Navigating the Waters: Setting Up Your Foreign Company in Nigeria

by Counseal Team

Updated July 22, 2024

Introduction

Picture this: you’re standing at the edge of a vast ocean, the Nigerian business landscape stretching out before you. Setting up a foreign company in this dynamic environment is like preparing for a deep dive – it requires careful planning, the right equipment, and a spirit of adventure. Whether you’re drawn to the burgeoning tech scene, the vibrant entertainment industry, or the untapped potential in agriculture, Nigeria offers a sea of opportunities. But before you take the plunge, let’s ensure you have your gear in order.

In this guide, we’ll be your diving instructors, leading you through the essential steps to establish your foreign company in Nigeria. We’ll cover crucial aspects like market research, legal compliance, and practical considerations. So, grab your entrepreneurial wetsuit, and let’s dive in!

- Research and Feasibility Assessment

- Choosing Your Business Structure

- Registering Your Company

- Obtaining Necessary Permits and Licenses

- Obtaining Your Tax Identification Number (TIN)

- Setting Up Your Corporate Bank Account

- Appointing a Company Secretary

- Holding Annual General Meetings (AGMs)

- Maintaining Proper Financial Records

- Conclusion: Navigating the Nigerian Business Waters

Research and Feasibility Assessment

Before you dive headfirst into the registration process, it’s crucial to test the waters. Conducting thorough market research is like checking the currents and assessing the depth before you plunge in.

Market Research: Analyzing the Tides

Comprehensive market research is your life jacket in the Nigerian business ocean. It helps you understand the demand for your product or service, identify your competitors, and spot the opportunities ripe for the taking.

Start by analyzing market trends – the prevailing winds in your industry. What’s hot? What’s on the decline? Are there any seasonal fluctuations you should be aware of? These insights will help you steer your business in the right direction.

Next, gauge the demand for your offering. Is there a swell of interest you can ride? Or is it a calm sea with little to no demand? Similarly, size up the competition. Identify who’s already making waves and analyze their strategies. What are they doing right? Where are they leaving gaps you could fill?

Legal and Regulatory Framework

Now, let’s navigate the legal and regulatory reefs. Just like a ship needs to avoid scraping the bottom, your business needs to steer clear of compliance issues.

Familiarize yourself with the Nigerian laws governing foreign investment. These regulations ensure your business operates smoothly in the eyes of the law.

Additionally, different sectors have their own specific rules – think of them as local guidelines. Whether you’re venturing into oil and gas, telecommunications, or finance, understand the unique regulations that apply to your industry.

Choosing Your Business Structure

Selecting the right business structure is like choosing the perfect vessel for your entrepreneurial journey. The two main options in Nigeria are setting up a subsidiary company or establishing a branch office.

Subsidiary Company: Your Independent Voyager

A subsidiary company is like a grown-up child – independent but still bearing the family name. It’s a separate legal entity from your foreign parent company, which means it can navigate the business waters on its own terms.

Here’s what you need to know about subsidiaries:

- Limited Liability: Your financial risk is limited to your invested capital. If storms hit, your personal assets remain safe on shore.

- Capital Requirements: Be prepared to show some financial muscle with a minimum share capital. It’s your way of saying, “I’m serious about this venture.”

- Directorship: You’ll need at least two directors on your crew, with one being a Nigerian resident – your local navigator.

- Long-Term Commitment: If Nigeria is your chosen business destination, a subsidiary company signals you’re here for the long haul.

Branch Office: Your Business Outpost

If a subsidiary is an independent voyager, a branch office is more like a scout – an extension of the parent company exploring new territories.

Key points about branch offices:

- No Separate Legal Identity: A branch office is tethered to the parent company. If it encounters legal turbulence, the parent bears the responsibility.

- Local Representative: You’ll need a trusted local representative to be the face of your operations on the ground.

- Market Entry or Short-Term Projects: Branch offices are ideal for testing the waters or executing time-bound missions.

Choosing between a subsidiary and a branch office depends on your long-term goals and operational needs. Consider your business strategy and objectives when deciding which structure aligns best with your vision.

Registering Your Company

With your business structure chosen, it’s time to make it official. Registering your company with the Corporate Affairs Commission (CAC) is like getting your diving license – it legitimizes your presence in the Nigerian business waters.

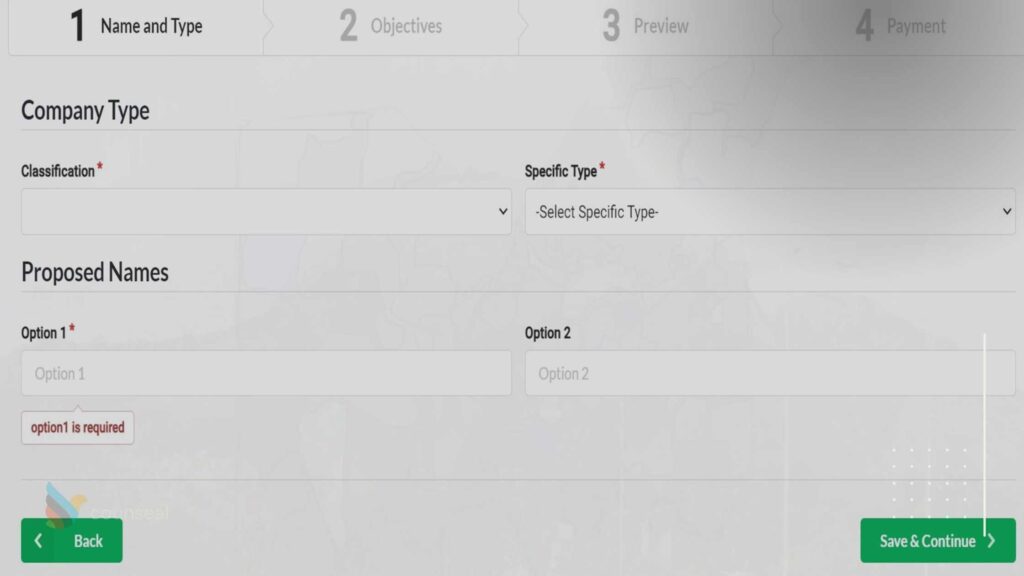

Step 1: Reserve Your Unique Company Name

Your company name is your unique identifier in the business ocean. It should be memorable, meaningful, and, most importantly, available. To ensure your desired name is all yours, reserve it with the CAC.

Here’s how:

- Brainstorm a name that encapsulates your brand identity and stands out from the competition.

- Submit your name reservation application on the CAC portal.

- If the CAC approves, they’ll reserve the name for 60 days – your window to complete the incorporation process.

Step 2: Incorporate Your Business

Incorporation is the process of legally establishing your company. It’s like receiving your official diving gear – you’re now ready to explore the depths of the Nigerian business landscape.

The Preparation Phase

Before you submit your incorporation application, gather the necessary documents:

- The memorandum and articles of association – your company’s rulebook.

- The CAC form – your company’s biography, detailing its structure and purpose.

Submission and Payment

Once your documents are in order:

- Submit them to the CAC, along with the required fees. Consider it an investment in your business’s future.

- Upon approval, the CAC will issue your Certificate of Incorporation – your company’s birth certificate and proof of legitimacy.

With your Certificate of Incorporation in hand, you’re ready to make a splash in the Nigerian business scene!

Obtaining Necessary Permits and Licenses

Navigating the world of business permits and licenses in Nigeria is like ensuring you have the right gear for your diving expedition. Depending on your industry and business activities, you may need to obtain specific permits and licenses to operate legally.

Business Permits: Your Keys to the Depths

Think of business permits as your access keys to the Nigerian market. The Nigerian Investment Promotion Commission (NIPC) is your first stop. They’ll assess your business and guide you on the necessary permits.

Some businesses may require additional permits from relevant ministries or agencies. For example, if you’re venturing into the oil and gas sector, you’ll need clearance from the Department of Petroleum Resources. It’s like having a specialized diving certification for exploring specific underwater environments.

Expatriate Quota and Work Permits: Gearing Up Your International Crew

If you’re bringing in foreign talent to help navigate your Nigerian business adventure, you’ll need to secure expatriate quotas and work permits. These ensure your international team can work legally in Nigeria.

To obtain expatriate quotas and work permits:

- Apply Early: Don’t wait until the last minute. Start the process well in advance to avoid any delays.

- Stay Updated: Keep abreast of any changes in immigration laws and regulations. You don’t want to be caught off-guard.

- Documentation is Key: Ensure your paperwork is complete and accurate. Any discrepancies could hinder the process.

Remember, compliance with immigration laws is crucial. It’s like having the right safety gear – it protects you and your team from legal complications.

Obtaining Your Tax Identification Number (TIN)

In the world of Nigerian business, your Tax Identification Number (TIN) is like your diving license – it’s your unique identifier in the eyes of the Federal Inland Revenue Service (FIRS). Without it, you can’t legally operate in the Nigerian business waters.

Why You Need a TIN

Your TIN is essential for:

- Filing tax returns

- Opening a corporate bank account

- Conducting official financial transactions

Think of it as your business’s passport – it establishes your legal presence and credibility in Nigeria.

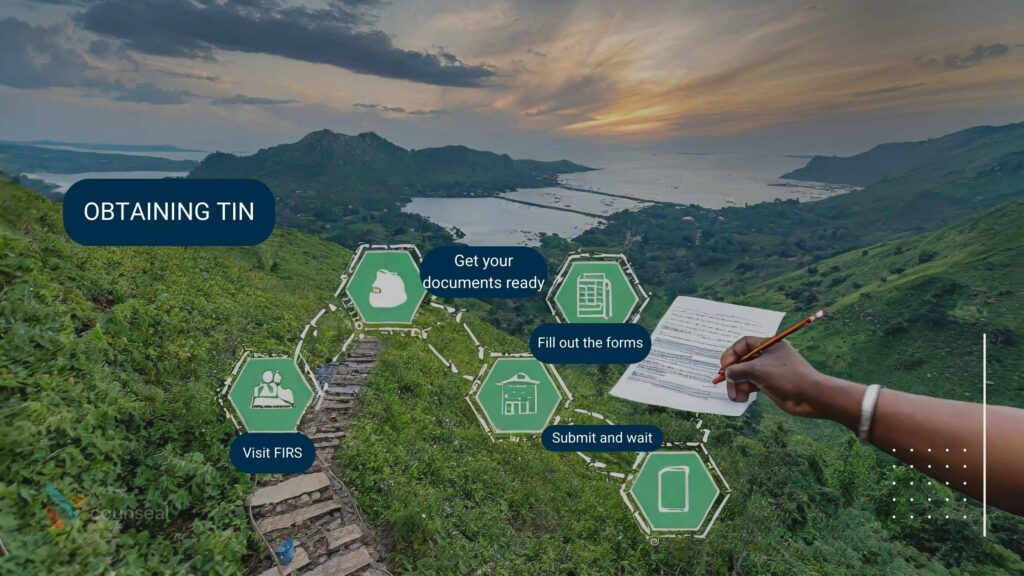

Getting Your TIN: A Step-by-Step Guide

Obtaining your TIN is like going on a treasure hunt. Here’s your map:

- Visit the FIRS: Your quest begins at the nearest FIRS office. They’re the gatekeepers of your TIN.

- Bring Your Documents: Come prepared with your business registration documents, proof of address, and a valid ID.

- Fill Out the Forms: You’ll be given a form to provide detailed information about your business. Accuracy is key.

- Submit and Wait: Hand over your completed forms and supporting documents to the FIRS officials. Patience is a virtue – it may take a few days to receive your TIN.

Staying Compliant: Annual Tax Returns

Having a TIN is not a one-time affair. It’s an ongoing commitment to staying compliant with Nigerian tax laws. Every year, you’ll need to file your tax returns by the 31st of March.

To ensure a smooth tax filing process:

- Keep Meticulous Records: Throughout the year, maintain accurate records of your income, expenses, and receipts. It’s like keeping a dive log – it helps you track your progress and stay organized.

- Seek Professional Help: If navigating the tax landscape feels overwhelming, don’t hesitate to seek guidance from tax professionals. They’re like experienced dive guides – they’ll help you avoid common pitfalls and ensure you stay on course.

Setting Up Your Corporate Bank Account

Just like a diver needs an air tank, your business needs a corporate bank account to function in the Nigerian business landscape. It’s not just a financial tool; it’s a symbol of your company’s professionalism and credibility.

Benefits of a Corporate Bank Account

Having a dedicated corporate bank account:

- Separates your personal and business finances, ensuring clear financial boundaries.

- Enhances your business’s professional image, showing clients and partners you’re serious about your venture.

- Facilitates seamless financial management, making it easier to track transactions and prepare financial statements.

Opening Your Corporate Bank Account

To open your corporate bank account in Nigeria:

- Gather Necessary Documents: Compile all required legal documents, including your Certificate of Incorporation, TIN, and directors’ identification.

- Choose Your Bank: Research and compare different banks to find the one that best suits your business needs and offers favorable terms.

- Fill Out Application: Accurately complete the bank’s application form, providing all requested information about your company and its directors.

- Submit and Undergo Verification: Submit your application and supporting documents to the bank. Be prepared for the bank’s due diligence process, which may involve additional questions or document requests.

Once your application is approved, your corporate bank account will be activated, and you’ll be ready to dive into the financial aspects of your business.

Appointing a Company Secretary

Think of a company secretary as your business’s trusted advisor – the one who ensures you navigate the legal and regulatory waters smoothly. Appointing a company secretary is not just a formality; it’s a strategic move to ensure your company stays compliant and avoids legal pitfalls.

Roles and Responsibilities of a Company Secretary

Your company secretary is your compliance champion, responsible for:

- Ensuring your business adheres to all relevant laws and regulations.

- Managing board meetings and maintaining accurate records of proceedings.

- Keeping your company’s statutory books and registers up to date.

- Serving as a liaison between your company and regulatory bodies.

In essence, your company secretary is your compass, guiding you through the complex landscape of corporate compliance. Their expertise and guidance can help you steer clear of legal troubles and keep your business on course.

Holding Annual General Meetings (AGMs)

Annual General Meetings (AGMs) are like your business’s annual check-up – a time to assess your company’s health, reflect on its progress, and set future goals. But more than that, AGMs are a legal requirement for companies in Nigeria.

Why AGMs Matter

AGMs serve several crucial purposes:

- Transparency: AGMs provide an opportunity to present your company’s financial performance and key achievements to shareholders.

- Shareholder Engagement: They allow shareholders to ask questions, voice concerns, and provide valuable feedback.

- Legal Compliance: Holding AGMs is a legal obligation under Nigerian corporate law. Failing to do so can result in penalties and legal complications.

Conducting Effective AGMs

To ensure your AGMs are productive and compliant:

- Plan Ahead: Schedule your AGM well in advance and send out timely notices to shareholders, along with the agenda and any relevant documents.

- Follow Proper Procedures: Conduct your AGM in accordance with your company’s articles of association and Nigerian corporate law.

- Document Everything: Keep accurate minutes of the meeting, recording all decisions and resolutions passed.

- Follow Up: Implement any decisions or actions agreed upon during the AGM and communicate updates to shareholders.

By treating your AGMs as an essential part of your corporate governance, you demonstrate your commitment to transparency, shareholder engagement, and legal compliance.

Maintaining Proper Financial Records

In the world of business, your financial records are like your dive logs – they provide a clear picture of your company’s financial health and performance. Maintaining accurate and up-to-date financial records is not just good practice; it’s a legal requirement in Nigeria.

Why Financial Records Matter

Proper financial record-keeping is crucial for:

- Financial Management: Accurate records help you track your income, expenses, and cash flow, enabling better financial decision-making.

- Tax Compliance: Well-maintained financial records make it easier to prepare and file your annual tax returns.

- Investor and Stakeholder Confidence: Transparent and reliable financial records boost confidence among investors, lenders, and other stakeholders.

Best Practices for Financial Record-Keeping

To ensure your financial records are in top shape:

- Keep It Organized: Establish a clear system for categorizing and filing your financial documents, such as invoices, receipts, and bank statements.

- Embrace Technology: Utilize accounting software to streamline your record-keeping and ensure accuracy.

- Stay Up to Date: Record transactions promptly and reconcile your accounts regularly to avoid backlogs and discrepancies.

- Retain Records: Keep your financial records for the legally required period, which is typically six years in Nigeria.

By prioritizing financial record-keeping, you not only fulfill your legal obligations but also gain valuable insights into your company’s financial performance, enabling you to make informed decisions and steer your business towards success.

Conclusion: Navigating the Nigerian Business Waters

Setting up a foreign company in Nigeria is an adventure filled with opportunities and challenges. By understanding the legal landscape, conducting thorough market research, and following best practices for compliance and financial management, you can navigate these waters with confidence.

Remember, at counseal.com, we’re here to be your trusted diving partner. Our team of experienced professionals is ready to guide you through every step of your Nigerian business journey, from choosing the right structure to staying compliant and achieving your goals.

So, whether you’re a seasoned entrepreneur or a first-time investor, take the plunge into the vibrant Nigerian business scene. With the right preparation and guidance, you can unlock the vast potential of this dynamic market and make your mark in the Nigerian business world.