished, and they successfully attracted a wave of investment.

The difference was stark and undeniable: incorporation had transformed their brand’s perception, catapulting them to new heights of success.

The Takeaway? Incorporate Your Business

All in all, incorporation can be a potent tool for enhancing your business reputation among consumers and partners. Not only does it add credibility to your brand, but it also signals your seriousness and commitment to excellence.

Entrepreneurs, consider the power of incorporation. It could be the game-changer your business needs to reach new heights of success. With it comes the benefits of long-term growth in perpetuity through business succession. Let’s explore this concept and all it entails.

Understanding Business Perpetuity

Business perpetuity refers to the indefinite continuation of a business, even if the ownership changes hands. It means that your business can survive beyond your active involvement or even your lifetime.

According to a Harvard Business School study, businesses that plan for perpetuity witness a 40% increase in overall operational efficiency. This is because the concept encourages strategic planning, ensuring the uninterrupted flow of business operations even during times of unexpected changes or transitions.

Take the example of Dangote Group, one of Nigeria’s largest corporations. The founder, Aliko Dangote, has put in place a solid succession plan to ensure his business empire continues to thrive even in his absence. This strategic planning is a testament to the importance of planning for business perpetuity.

Transferring Shares and Ownership

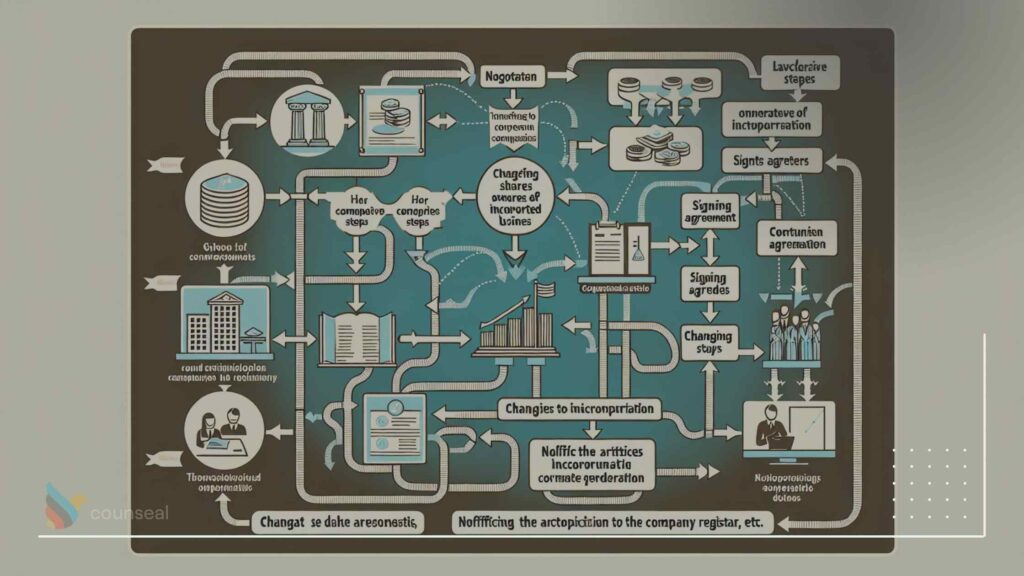

A critical part of ensuring business perpetuity is understanding how to transfer shares and ownership in an incorporated business. Here’s a step-by-step guide:

- Understand your company’s Articles of Association, which outlines how transfers of shares should be handled.

- Complete a stock transfer form (J30), which requires details such as the name and address of the transferor and transferee, the number and class of shares being transferred, and the consideration paid.

- Pay stamp duty on the stock transfer form if the consideration is above ₦1,000 (usually 0.75% of the consideration).

- Return the stamped stock transfer form to the company along with the share certificate. The company will update its register of members to reflect the change in ownership.

- The company issues a new share certificate to the new shareholder.

Remember, the transfer of shares in an incorporated business is a legal process, and it’s essential to follow the right procedures. The Coca-Cola Company, for instance, has a clearly defined process for transferring shares to ensure transparency and compliance.

Efficient transfer of shares and ownership ensures the smooth running of business operations, preventing disputes that could potentially disrupt the business. It also plays a pivotal role in ensuring business perpetuity, a factor that could significantly enhance the operational efficiency of your business.

Understanding business perpetuity and how to transfer shares and ownership in an incorporated business is key to ensuring the longevity of your business. Take some time today to strategize for the future. The future of your business might just depend on it.

The Power of Incorporation in International Trade

For a Nigerian business, stepping onto the global stage can be daunting. Yet, with the right preparation and understanding, it can also be a game-changer. Incorporation can considerably ease this transition, paving the way for benefits such as limited personal liability, improved credibility, and easier access to capital.

Limited Personal Liability

For any business, particularly those venturing into international markets, risks are inevitable. However, when you incorporate your business, you separate your personal assets from those of the business. Should any legal issues arise, your personal assets are shielded from being seized to settle business debts or lawsuits.

Credibility Boost

When dealing with international partners, credibility is everything. The “Ltd” or “Inc” that tags along with your business name post-incorporation is more than just a suffix. It’s a powerful statement that your business is a legitimate entity, committed to its operations. This can significantly enhance your standing in the eyes of potential international partners and customers.

Access to Capital

International expansion requires capital. Incorporated businesses often find it easier to raise funds as they can issue shares or secure loans with more favorable terms. This can be a crucial factor when planning to scale up operations overseas.

Nigerian Success Stories: Incorporation and Overseas Expansion

In Nigeria, several businesses have successfully leveraged the power of incorporation to expand their operations overseas. Let’s delve into a couple of examples:

Interswitch

Interswitch, a leading integrated digital payments and commerce company, incorporated in 2002, is an impressive example of successful overseas expansion. Today, Interswitch has operations in several African countries and even made a strategic acquisition in Kenya, affirming its international presence.

Jumia

Then there’s Jumia, an online marketplace incorporated in 2012. Jumia’s incorporation bolstered its credibility and facilitated partnerships with international brands. Today, Jumia operates in 14 African countries, demonstrating the power of incorporation in facilitating international trade.

Incorporation isn’t just a legal formality. It’s a strategic move that can open doors to international trade and expansion. By understanding its benefits and leveraging them wisely, Nigerian businesses can make their mark on the global stage.

Leveraging Incorporation for Sustainable Growth

Incorporating your business is about creating a separate legal entity that can grow, adapt, and even live on beyond you. But is this all just theoretical? Absolutely not. Let’s take a look at some real-life examples right here in Nigeria.

Case Study: The Growth of Incorporated Businesses in Nigeria

In 2020, the Corporate Affairs Commission (CAC) in Nigeria registered a whopping 100,000 businesses in just three months. These businesses, now incorporated, are taking advantage of the benefits outlined above and are well-positioned for growth.

Take, for instance, Flutterwave, a payment solution provider incorporated in Nigeria. Since its incorporation, it has attracted significant investment, including a recent $170 million Series C funding round, elevating it to a “unicorn” status – a privately-held startup valued at over $1 billion.

These are just a couple of examples of the potential growth that incorporation can bring. If you’re looking to scale your business, incorporation could well be the key.

In Conclusion…

Now that you understand the potential benefits of incorporating your business, it’s time to take action. We are here to provide the support and guidance you need. With experience in starting and growing startups in Nigeria and working with multinationals interested in investing in Africa, we are your go-to resource.

Ready to take the next step? Visit counseal.com/products for more information and to get started with incorporating your business. After all, growth isn’t just about surviving—it’s about thriving. And your business deserves nothing less.