Frequently Asked Questions About Business Registration in Nigeria

by Counseal Team

Updated July 14, 2024

Are you an ambitious Nigerian entrepreneur ready to turn your business dreams into reality? We understand that navigating the world of business registration can be daunting. That’s why we’ve compiled this comprehensive guide to answer your most pressing questions and demystify the process. Let’s dive in and unravel the essentials of business registration in Nigeria.

- Can a Foreigner Register a Business in Nigeria?

- How Long Does Business Registration Take in Nigeria?

- What are the Costs Involved in Registering a Business in Nigeria?

- Understanding the Basics of Business Registration in Nigeria

- Navigating the Pre-Registration Process

- The Registration Process Demystified

- FAQs About Business Registration in Nigeria

- Common Challenges in Business Registration

- Understanding Nigerian Business Laws

- The A to Z of Resources for Nigerian Entrepreneurs

- Why Seek Professional Advice?

- Key Takes on Business Registration in Nigeria

- In Conclusion…

Can a Foreigner Register a Business in Nigeria?

Absolutely! Nigeria’s laws allow foreign investors to register businesses and own 100% equity. However, it’s crucial to check if there are any sector-specific limitations or restrictions before proceeding.

How Long Does Business Registration Take in Nigeria?

The duration of the business registration process varies depending on the type of business and the completeness of your submitted documents. On average, expect the process to take between 2 to 3 weeks.

What are the Costs Involved in Registering a Business in Nigeria?

The cost of business registration in Nigeria depends on the type of business entity you choose. For instance, registering a Business Name is more affordable than registering a Limited Liability Company. Consult the Corporate Affairs Commission’s (CAC) schedule of fees for accurate information.

Understanding the Basics of Business Registration in Nigeria

Before embarking on your entrepreneurial journey, it’s essential to grasp the fundamentals of business registration. Think of it as obtaining a legal passport for your venture, granting it recognition and legitimacy in the eyes of the Nigerian government.

Exploring the Business Landscape: Types of Business Entities in Nigeria

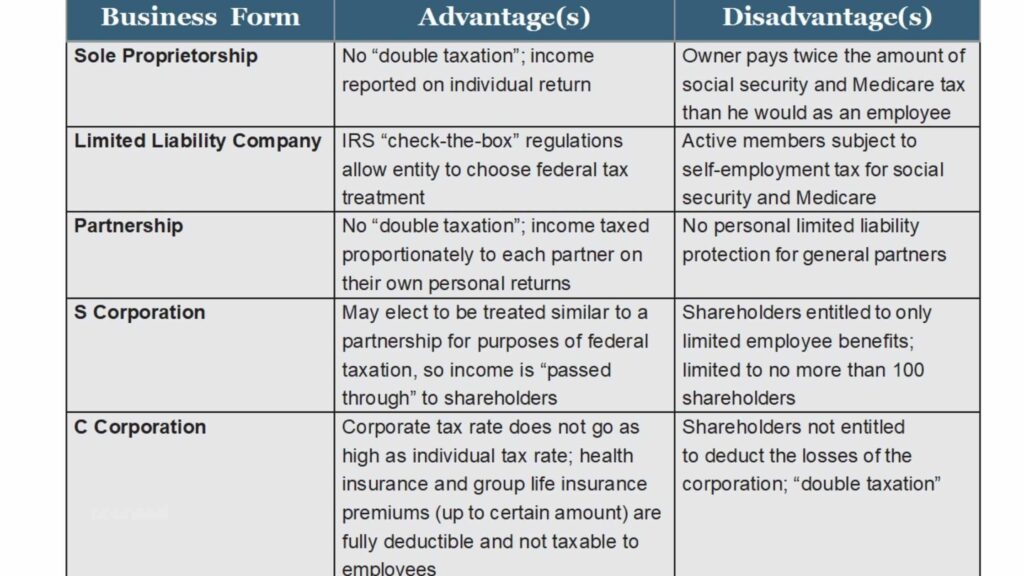

Nigeria offers three primary types of business entities:

- Sole Proprietorship: A one-person show where you own and run the business independently, enjoying all the profits but also bearing all the risks.

- Partnership: A business marriage where two or more individuals join forces, sharing profits and losses based on their agreed shares.

- Limited Liability Company: A more complex structure where the business is a separate legal entity from its owners, offering them limited liability protection.

Why Should You Register Your Business?

- Gain Legal Recognition: Registration gives your business a unique identity, making it a recognized entity under Nigerian law. This credibility boost can open doors to new opportunities and partnerships.

- Access Loans and Grants: Registered businesses have a higher chance of securing loans and grants from banks, financial institutions, and government bodies. According to a Central Bank of Nigeria report, registered businesses are 60% more likely to obtain financing compared to unregistered ones.

- Protect Your Brand: Registering your business name safeguards your brand from infringement. Like how Coca-Cola fiercely protects its trademark, you too can take legal action against anyone attempting to use your registered business name or logo.

Navigating the Pre-Registration Process

Step 1: Choosing the Perfect Business Name

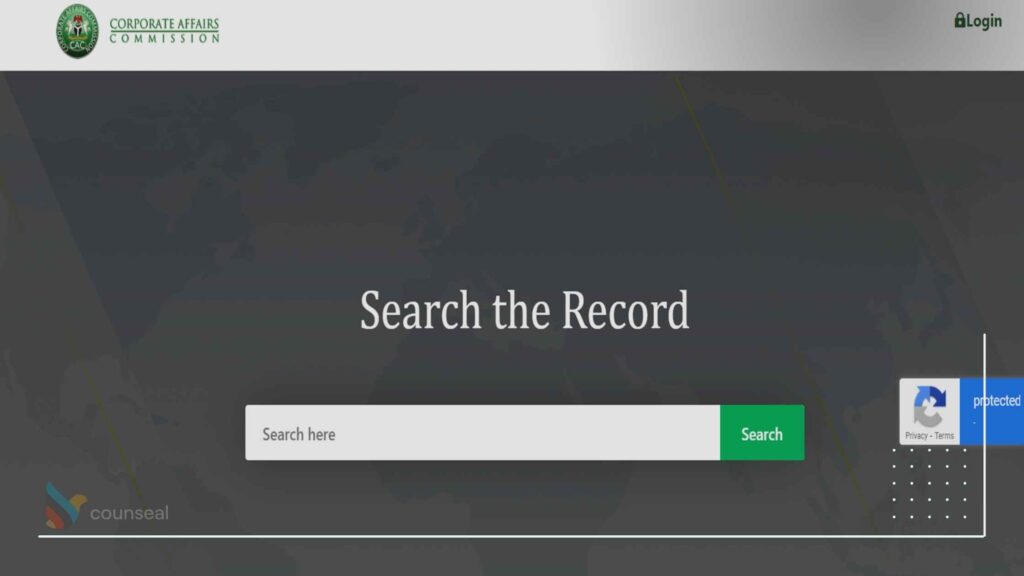

Your business name is the cornerstone of your brand identity. It’s what customers will remember and associate with your products or services. Before falling in love with a name, conduct a quick search on the CAC’s public portal to ensure it’s available and distinct from existing businesses.

Step 2: Understanding the Costs Involved

Starting a business is akin to climbing a mountain—it involves various costs along the way. Beyond the CAC registration fees, consider additional expenses such as legal consultation, business permits, and licenses. Prepare a comprehensive budget to avoid any surprises down the road.

As Aliko Dangote, Africa’s richest man, wisely said, “In the journey to success, tenacity of purpose is supreme.” Embrace the challenges with determination and a well-planned approach.

The Registration Process Demystified

Picture business registration as a well-choreographed dance—each step must be executed with precision and timeliness. Here’s a breakdown of the process:

- Name Availability Check and Reservation: Propose two unique names for your business. If available, one will be reserved for you.

- Application Form Submission: Fill out the necessary CAC forms, providing detailed information about your business and its proposed directors.

- Document Review and Payment: The CAC will review your submission, and upon approval, you’ll be asked to pay the prescribed fees.

- Issuance of Certificate: Once your payment is confirmed, the CAC will issue your Certificate of Incorporation—your business’s official birth certificate.

Remember, the team at counseal.com is always ready to guide and support you throughout this exciting adventure. Your success is our success.

FAQs About Business Registration in Nigeria

What is The CAC?

The Corporate Affairs Commission (CAC) is the regulatory body responsible for the incorporation of companies and the management of business names in Nigeria. Think of it as the gatekeeper to the vibrant world of Nigerian entrepreneurship.

How Long Does The Registration Process Take?

With all the required documents and information in order, the CAC registration process typically takes between 2–3 weeks. This timeline assumes a smooth run, with your proposed business name being available and your application free of errors.

The Nitty-Gritty of the Registration Process

The business registration process in Nigeria is a well-defined dance, and mastering the steps is key:

- Name Availability Check and Reservation: Propose two unique names for your business. If available, one will be reserved for you.

- Application Form Submission: Fill out the necessary CAC forms, providing details about your business and its proposed directors.

- Document Review and Payment: The CAC will review your submission, and if everything checks out, you’ll be requested to pay the prescribed fees.

- Issuance of Certificate: Upon payment confirmation, the CAC will issue your Certificate of Incorporation.

Remember, the team at counseal.com is always here to provide guidance and support. Your success is our success.

Can Foreigners Register a Business in Nigeria?

Yes, foreigners can register a business in Nigeria. However, the law stipulates that foreign companies must be incorporated as a separate entity under the Companies and Allied Matters Act (CAMA). This means establishing a Nigerian subsidiary rather than operating under an existing foreign company name.

What are the Tax Implications of Business Registration?

Registering a business in Nigeria comes with tax obligations. Companies are subject to a 30% Companies Income Tax (CIT) on profits and a 7.5% Value Added Tax (VAT). Depending on your business sector, additional taxes like the Petroleum Profits Tax may apply. Upon registration, you’ll receive a Tax Identification Number (TIN) for tax purposes.

Running a business is a marathon, not a sprint. With the right guidance and determination, you’ll cross the finish line victoriously. The Nigerian market is brimming with opportunities, and with the proper approach, you could be the next success story.

Common Challenges in Business Registration

Starting a business in Nigeria is not without its hurdles. Delays and bureaucratic challenges are common themes. According to the World Bank’s Doing Business 2020 report, it takes an average of 19.5 days to start a business in Nigeria, compared to the Sub-Saharan Africa average of 23.8 days.

Tip: Be proactive in following up on your applications and don’t hesitate to seek clarifications. It’s your business, after all!

Overcoming Registration Obstacles: A Case Study

To illustrate how these challenges can be navigated, let’s share a story from our experience. We once worked with a multinational company looking to invest in Nigeria. They faced significant delays in the registration process, costing them valuable time and resources.

Our solution? We hired a reputable local consultant with years of experience dealing with the CAC and other relevant agencies. This expert navigated the bureaucratic red tape and expedited the process significantly.

Takeaway: Sometimes, engaging a knowledgeable professional can save you time, stress, and potentially, money.

The key to overcoming these challenges lies in understanding them. The more you grasp the registration process, the easier it becomes to navigate. Let’s delve further into understanding business registration laws.

Understanding Nigerian Business Laws

As an entrepreneur, navigating the labyrinth of Nigerian business laws can seem daunting. But fear not, we’re here to help you understand the basics and set your business on the right path.

The Companies and Allied Matters Act (CAMA)

The Nigerian Companies and Allied Matters Act (CAMA) is the primary law governing business operations in Nigeria. Enacted in 1990 and updated in 2020 to accommodate modern business realities, this law provides the legal framework for the formation, management, and winding up of various business entities.

Compliance with Tax Laws

Understanding tax laws is crucial for any business in Nigeria. The Federal Inland Revenue Service (FIRS) administers different taxes and levies at the federal level, including Companies Income Tax, Value Added Tax (VAT), and Withholding Tax.

As a business owner, you must register for tax, maintain accurate records, and file tax returns as required. Non-compliance can result in penalties and interest on unpaid taxes.

Labour Laws

If you plan on hiring employees, familiarize yourself with Nigerian labour laws. The Labour Act is the principal legislation outlining the rights, duties, and responsibilities of both employers and employees.

These are just the fundamentals, but they provide a solid foundation for understanding Nigerian business laws. Remember, staying compliant is not optional but a legal requirement. As your business grows, so will your legal obligations.

At counseal.com, we’re here to guide you through the process based on our extensive experience and research. Don’t hesitate to reach out with any questions. Knowledge is power, and as an entrepreneur, you need all the power you can get!

The A to Z of Resources for Nigerian Entrepreneurs

For entrepreneurial spirits in Nigeria, finding the right resources can be the difference between thriving and barely surviving. With over 6 years of experience in starting and growing Nigerian startups, plus first-hand work with multinationals investing in Africa, our founder, Dele Omotosho, has the inside scoop. Let’s explore the abundant resources available to Nigerian entrepreneurs.

Government Assistance to Boost Your Business

The Nigerian government has implemented several initiatives to support entrepreneurs:

- The Small and Medium Enterprises Development Agency of Nigeria (SMEDAN): SMEDAN provides training, access to finance, and business information services to support Nigerian SMEs.

- The Bank of Industry (BOI): The BOI offers long-term financial assistance to Nigerian businesses, with a focus on supporting SMEs. If you need a financial boost to kickstart your entrepreneurial journey, the BOI is your go-to.

Private Sector Assistance: Your Secret Weapon

The private sector is also actively supporting Nigerian entrepreneurs:

- Tony Elumelu Foundation (TEF): TEF provides funding, training, and mentoring for African entrepreneurs, with a focus on Nigerian businesses. If you’re a startup seeking support, TEF might be your knight in shining armor.

- Lagos State Employment Trust Fund (LSETF): Funded by the Lagos State Government, LSETF offers low-cost finance to SMEs operating in Lagos. If your business is based in Lagos, this is a resource you definitely want to tap into.

Remember, starting a business is a marathon, not a sprint. These resources are your support crew, helping you navigate the tricky terrain of entrepreneurship in Nigeria. Make full use of them and don’t hesitate to seek professional help when needed.

Why Seek Professional Advice?

As an entrepreneur, wearing many hats is par for the course. However, there are times when the expertise of a professional is invaluable, particularly when it comes to business registration in Nigeria. Let’s explore when and why you should consider professional consultation.

Navigating the Legal Maze

The legal aspects of setting up a business in Nigeria can be a minefield. A legal expert can guide you through the intricacies, help you avoid potential pitfalls, and ensure your business complies with all necessary regulations. Having a legal advisor by your side can save you time, money, and stress in the long run.

Understanding the Market

Market research is essential for setting up a successful business. A professional market research consultant can provide valuable insights into the market, your competitors, and your potential customers. They can also help refine your business ideas and strategies based on these insights.

Financial Planning and Management

A financial advisor can help you set up a solid financial foundation for your business by advising on matters such as budgeting, financial forecasting, and cash flow management. They can also guide you on important financial decisions such as investments, loans, and tax planning.

Overcoming Operational Challenges

If you’re struggling with operational aspects like supply chain management, human resources, or customer service, a business consultant can help streamline your operations, improve efficiency, and overcome any challenges you might be facing.

In our years of experience in starting and growing businesses in Nigeria, we advise fellow entrepreneurs not to shy away from seeking professional help when needed. It’s an investment that can pay off in the long run, leading to a smoother business setup process, better operational efficiency, and ultimately, a more successful business. Remember, no one is an expert in everything, and it’s okay to ask for help when you need it.

Key Takes on Business Registration in Nigeria

So, you’ve decided to step into the vibrant world of entrepreneurship in Nigeria. Congratulations! But amidst the excitement, you’re probably wondering, “How exactly do I register my business?” Fear not, dear entrepreneur. We’ve got the answers to your burning questions.

Why is Business Registration Important?

Think of business registration as the first formal step in your entrepreneurial journey. It’s about making your startup official and legal. According to the Corporate Affairs Commission (CAC), Nigeria’s primary business registry, over 3 million businesses have been registered as of 2020. Clearly, Nigerian entrepreneurs understand the importance of this process.

Registering your business in Nigeria confers a host of benefits:

- Legal Protection: It provides protection against personal liability and potential legal issues.

- Credibility: It adds credibility to your business, making it more attractive to potential investors, partners, and customers.

- Access to Loans: It gives you an edge when applying for business loans or grants.

What are the Different Types of Business Entities in Nigeria?

In Nigeria, there are three main business entities you can register:

- Sole Proprietorship: A business owned and managed by an individual. It’s the easiest and least expensive to set up.

- Partnership: A business owned by two or more people who share the profits and losses.

- Limited Liability Company: A separate legal entity from its owners. It’s more complex to set up but offers more protection to its owners.

The type of entity you choose should depend on the nature of your business and your long-term goals.

How do I Register my Business?

The process of business registration in Nigeria has been simplified in recent years. It can be done online via the CAC’s website. Here’s a step-by-step guide:

- Name Search and Reservation: Propose two unique names for your business. The CAC will conduct a search to confirm that the names are not already in use.

- Filing of Registration Forms: After your name is approved, complete the registration forms.

- Payment of Fees: Pay the registration fees. The fees vary depending on the type of business entity.

- Submission of Documents: Submit all the necessary documents and await confirmation from the CAC.

What are the Common Pitfalls to Avoid?

While the process has been made easier, there are still some common mistakes to avoid:

- Don’t rush the process. Take your time to understand each step and ensure you have all the necessary documents.

- Avoid using a business name that is already in use or too similar to an existing one. The goal is to create a unique identity for your business.

In Conclusion…

Starting a business in Nigeria is a journey filled with excitement and challenges. But with the right information and guidance, you can navigate the process with ease. Remember, at counseal.com, we’re here to help you every step of the way.

So, why not take that first step towards making your business dream a reality? Your entrepreneurial journey starts here. Happy business building!