The Essential Guide to Nigerian Business Regulations: Stay Compliant in 2025

by Counseal Team

Updated April 15, 2025

Staying current with Nigerian business regulations is crucial for sustainable business operations. This comprehensive guide outlines the key regulatory bodies, essential compliance requirements, and practical strategies for maintaining regulatory awareness in Nigeria’s dynamic business environment.

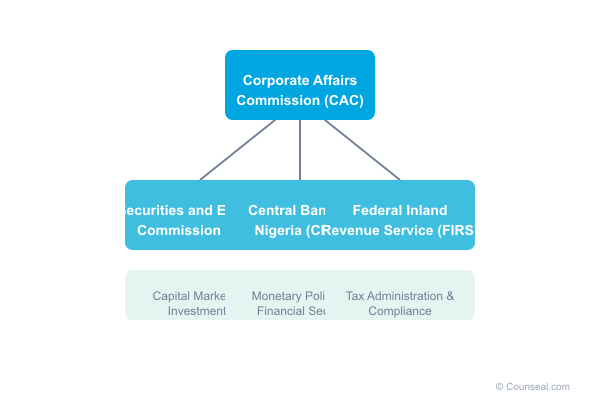

Understanding Nigeria’s Regulatory Framework

Key Regulatory Bodies

- Corporate Affairs Commission (CAC): Oversees company registration and corporate compliance

- Securities and Exchange Commission (SEC): Regulates capital markets and investments

- Central Bank of Nigeria (CBN): Controls monetary policy and financial sector regulations

- Federal Inland Revenue Service (FIRS): Manages tax administration and compliance

Critical Regulations for Nigerian Businesses

Companies and Allied Matters Act (CAMA) 2020

- Single-member company provisions

- Simplified filing requirements

- Electronic filing systems

- Modified share capital requirements

Nigeria Data Protection Regulation (NDPR)

- Personal data protection requirements

- Consent management protocols

- Cross-border data transfer rules

- Breach notification requirements

Practical Compliance Strategies

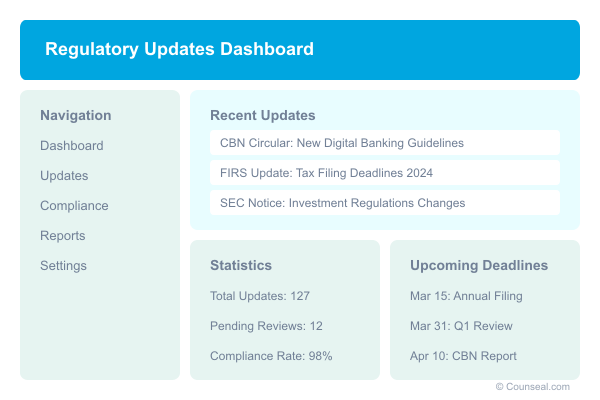

Digital Tools for Regulatory Tracking

- Official channels:

- Regulatory body websites

- Government gazettes

- Official circulars

- Technology solutions:

- Regulatory update platforms

- Compliance management software

- Document management systems

Professional Networks and Resources

- Industry associations

- Professional bodies

- Legal advisory services

- Regulatory consultants

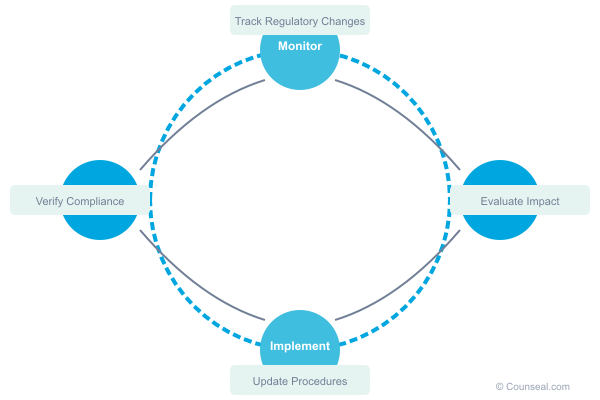

Implementation Framework

Monthly Compliance Checklist

- Review regulatory updates

- Assess impact on operations

- Update internal policies

- Train relevant staff

- Document compliance measures

Risk Management Strategy

- Identify regulatory risks

- Assess impact levels

- Develop mitigation plans

- Monitor compliance status

- Review and update procedures

Case Studies: Regulatory Adaptation

Success Story: Lagos-Based FinTech

A Lagos-based financial technology company successfully navigated the CBN’s new licensing requirements by:

- Establishing a dedicated compliance team

- Implementing automated monitoring systems

- Developing stakeholder communication channels

- Creating clear compliance documentation

Lessons Learned

- Proactive monitoring is essential

- Documentation saves time

- Professional networks provide valuable insights

- Technology investment pays off

Expert Recommendations

Best Practices

- Maintain a regulatory calendar

- Build relationships with regulatory bodies

- Invest in compliance training

- Document everything

- Regular policy reviews

Common Pitfalls to Avoid

- Reactive compliance approaches

- Inadequate documentation

- Poor communication channels

- Insufficient staff training

- Outdated compliance procedures

Moving Forward

Action Steps

- Audit current compliance status

- Identify gaps in monitoring systems

- Develop or update compliance procedures

- Train team members

- Implement tracking tools

Ready to strengthen your regulatory compliance? Visit counseal.com/start for expert guidance and support.

Up next:

Challenges and Opportunities for Nigerian Entrepreneurs in the Diaspora

Discover how Nigerian entrepreneurs in the diaspora can transform challenges into opportunities. From accessing global markets to leveraging technology, this comprehensive guide provides actionable strategies for building successful cross-border businesses.

The Essential Elements of a Valid Contract in Nigeria

Discover the 6 essential elements that make contracts legally binding in Nigeria. From offer and acceptance to free consent, learn how to protect your business with enforceable agreements that stand up in court.

The Tax System in Nigeria: A New & Updated Overview

Key Stakeholders in the Tax System in Nigeria The Government This includes the federal, state, and local governments with their respective ministries and agencies. The government is obligated to: The Taxpayer A taxpayer is a person or group of persons or an entity that pays or is liable to tax. As a taxpayer, you are…