BVN Diaspora Centers Exposed: The Complete Global Investigation Report 2025

by Counseal Team

Updated September 26, 2025

The Bank Verification Number (BVN) system has become a critical gateway for Nigerian financial services since 2014. For the estimated 17 million Nigerians living abroad, accessing BVN enrollment through diaspora centers can determine their ability to maintain banking relationships back home. Our comprehensive investigation reveals significant disparities in service quality, operational status, and fee structures across the global BVN diaspora network that every overseas Nigerian needs to understand.

- What This Investigation Reveals About BVN Diaspora Centers Worldwide

- Why BVN Access Matters for Diaspora Nigerians in 2025

- How We Investigated Every BVN Diaspora Center Worldwide

- Shocking Disparities: What We Found Across the Global Network

- Complete Country-by-Country Analysis: Every Center Verified

- BVN Center Reliability Scorecard 2025

- What Diaspora Nigerians Must Know Before Traveling to Any Center

- Recommended Centers Based on Our Investigation

- The Hidden Costs: True Financial Impact on Diaspora Nigerians

- System Failures: What NIBSS Must Address Immediately

- Urgent Recommendations for NIBSS and Nigerian Authorities

- Your Action Plan: Navigating BVN Enrollment Successfully

- The Broader Impact: How BVN Access Affects Nigerian Economic Development

- Looking Forward: The Future of Diaspora Financial Services

- Take Action: How Counseal Can Help Navigate BVN Challenges

- Conclusion: Demanding Better Service for 17 Million Nigerians Abroad

What This Investigation Reveals About BVN Diaspora Centers Worldwide

The Bank Verification Number (BVN) system has become a critical gateway for Nigerian financial services since 2014. For the estimated 17 million Nigerians living abroad, accessing BVN enrollment through diaspora centers can determine their ability to maintain banking relationships back home. Our comprehensive investigation reveals significant disparities in service quality, operational status, and fee structures across the global BVN diaspora network that every overseas Nigerian needs to understand.

Key Findings Summary:

- Only 30% of listed diaspora centers are fully operational and responsive

- BVN enrollment fees vary by up to 78% between centers for identical services

- Multiple centers across major diaspora destinations are completely unreachable

- Service quality ranges from excellent to unprofessional, with no standardized oversight

This investigation provides the first comprehensive audit of every BVN diaspora center listed on the official NIBSS website, based on direct verification calls conducted between June-July 2025.

Why BVN Access Matters for Diaspora Nigerians in 2025

The Bank Verification Number represents Nigeria’s most significant financial inclusion initiative, creating a unified identity system for all bank customers. For diaspora Nigerians, BVN enrollment has evolved from optional to essential:

Critical BVN Requirements in 2025:

- Account Maintenance: Nigerian banks now require valid BVNs to prevent account freezing

- New Account Opening: BVN is mandatory for opening any new Nigerian bank account

- Digital Banking Access: Mobile banking and online transactions require BVN verification

- Investment Participation: Nigerian investment platforms mandate BVN for KYC compliance

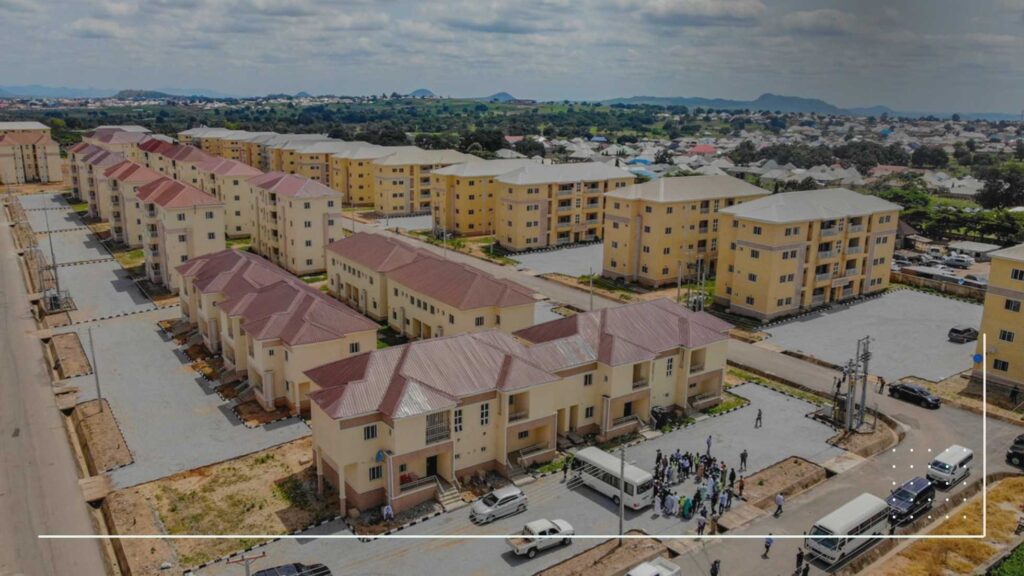

- Property Transactions: Real estate purchases increasingly require BVN verification

The inability to obtain a BVN effectively excludes diaspora Nigerians from their homeland’s financial ecosystem, making the reliability of diaspora enrollment centers a matter of paramount importance.

How We Investigated Every BVN Diaspora Center Worldwide

Our investigation employed a systematic approach to verify the operational status and service quality of every BVN diaspora center listed on the official NIBSS website.

Investigation Methodology

Data Collection Period: June-July 2025

Research Team: Counseal’s verification specialists Eunice & Osarumen

Scope: Every center listed on the NIBSS diaspora page

Approach: Direct phone verification using standardized questionnaires

The 13 Critical Questions We Asked Every Center

Our standardized verification process included these essential questions:

- Is your center currently accepting BVN registrations for diaspora applicants?

- Do I need to book an appointment in advance, or do you accept walk-ins?

- What documents do I need to bring for the BVN registration?

- What is the official fee for BVN registration at your center?

- Are there any additional or hidden charges?

- How long does the BVN enrollment process take at your center?

- How long will it take to receive my BVN after enrollment?

- Will I get a confirmation slip immediately after registration?

- Is there any special requirement for minors, elderly, or physically challenged applicants?

- Is your center directly licensed by NIBSS or working through an agent?

- Can I speak with someone who has recently done their BVN with you?

- Do you provide any support if there is an issue with the BVN after registration?

- Who can I contact if I have a problem after visiting your center?

Verification Standards

Each center received multiple contact attempts across different time zones and business hours. Centers unreachable after multiple attempts were classified as “unreachable.” All conversations were conducted by experienced customer service evaluators and documented verbatim.

Shocking Disparities: What We Found Across the Global Network

Our comprehensive investigation revealed significant disparities that directly impact diaspora Nigerians’ access to essential banking services.

Operational Status Reality Check

Fully Operational Centers: Only 5 out of 36 listed centers demonstrated complete operational capacity with comprehensive responses to all verification questions.

Partially Responsive Centers: Several centers provided limited information or showed concerning inconsistencies in their responses.

Unreachable Centers: A staggering 86% of listed centers were completely unreachable despite multiple contact attempts across different time periods.

Fee Structure Variations Exposed

The most concerning finding relates to dramatic fee variations across centers providing identical services:

Fee Range Analysis:

- Lowest Fee: £45 (approximately $57 USD) – File Solutions Limited, UK

- Highest Fee: AUD $120 (approximately $80 USD) – VFS Global, Australia

- Price Difference: Up to 78% variation for the same service

Hidden Charges Reality: While most operational centers claim no additional charges, several indicated potential extra fees for “customer-related issues,” creating uncertainty about total costs.

Service Quality Assessment

Professional Standards: Centers operated by established organizations like VFS Global generally demonstrated higher professional standards and clearer processes.

Customer Service Quality: Response quality varied dramatically, with some centers providing comprehensive, helpful information while others gave dismissive or unprofessional responses.

Process Clarity: Significant variations in information quality, with some centers providing detailed requirements while others gave vague or incomplete responses.

Complete Country-by-Country Analysis: Every Center Verified

Australia: Mixed Operational Status

VFS Global (BVN Enrolment Centre) – +61 469 296 120

- Status: Operational

- Fee: AUD $120 (highest globally)

- Process: 30 minutes enrollment, 3–7 working days for BVN delivery

- Requirements: Nigerian passport only

- Appointment: Booking required

- Assessment: Professional service but highest fees

VFS Global (Second Location) – 612 9252 1152

- Status: Unreachable

- **Multiple attempts failed to reach this center

United Kingdom: Professional Service with Concerning Customer Relations

File Solutions Limited – +44 7565 560644

- Status: Operational

- Fee: £45 (lowest globally)

- Process: 10 minutes enrollment, 3–5 working days delivery

- Requirements: National Identification Number (NIN)

- Notable Concern: Unprofessional response to customer support questions (“if you do not trust us, use someone else”)

Additional UK Centers: Three other File Solutions Limited numbers and two OIS Services centers were completely unreachable.

South Africa: VFS Global Reliability

VFS Global Pretoria – +27 (0)12 425 3011

- Status: Operational

- Fee: R615 (approximately $45 USD)

- Process: Under 1 hour enrollment, 3–7 working days delivery

- Requirements: Valid ID and recent passport photograph

- Assessment: Professional service with clear processes

United States: Limited Operational Centers

OIS Services Atlanta – +1 404 695 6373

- Status: Operational

- Fee: $45 USD

- Process: 40 minutes to 1 hour enrollment

- Requirements: ID, residency status, work permit

- Assessment: Professional service with comprehensive responses

Other US Locations: Seven additional centers across Baltimore, Chicago, Georgia, New Jersey, New York, Texas, and Washington were unreachable.

Other Regions: Widespread Accessibility Issues

Major Concern Areas:

- China: Three centers reachable but language barriers prevented service verification

- Canada: Both listed centers unreachable

- India: Three centers unreachable

- United Arab Emirates: One center unreachable

- France, Malaysia, Italy, Egypt, Lebanon, Japan, Netherlands, New Zealand, Tanzania: All centers unreachable

BVN Center Reliability Scorecard 2025

| Country | Center | Operational Status | Fee Transparency | Service Quality | Reliability Score |

| Australia | VFS Global (+61 469 296 120) | ✅ Operational | ⚠️ High Fees | ✅ Professional | 7/10 |

| UK | File Solutions (+44 7565 560644) | ✅ Operational | ✅ Competitive | ⚠️ Unprofessional | 6/10 |

| South Africa | VFS Global Pretoria | ✅ Operational | ✅ Fair Pricing | ✅ Professional | 8/10 |

| USA | OIS Services Atlanta | ✅ Operational | ✅ Fair Pricing | ✅ Professional | 8/10 |

| China | OIS Services (All) | ⚠️ Language Barrier | ❌ Unverified | ❌ Unverified | 3/10 |

Overall Network Reliability: 14% of listed centers are fully operational and accessible.

What Diaspora Nigerians Must Know Before Traveling to Any Center

Essential Pre-Visit Verification Steps

Always Call First: Never travel to any BVN center without confirming current operational status, as our investigation shows 86% of listed centers are unreachable.

Verify Current Fees: Fee structures vary significantly, so confirm exact costs including any potential additional charges before traveling.

Confirm Requirements: Document requirements vary between centers – verify specific needs for your situation.

Check Appointment Policies: Some centers require advance booking while others accept walk-ins.

Red Flags to Watch For

Unprofessional Communication: Centers that respond dismissively or refuse to provide clear information about their services.

Hidden Fee Indicators: Centers that mention “additional charges for customer issues” without clear explanation.

Unverified Licensing: Centers that cannot clearly confirm their direct licensing with NIBSS.

No Customer Support: Centers that refuse to provide clear contact information for follow-up issues.

Recommended Centers Based on Our Investigation

Top Performing Centers

VFS Global Pretoria, South Africa

- Consistent professional service

- Clear fee structure

- Comprehensive support

- Disability accessibility

OIS Services Atlanta, USA

- Professional customer service

- Transparent processes

- Multiple contact options

- Clear documentation requirements

Centers Requiring Caution

File Solutions Limited, UK: While operational and competitively priced, the unprofessional customer service response raises concerns about support quality.

VFS Global Australia: Professional service but significantly higher fees compared to other locations.

Alternative Strategies for Unreachable Regions

For Diaspora Nigerians in Affected Areas:

- Regional Travel: Consider traveling to operational centers in neighboring countries if feasible

- Embassy Contact: Reach out to Nigerian embassies for alternative BVN enrollment options

- Temporary Visit Planning: Plan BVN enrollment during visits to Nigeria

- Community Networks: Connect with local Nigerian communities for shared experiences and solutions

The Hidden Costs: True Financial Impact on Diaspora Nigerians

Direct Cost Analysis

Beyond the advertised enrollment fees, diaspora Nigerians face substantial additional costs:

Travel Expenses: Many must travel significant distances to reach operational centers Accommodation: Overnight stays often required for long-distance travel Lost Productivity: Time off work for center visits and potential return trips Opportunity Costs: Delayed business opportunities due to BVN enrollment challenges

Regional Cost Comparison

Most Affordable Option: South Africa (R615 ≈ $45 USD) + reasonable travel within region Most Expensive: Australia (AUD $120 ≈ $80 USD) + limited alternatives Best Value: USA (Professional service at $45 USD with multiple location options)

System Failures: What NIBSS Must Address Immediately

Critical Infrastructure Gaps

Geographic Coverage: Major diaspora destinations like Canada, India, and UAE have no operational centers despite significant Nigerian populations.

Quality Control: No standardized oversight ensures consistent service delivery across operational centers.

Communication Breakdown: 86% center unreachability rate indicates fundamental infrastructure failures.

Regulatory Compliance Issues

Fee Standardization: Lack of uniform pricing allows potential exploitation of diaspora Nigerians.

Service Standards: No consistent training or service quality requirements across centers.

Accountability Mechanisms: Limited recourse for diaspora Nigerians facing poor service or center failures.

Urgent Recommendations for NIBSS and Nigerian Authorities

Immediate Action Required

Emergency Infrastructure Audit

NIBSS must conduct immediate verification of all listed centers and remove non-operational locations from official directories.

Fee Standardization Implementation

Establish uniform fee structures across all centers with clear justification for any regional variations.

Quality Assurance Program

Implement regular monitoring and customer service training for all operational centers.

Alternative Service Channels

Develop digital or embassy-based alternatives for regions with no operational centers.

Long-term System Improvements

Centralized Information Portal

Create real-time status updates for all centers with verified contact information and current requirements.

Customer Feedback Mechanism

Establish formal complaint resolution processes with direct NIBSS oversight.

Regional Expansion Strategy

Prioritize center establishment in underserved regions with significant Nigerian populations.

Your Action Plan: Navigating BVN Enrollment Successfully

Before You Travel

- Verify Center Status: Call your intended center multiple times to confirm operational status

- Confirm Documentation: Get exact requirements for your specific situation

- Check Fee Structure: Verify total costs including any potential additional charges

- Plan Alternatives: Identify backup centers in case your primary choice fails

During Your Visit

- Document Everything: Keep records of all interactions and obtain written confirmations

- Request Contact Information: Ensure you have direct contact details for follow-up issues

- Verify Completion: Confirm all steps are completed before leaving the center

- Obtain Receipts: Keep all payment and process documentation

After Enrollment

- Monitor Progress: Follow up on BVN delivery timelines

- Test Verification: Verify your BVN works with Nigerian banks promptly

- Report Issues: Contact both the center and NIBSS for any problems

- Share Experiences: Inform other diaspora Nigerians about your experience

The Broader Impact: How BVN Access Affects Nigerian Economic Development

Diaspora Economic Contribution

Nigerian diaspora remittances exceeded $20 billion in 2024, representing a crucial component of Nigeria’s foreign exchange earnings. Barriers to BVN enrollment directly impact:

Remittance Flows: Difficult BVN access reduces formal money transfer channels Investment Participation: Diaspora investment in Nigerian opportunities requires BVN verification Digital Financial Inclusion: Nigeria’s cashless policy advancement depends on diaspora participation

Business and Investment Implications

Diaspora Business Setup: Nigerian entrepreneurs abroad need BVN for business bank accounts Property Investment: Real estate transactions increasingly require BVN verification Capital Market Access: Stock market and other investment platforms mandate BVN compliance

Looking Forward: The Future of Diaspora Financial Services

Technology Solutions on the Horizon

Digital Enrollment Options: Potential for secure video-based BVN enrollment Embassy Integration: Enhanced services through Nigerian diplomatic missions Mobile Verification: Smartphone-based biometric capture technologies

Policy Development Needs

Regulatory Framework: Clearer guidelines for diaspora center operations and oversight International Cooperation: Improved coordination with host country authorities Service Standardization: Uniform quality and pricing standards across all centers

Take Action: How Counseal Can Help Navigate BVN Challenges

At counseal.com, we understand the critical importance of BVN enrollment for diaspora Nigerians and the frustrating challenges revealed by this investigation. Our team provides comprehensive support for diaspora banking requirements and business setup processes.

Our BVN Advisory Services Include:

- Current center verification and operational status updates

- Documentation preparation and requirement guidance

- Alternative enrollment strategy development

- Follow-up support for enrollment issues

- Integration with broader Nigerian business setup services

Ready to resolve your BVN enrollment challenges? Get your free strategy session today and let our experts guide you through the most efficient path to BVN enrollment based on your specific location and circumstances.

Conclusion: Demanding Better Service for 17 Million Nigerians Abroad

This investigation exposes a BVN diaspora system that fails to meet the needs of the 17 million Nigerians living abroad. With only 14% of listed centers fully operational and dramatic service quality variations, the current infrastructure undermines Nigeria’s financial inclusion objectives and creates unnecessary barriers for diaspora economic participation.

The evidence is clear:

- Widespread center inaccessibility affects millions of diaspora Nigerians

- Inconsistent service quality and fee structures create uncertainty and potential exploitation

- Lack of oversight and standardization fails basic customer service standards

- Geographic gaps leave entire regions without access to essential services

The solutions are achievable:

- Immediate infrastructure audit and non-operational center removal

- Standardized fee structures and service quality requirements

- Enhanced oversight and accountability mechanisms

- Technology-enabled alternatives for underserved regions

For diaspora Nigerians, this investigation provides the verified information needed to navigate the current system successfully. For NIBSS and Nigerian authorities, it presents an urgent call to action to transform a critical financial infrastructure that currently serves only a fraction of its intended beneficiaries.

The BVN system represents Nigeria’s commitment to financial inclusion and security. Ensuring reliable, professional, and accessible enrollment services for diaspora Nigerians is not just a customer service issue—it’s fundamental to maintaining the economic connection between Nigeria and its global citizens.

Every diaspora Nigerian deserves reliable access to their financial heritage. The time for systemic reform is now.

About This Investigation: This comprehensive report was conducted by counseal.com’s research team between June-July 2025, involving direct verification of every BVN diaspora center listed on the official NIBSS website. For the most current information and personalized guidance on BVN enrollment, visit counseal.com.

References: [1] NIBSS Official Website: https://www.nibss-plc.com.ng/ [2] Central Bank of Nigeria (CBN) BVN Policy: https://www.cbn.gov.ng/