Register a British Virgin Islands Company

by Counseal Team

Updated November 26, 2023

Are you considering registering a company in the British Virgin Islands? If yes, it’s overwhelming to navigate through the registration process on your own. However, with the right guidance and knowledge, you can streamline this procedure and save yourself time and unnecessary stress.

In this article, we will provide an in-depth guide for registering a company in the British Virgin Islands. From understanding legal requirements to choosing the right legal structure, our professional tips and advice will equip you with everything you need to know to register your business in this beautiful Caribbean nation successfully.

Overview of Company Registration in the British Virgin Islands (BVI)

Registering a company in the British Virgin Islands (BVI) is an attractive option for many individuals and businesses because of the ease of the process, low tax rates, and privacy laws. You can complete the registration process within one day, making it efficient when you are seeking to establish a company quickly.

To register a BVI company, you must meet legal requirements by selecting an appropriate legal structure, such as limited liability companies, partnerships, etc. It’s crucial to understand the benefits associated with each type of structure before choosing one based on your specific needs.

Once you’ve decided on your preferred legal structure and name choice that adheres to local guidelines, concomitantly ensuring it doesn’t infringe any trademark rights of any pre-existing companies operating under similar names, you may proceed with filing articles of association with the Registrar of Corporate Affairs, following which you will need help from legal professionals specialised in this field who will ensure regulatory compliance with current legislation, as failure to do so could have detrimental impacts on the success and longevity of your venture.

We will discuss this further in the article as we look at the following:

- Requirements for Company Registration

- Types of companies that you can structure your business as

- The procedure for registration

- Documents required

- Advantages and the Disadvantages of setting up a company in the BVI

- Post registration compliance

- Corporate Tax requirements

In conclusion, enlisting support from experts during this procedure will reduce errors while providing valuable insights into navigating document filings, including getting the requisite work permits or visas if needed.

Requirements for Company Registration in the BVI

Eligibility criteria for company registration in the British Virgin Islands include having at least one director and shareholder, a registered office address in the country, and a standard authorised share capital of at least US$50,000. BVI companies are required to have a company secretary who is a resident or based locally.

Foreign nationals can set up their businesses in the BVI, but they must also meet certain requirements. These include conducting due diligence checks on all shareholders and directors, getting necessary licences or permits for regulated industries, and complying with anti-money laundering regulations. BVI companies are also required to submit annual returns to maintain good standing.

Navigating through these eligibility criteria can be complex without professional guidance. Hiring a corporate service provider with expertise in local regulations can ensure that your company meets all legal requirements during the registration process while saving you time and resources. You should note that it is mandatory to employ the services of a registered agent for your company.

Types of Companies in the BVI

International Business Company (IBC)

An International Business Company (IBC) is a popular business entity structure in the British Virgin Islands (BVI). These BVI companies are designed for international trade and investment, making them attractive to global entrepreneurs looking to establish an offshore presence. IBCs provide several benefits, including low tax rates and high levels of privacy. They also have minimal regulatory requirements, making them relatively easy to set up and operate.

To set up an IBC in the BVI, you need to meet some specific legal requirements. An applicant must submit proper documentation, such as proof of identity, address verification, and information about company directors.

Choosing the right type of business structure for your needs is essential when registering an IBC in the BVI; common options include limited liability companies (LLCs), partnerships, or joint ventures.

With proper planning combined with adequate support throughout the registration process, registering an IBC could give your business a significant competitive edge on a global scale while benefiting from tax-friendly policies within the BVI’s financial district.

BVI Business Company (BVIBC)

BVI Business Company (BVIBC) is a popular choice among investors worldwide interested in registering a company in the British Virgin Islands. It is an ideal option for corporations seeking a tax-efficient holding entity and for those who wish to use the BVI jurisdiction systemically.

One of the major benefits of BVIBCs is their streamlined registration process, which can be completed relatively quickly while adhering to strict legal requirements.

Once registered, BVIBCs boast high levels of flexibility and ease-of-use – allowing businesses to operate efficiently within international markets.

Limited Partnership

A limited partnership involves a general partner who manages and operates the company, while passive investors act as limited partners.

This business structure separates liability between the general and limited partners, where only the former is personally liable for any debts or legal issues incurred by the company.

Limited partnerships are an attractive option for entrepreneurs looking to raise capital without losing control of their business.

In the BVI, registering a limited partnership requires filing a Memorandum and Articles of Association with the Registrar of Companies, along with other necessary documentation such as proof of identity, address confirmation, and payment of fees. It’s important to note that an entity must have at least one local agent or registered office established within the BVI territory.

Limited Liability Company (LLC) in BVI

A Limited Liability Company (LLC) is a popular choice because it offers liability protection for its members. This means that if the company faces legal or financial obligations, only the assets of the LLC are at risk, not those of its owners. The registration process to form an LLC in the BVI is straightforward and cost-effective. It requires filing Articles of Association with the Registrar of Corporate Affairs and payment of applicable fees.

LLCs in the BVI have flexible internal management structures that allow members to tailor their business operations according to their specific needs.

They can appoint managers to oversee day-to-day activities or choose a member-managed structure where all owners have equal decision-making authority.

With these benefits, forming an LLC in the BVI can provide businesses excellent value as they expand into international markets while also protecting their interests against potential liabilities and risks.

Ordinary Resident Company

An ordinary resident company is a local company that conducts business within the BVI and has at least one director who lives in the territory. This company type can be used for any lawful activity, including international trading, consulting, or holding investments.

To set up an ordinary resident company in the BVI, you will need to provide information about your proposed company name and registered office address, as well as submit required documents such as the Articles of Association.

One benefit of setting up an ordinary resident company is that it provides access to tax-efficient structures, such as exemption from income tax on foreign-sourced income or capital gains. Additionally, this type of company offers flexibility regarding corporate governance matters, such as the appointment and removal of directors.

Overall, registering an ordinary resident company can offer many advantages in conducting business both locally and internationally through a tax-efficient structure with flexible corporate governance arrangements.

Segregated Portfolio Company (SPC)

In making your decision about how to legally structure your BVI company, it’s worth inspecting SPCs. SPCs provide an attractive option for companies looking to protect their assets.

This structure enables you to operate several portfolios within one company, with each portfolio remaining separate from the others. This can help reduce risks and protect against insolvency and legal claims.

Incorporating an SPC in the BVI is relatively straightforward and offers many benefits over other offshore jurisdictions. An SPC affords great flexibility as well – you can create multiple sub-funds being collected under one umbrella employing different currencies, specific investment strategies, etc., while still keeping them distinct from each other by law!

These features make this type of company highly desirable for those with specialised investments that require individual management without unnecessary exposure between portfolios.

Procedure for Company Registration in the BVI

The registration process for a BVI company can seem daunting, but with an understanding of the legal requirements and business structures, it can be streamlined.

The first step is to choose a unique name for your company that complies with BVI regulations. You will also need to provide details on shareholders, directors, and authorised capital.

Once you have gathered all the information and documentation, you can apply to the Registrar of Corporate Affairs for incorporation. Registration fees vary depending on the type of corporate entity and are typically paid at this stage.

After processing your application, which usually takes four to five business days, you will receive a Certificate of Incorporation verifying your new company’s existence.

By following these key steps and seeking professional guidance as needed, setting up a BVI company will become straightforward. Whether you’re setting up an offshore company or operating entity, knowing how to navigate through the legal formalities ensures compliance with local laws while avoiding unnecessary stress or delays along the way.

Documents required for Company Registration in the BVI

When setting up a BVI company, there are a few important documents that you will need to submit. These include:

- A duly completed application form for incorporation. At least one director or secretary of the company must sign this.

- Certified copies of all directors’ and shareholders’ identification documents, such as passports or driver’s licences

- Articles of association detailing shares and more issued to each shareholder

- your preferred name/s, addresses

- Supporting Incorporation minutes, where applicable

- Proof of payment for incorporation fees; among other documents

It is mandatory to have a registered agent and registered office address in the BVI when incorporating your company. The registration agent plays an essential role in facilitating communication between your business and the local authorities while ensuring compliance with legal regulations.

In summary, when setting up a company in the BVI, it is crucial to have all necessary documentation ready beforehand. The streamlined approach followed by professional services would help expedite this process while also considering other pertinent national laws applicable from time to time.

Post Registration Compliances

Once you set up a company in the British Virgin Islands, it must comply with post-registration requirements. These include appointing a local agent and maintaining their registration status by paying annual fees. Companies must also keep accurate accounts and file yearly financial statements with the Registrar of Corporate Affairs.

BVI companies are required to hold annual general meetings and maintain minutes of these meetings, as well as maintain registers for shareholders, directors, and officers.

Failure to comply with post-registration requirements can cause penalties, such as fines or even the revocation of registration.

By understanding these compliance obligations from the outset, companies can better manage their ongoing responsibilities in the British Virgin Islands.

Seeking guidance from a professional adviser can ensure that all necessary steps are taken for successful registration and ongoing compliance.

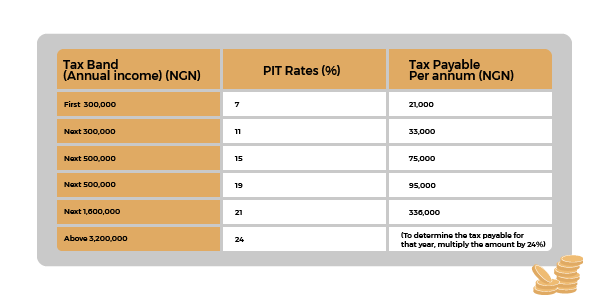

Corporate Tax Requirements

When setting up a BVI company, it is important to understand the corporate tax requirements. The BVI has a highly attractive tax system for foreign investors and businesses, with no income or capital gains taxes applied to offshore companies. However, the government imposes an annual fee on all registered companies called the Annual Governmental Fee (AGF). This fee varies depending on the type of company and its share capital.

Besides the AGF, both resident and non-resident corporations are required to file annual financial statements with the Registrar of Corporate Affairs. These statements should include information such as balance sheets, profit-and-loss accounts, and notes that explain significant events affecting their financial position during that fiscal year. Companies must also keep accurate books of account at their registered office or place designated by directors that are available for inspection upon request by authorities.

Understanding these corporate tax requirements is crucial when you are setting up a BVI company, as they form part of ongoing compliance obligations that need careful attention throughout your business’ lifetime in this jurisdiction.

Advantages/Benefits of registering a company in the BVI

- There is no corporate tax, capital gains tax, or withholding tax on dividends. This makes it an attractive location for businesses that want to minimise their tax liabilities.

- The incorporation process is streamlined and efficient, with minimal bureaucratic red tape. It can take as little as 24 hours to incorporate your business in the BVI.

- Favourable asset protection laws. The jurisdiction provides strict confidentiality measures that allow shareholders to operate anonymously if they choose to do so. Under some circumstances, investors are protected by tight restrictions on creditors’ rights against assets held within BVI companies.

- FinTech Friendly. As Financial technology is fast becoming the new normal, the BVI currently has an up-to-date regulatory framework for FinTech companies and transactions.

BVI’s jurisdiction attracts entrepreneurs from around the world because of its simplified regulations and reasonable registration costs for new businesses compared to other offshore financial centres, whose requirements may be more cumbersome or expensive.

By incorporating here, entrepreneurs can enjoy low overhead while benefiting from reduced risks associated with regulatory regimes closer to their home jurisdictions.

Disadvantages of/Restrictions on Registering a company in the British Virgin Islands

While registering a company in the British Virgin Islands can offer many benefits, such as tax exemptions and confidentiality, there are also several disadvantages and restrictions.

- It’s costly to set up because of high legal fees. Companies must hire local registered agents, pay government registration fees, and provide audited financial statements annually, which can all add up quickly.

- While privacy is a major benefit of setting up a company in the British Virgin Islands, it might work against businesses looking to build credibility with investors or customers who may be sceptical about offshore companies.

- Certain industries, like banking and finance, require additional licences and approvals before operating within the territory.

Overall, while registering a business in this jurisdiction can offer many advantages for some businesses, it’s important to consider all the downsides before making any final decisions.

Frequently Asked Questions

u003cstrongu003eWhich law regulates company registration in the British Virgin Islands?u003c/strongu003e

Company registration and all company activities are regulated by the BVI Business Companies Act 2004, the Insolvency Act 2003, and the Securities and Investment Business Act 2010.

u003cstrongu003eIs it mandatory to hire a registered agent for company registration in the British Virgin Islands?u003c/strongu003e

Yes. The BVI Business Companies Act 2004 provides that a company must at all times have a registered agent. Failure to comply with this attracts a sanction of $10,000.

u003cstrongu003eWhat can be done if there is a change in the reserved name of the company?u003c/strongu003e

Once you reserve the name of your company, wait for it to be accepted or rejected. If it is rejected, you can change the name and make another reservation. If the name is accepted, apply to the Registrar of Companies for a name change.

u003cstrongu003eDo the companies registered in BVI need to hold annual meetings?u003c/strongu003e

The BVI Business Companies Act 2004 provides for an annual general meeting, which can be held physically or electronically. It also provides that, in place of a physical meeting, companies can pass written resolutions.

u003cstrongu003eHow do I find a company in the British Virgin Islands?u003c/strongu003e

Information on companies registered in the BVI can be found in the BVI Commercial Registry. You will be charged a fee for the service. Visit the BVI Financial Services Commission’su003ca href=u0022https://www.bvifsc.vg/faq/how-do-i-conduct-company-searchu0022u003e websiteu003c/au003e for contact details.

u003cstrongu003eHow much does it cost to set up a company in the British Virgin Islands?u003c/strongu003e

The statutory incorporation fee for a BVIBC that is allowed to issue up to 50,000 shares is US$450. If the authorised number of shares is more than 50,000, the incorporation fee is US$1,200. u003cbru003eu003cbru003eThe annual licence fee, which is payable every year after incorporation, is US$450 where the authorised number of shares is 50,000 or less, and US$1,200 where the authorised number of shares is 50,000 or more.u003cbru003eu003cbru003eYou should take into consideration the fees of the registered agent.