Common Regulatory Compliance Challenges and How to Overcome Them

by Counseal Team

Updated March 11, 2025

Regulatory compliance forms the backbone of business sustainability in Nigeria, yet many organisations struggle with its complexities. From interpreting intricate legal frameworks to adapting to regulatory changes, maintaining compliance demands strategic attention and resources.

Regulatory compliance forms the backbone of business sustainability in Nigeria, yet many organisations struggle with its complexities. From interpreting intricate legal frameworks to adapting to regulatory changes, maintaining compliance demands strategic attention and resources.

Understanding Nigeria’s Regulatory Landscape

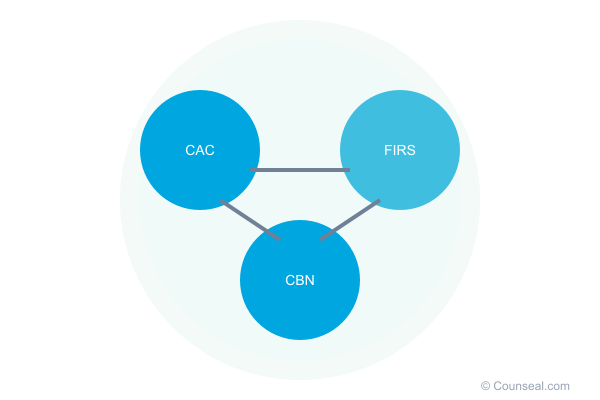

Nigeria’s robust regulatory environment reflects its position as Africa’s largest economy. The nation’s regulatory framework encompasses multiple sectors, each overseen by specific authorities:

The Corporate Affairs Commission (CAC) serves as the primary business registry, mandating all enterprises to register and file annual returns. Recent digitalisation initiatives have streamlined the registration process, though companies must still navigate specific documentation requirements and timelines.

The Federal Inland Revenue Service (FIRS) implements tax regulations requiring businesses to obtain Tax Identification Numbers (TIN) and register for Value Added Tax when turnover exceeds ₦25 million. Recent amendments to the Finance Act have introduced additional obligations for digital services and non-resident companies.

The National Agency for Food and Drug Administration and Control (NAFDAC) enforces strict product registration protocols. Their updated guidelines emphasise Good Manufacturing Practice (GMP) certification and comprehensive product documentation.

The Central Bank of Nigeria (CBN) maintains oversight of financial services, particularly in the growing fintech sector. Recent frameworks have introduced new requirements for cybersecurity, data protection, and minimum operational standards.

Critical Compliance Challenges

Regulatory Evolution and Interpretation

The Nigerian regulatory landscape undergoes frequent updates, particularly in emerging sectors like financial technology and renewable energy. The CBN’s recent guidelines on payment service banks exemplify this dynamic environment, requiring businesses to constantly reassess their compliance strategies.

Resource Allocation

While large corporations maintain dedicated compliance departments, small and medium enterprises often struggle with limited resources. The cost of compliance, including technology investments and expert consultation, can strain operational budgets.

Data Protection Implementation

The Nigeria Data Protection Regulation (NDPR) mandates comprehensive data protection measures. Organisations must implement:

- Robust encryption protocols

- Regular security audits

- Staff training programmes

- Clear data handling procedures

Strategic Compliance Solutions

Digital Compliance Management

Implement regulatory technology (RegTech) solutions to automate compliance processes. Modern compliance platforms offer:

- Real-time regulatory updates

- Automated reporting capabilities

- Document management systems

- Compliance calendar tracking

Professional Expertise Integration

Engage with qualified compliance consultants who understand Nigeria’s regulatory nuances. Focus on professionals with:

- Sector-specific experience

- Proven track records with regulatory bodies

- Understanding of local and international compliance standards

Organisational Compliance Culture

Develop a compliance-focused culture through:

- Regular training programmes

- Clear compliance policies and procedures

- Defined roles and responsibilities

- Continuous monitoring and improvement processes

Future-Proofing Compliance

Success in regulatory compliance requires proactive engagement with regulatory changes and strategic investment in compliance infrastructure. Organisations must view compliance as a competitive advantage rather than a regulatory burden.For personalised guidance on navigating Nigeria’s regulatory landscape, visit counseal.com/start to connect with experienced compliance professionals.