Environmental Regulations and Compliance in Nigeria: A Comprehensive Guide for Businesses

by Counseal Team

Updated February 10, 2025

For Nigerian businesses, environmental compliance isn’t merely a legal obligation—it’s a strategic imperative that drives sustainable growth and market advantage. With Nigeria’s expanding regulatory framework and increasing global focus on environmental responsibility, understanding and implementing proper environmental compliance measures has become crucial for business success.

For Nigerian businesses, environmental compliance isn’t merely a legal obligation—it’s a strategic imperative that drives sustainable growth and market advantage. With Nigeria’s expanding regulatory framework and increasing global focus on environmental responsibility, understanding and implementing proper environmental compliance measures has become crucial for business success.

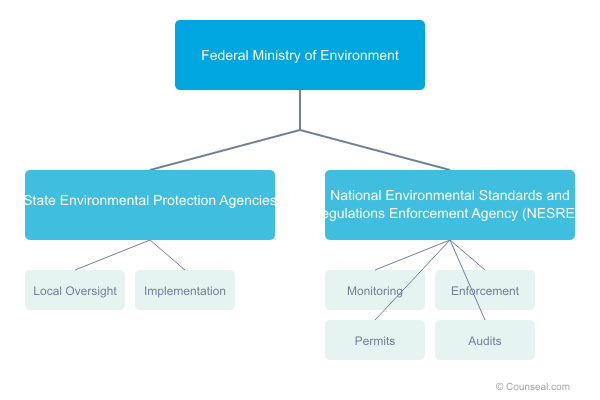

The Regulatory Landscape

The Nigerian environmental regulatory framework operates on multiple levels, with federal and state agencies working in concert to ensure comprehensive environmental protection. At the federal level, two primary institutions stand at the forefront:

Federal Ministry of Environment

The Ministry serves as the architectural foundation of Nigeria’s environmental policy framework, establishing comprehensive guidelines that shape business operations across all sectors. Their mandate encompasses:

- Policy formulation and implementation

- Environmental quality monitoring

- Coordination with international environmental bodies

- Strategic planning for sustainable development

National Environmental Standards and Regulations Enforcement Agency (NESREA)

NESREA functions as Nigeria’s primary environmental enforcement body, with broad powers to:

- Monitor and enforce environmental standards

- Regulate industrial and agricultural activities

- Issue permits and licenses

- Conduct environmental audits

- Impose sanctions for non-compliance

Critical Compliance Requirements

Environmental Impact Assessment (EIA)

The EIA process represents a fundamental requirement for new projects and significant business expansions. Key components include:

- Preliminary assessment

- Detailed environmental impact study

- Public consultation

- Review and approval process

- Implementation monitoring

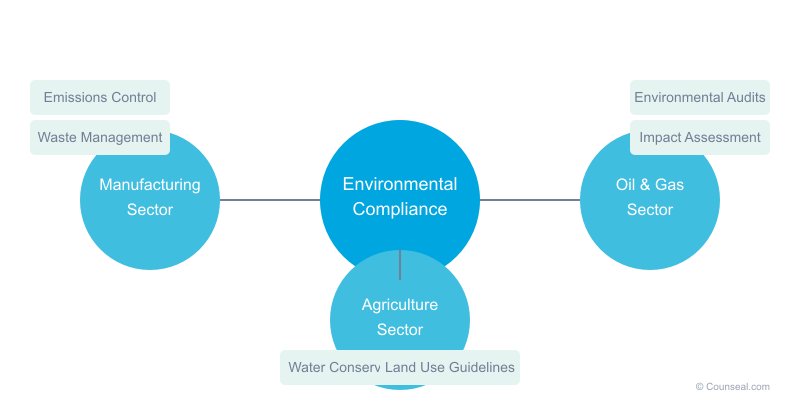

Sector-Specific Regulations

Different industries face varying compliance requirements:

Manufacturing:

- Emissions control standards

- Waste management protocols

- Energy efficiency requirements

Oil and Gas:

- Specific environmental protection measures

- Regular environmental audits

- Community impact assessments

Agriculture:

- Land use regulations

- Water conservation requirements

- Pesticide and chemical usage guidelines

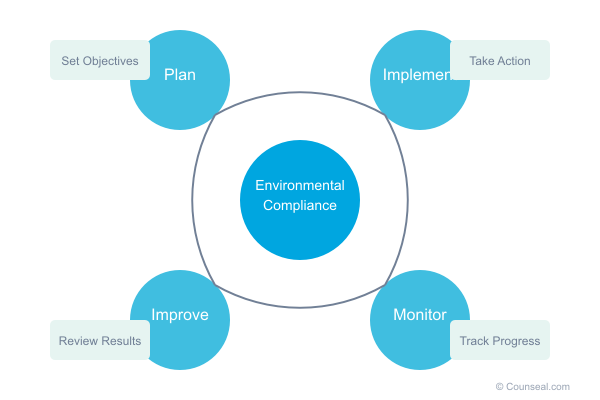

Implementation Strategy

Step 1: Initial Assessment

Begin with a comprehensive evaluation of your business operations:

- Document current environmental impacts

- Identify applicable regulations

- Assess compliance gaps

- Develop action plans

Step 2: Systems Development

Establish robust environmental management systems:

- Create monitoring protocols

- Implement documentation procedures

- Develop emergency response plans

- Train staff on compliance requirements

Step 3: Ongoing Monitoring

Maintain continuous oversight of environmental performance:

- Regular internal audits

- Performance metrics tracking

- Compliance reporting

- Stakeholder engagement

Financial Implications

Compliance Costs

Understanding the financial aspects of environmental compliance helps in proper budgeting:

Initial Setup:

- Environmental assessment fees: ₦500,000 – ₦5,000,000

- Equipment upgrades: Variable based on industry

- Training and certification: ₦200,000 – ₦1,000,000

Ongoing Costs:

- Monitoring and reporting: ₦100,000 – ₦500,000 annually

- Maintenance and upgrades: Variable

- Professional services: ₦250,000 – ₦2,000,000 annually

Non-Compliance Penalties

The cost of non-compliance can be severe:

- Fines: Up to ₦1,000,000 per day for continued violations

- Business suspension

- Legal proceedings

- Reputational damage

Best Practices and Success Strategies

Documentation Management

Maintain comprehensive records of:

- Environmental permits and licenses

- Monitoring data and reports

- Training records

- Incident reports and corrective actions

- Audit findings and responses

Stakeholder Engagement

Build strong relationships with:

- Regulatory agencies

- Local communities

- Environmental NGOs

- Industry associations

Continuous Improvement

Regularly review and enhance environmental performance through:

- Technology upgrades

- Process optimisation

- Staff training

- Best practice adoption

Future Outlook

Nigerian environmental regulations continue to evolve, with increasing focus on:

- Climate change mitigation

- Circular economy principles

- Sustainable resource management

- Green technology adoption

Businesses that proactively adapt to these trends position themselves for sustainable growth and market leadership.

Ready to ensure your business meets all environmental compliance requirements? Visit counseal.com/start for expert guidance and support in navigating Nigeria’s environmental regulations.