Nigeria Social Insurance Trust Fund (NSITF): An Expert Guide

by Counseal Team

Updated November 26, 2023

The Nigeria social insurance trust fund (NSITF) is an institution established by the Nigerian government to provide financial and insurance services to employees in Nigeria.

It is a proactive and employee-dedicated government institution, committed to the welfare of employees, in the event of work-related accidents, injuries, or other employees related contingencies.

Let’s take it further:

A Brief History of the Nigeria Social Insurance Trust Fund (NSITF)

The NSITF was established in 1961 as the National Provident Fund (NPF) to provide a poverty alleviation measure as required by convention No.102 of the International Labour Organization (ILO).

The scheme is targeted at protecting private sector employees (whose employers were then mostly multinationals) from financial difficulties in the event of either old age, cessation of employment, invalidity, or death since most employers then did not have such provisions in their employment policies. In a way, the provident fund scheme was a compulsory savings scheme.

However, because of the defects of the NPF the federal government of Nigeria promulgated the NSITF to succeed the defunct NPF to reflect the objectives it seeks to accomplish. The NSITF has evolved from a Provident Fund Scheme to a Social Insurance Scheme and currently the Employees’ Compensation Scheme.

Also, in 1993, the government of the Federal Republic of Nigeria established the NSITF to cater for the welfare of employees, in the event of work-related accidents or injuries and to address its findings that some employers do not provide for a well-structured working condition, health benefits or security for their employees.

It is important for you to note that the NSITF is the only governmental institution backed up by law to ensure that all employers of labour adhere to the employees’ compensation scheme.

The NSITF board regulates the scheme to ensure the protection of all employees.

What are the laws regulating NSITF?

The law which controls the enforceability and administrative activities of the NSITF is the Nigeria Social Insurance Trust Fund Act 1993.

Some of the laws which gives statutory backing to the NSITF are:

- The Pension Reform Act (PRA) (2014)

By the enactment of the PRA, NSITF relinquished its pension’s business. In compliance with the Section 42 of the PRA 2004, NSITF incorporated a subsidiary company, Trust-fund Pensions Plc in partnership with other stakeholders viz: Mainstreet Bank (Afribank Plc), Denham Management Limited, Nigeria Employers Consultative Association, Nigeria Labour Congress and Trade Union Congress in 2004.

Also, the NSITF owns majority shares of Trust Fund Pensions Plc which was licensed by the National Pension Commission in December 2005 and began operation in January 2006 having transferred assets over NGN54 Billion to the Trust Fund Pension Plc.

However, the Pension Reform Act 2014 (Section 84(2&3) redefined the mandate of the NSITF to provide for “Social Security Insurances services other than pension.”

- Employees Compensation Act (2010)

The Employees Compensation Act was passed into Law in December 2010, to give statutory backing to the mandate given by section 84(2&3) of the PRA 2014 to NSITF for the provision of Social Security Insurance Services by operating the ECS.

Furthermore, the transition between the NSITF Scheme and the commencement of the Employees Compensation Scheme in 2011 was a period that was devoted to mainly strategizing and ensuring that the Employees Compensation Scheme became a reality.

Some objectives the Act sought to achieve are:

- To provide for an open and fair system of guaranteed and adequate compensation for all employees or their dependents for any death, injury, disease or disability arising in employment;

- To provide rehabilitation to employees with work disability as much as possible;

- To establish and maintain a solvent compensation fund managed in the interest of employees and employers;

- To provide for adequate assessments for employers;

- To provide an appeal procedure that is simple, fair and accessible, with minimal delays; and

- To combine efforts and resources of relevant stakeholders to prevent workplace disabilities, including the enforcement of occupational safety and health standards.

The above objectives have been achieved as there are cases of industrial accidents, injuries and diseases being promptly treated as they are reported, in full compliance with the provisions of the ECA and to the satisfaction of stakeholders.

It is also important for you to understand that the NSITF scheme is a defined benefit scheme which enables you as a contributor to enjoy pension and grants far beyond your contributions. It is from the cumulative contribution that the cost of administering the Fund (NSITF) is funded from the resources generated and the surplus is invested in safe, liquid and profitable investment to generate income for the payment of benefits.

It is important to note that as a registered member; you are entitled to receive pension and grants as benefits upon reaching the retirement age of 60 (or 55), invalidity or death. These benefits would be paid to you or your survivors, as the case may be.

The NSITF in order to deliver on this mandate, has the operational autonomy to carry out the following task:

- evolve a more result-oriented and accountable management based on performance contracts;

- strengthen financial or accounting controls;

- ensure financial solvency through effective cost recovery, cost control and prudent management,

- remove bureaucratic bottlenecks and political interference through clear role definitions between the supervising Ministry, the Board and the Management.

Persons required to register with the NSITF

The NSITF act provides that all employers of labour in the private sector, registered under the Companies and Allied Matters Act (CAMA) 2020 are to register with the NSITF. The act further provides as follows, individual or companies that are required to register with the NSITF:

- Persons who are employed by a company or

- Persons employed by a partnership irrespective of the number of persons employed by the company or partnership or

- In any other case, where the number of persons employed is not less than five in a company, then you are required to register as members of the NSITF (provided in section 10 of the NSITF Act)

Are some people exempted from registering with the NSITF?

Yes, the Act exempts the following people from registering with the Fund:

- Anyone employed in the public service of the Federation or a State or Local Government, who is entitled to the benefit of any scheme or pension on terms substantially similar to those prescribed by the Pensions Act or

- Anyone who is entitled to diplomatic or equivalent status under the Diplomatic Privileges and Immunities Act or

- Anyone who is not a citizen of Nigeria, who is employed in Nigeria for a period less than six years at a time, if the employee is liable to contribute to or is prospectively entitled to benefits from the social security scheme of any country other than Nigeria or any benefit scheme by because his employment which would provide the employee with benefits substantially not less favourable than the likely benefits to which he would have been entitled to under this Act

- A minister of religion who is engaged in the propagation of his faith (such as a priest or iman) (provided in section 11 of the Act)

Requirements for registering your company with the NSITF

- Corporate Affairs Certificate

- Directors’ means of identification

- Company details

- Tax identification Number of the Company

- Staff list

- Salary structure of staff.

What are the objectives of the NSITF?

The following objectives or functions of the NSITF

- To provide a fair, guaranteed, and adequate compensation for all insured employees in case of any injury, disease, disability or death arising out of, or in the course of employment.

- To rehabilitate employees who suffer from work-related injuries, disabilities, or occupational diseases.

- To establish and maintain a solvent compensation fund, which will be managed in the interest of both employees and employers.

- To provide for a fair and adequate assessment of employers’ risk rating and ensure contribution is paid.

- To provide a claim procedure that is simple, fast and less cumbersome for the injured persons, or their dependents in case of death.

- To promote the enforcement of occupational safety and health standards in the workplace

It is important to note that the objectives of the NSITF are similar to those stated under the ECA above, as the ECA empowers the functionality of the NSITF.

How does the NSITF administer its functions?

The NSITF scheme was funded with contributions from the registered members of the scheme. The cost of administration of the scheme (capital and recurrent) is borne by the Fund, as the scheme plan allowed between 5-25% of contributions received to meet administrative costs (normally higher at inception of scheme and progressively lower as the scheme matures).

NSITF is also empowered under the Act to carry on business of a profitable nature, investment, etc. This is stated in the financial provisions of the NSITF Act (Sections 27 & 23)

What is the funding scheme of the NSITF?

The funding of the scheme is based on 1% of your payroll as an employer, which should be remitted to the Fund. It comprises of the total emoluments, excluding pension contributions, bonuses, overtime payments, 13th month income.

The NSITF in achieving the above will perform a risk assessment to clarify contributions on workers’ exposure and estimate the appropriate payments.

The NSITF has begun the process of putting in place the infrastructures to implement social security benefits of aged, unemployed persons welfare and physically challenged. It has also put in place the means of collecting and collating data of those listed in Act that are entitled to social security benefits.

Categories of contributions covered by the above scheme.

You should know that the above scheme applies to contributions payable by you as an employer on behalf of your employees against the contingencies of retirement, pension, death, invalidity, emigration, or contributions against other contingencies of employees in private companies. (Provided in section 12 of the NSITF Act).

It is important to note that the deduction is not from the employees salary rather; it is a statutory payroll contribution from you. The NSITF states that an employer who deducts from an employee’s salary is subject to sanction (provided in section 20 subsection 2b and section 16 of the NSITF Act).

In addition, the Fund covers only social security insurance services except for pension, in accordance to section 84 of the Pension Reform Act, 2014, and the NSITF act 1993.

How to calculate the contribution of a company to NSITF

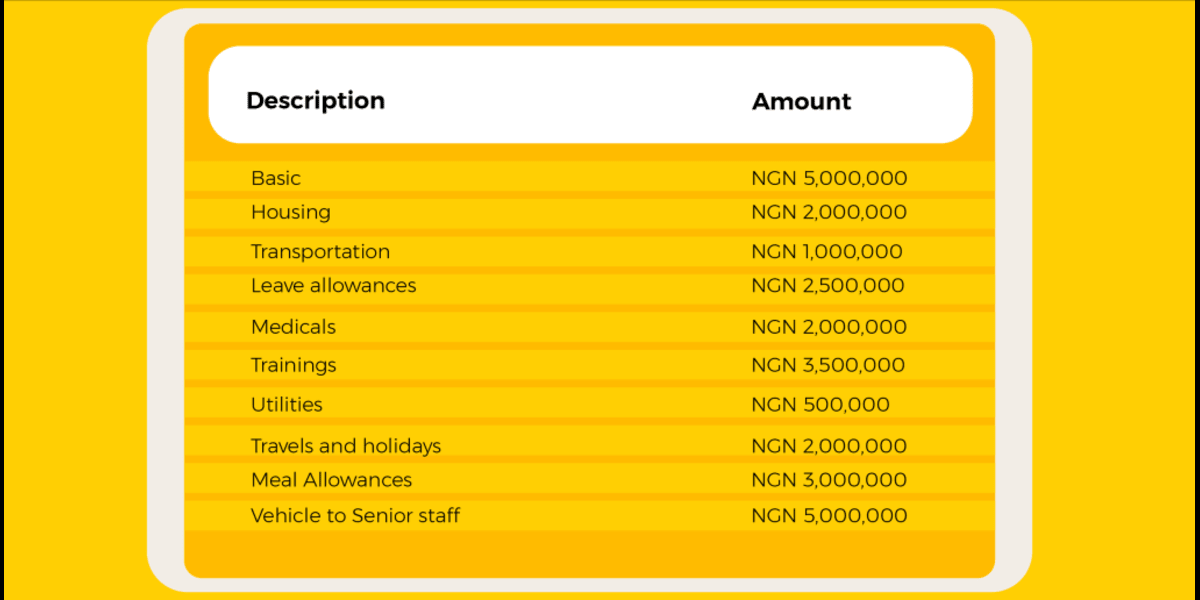

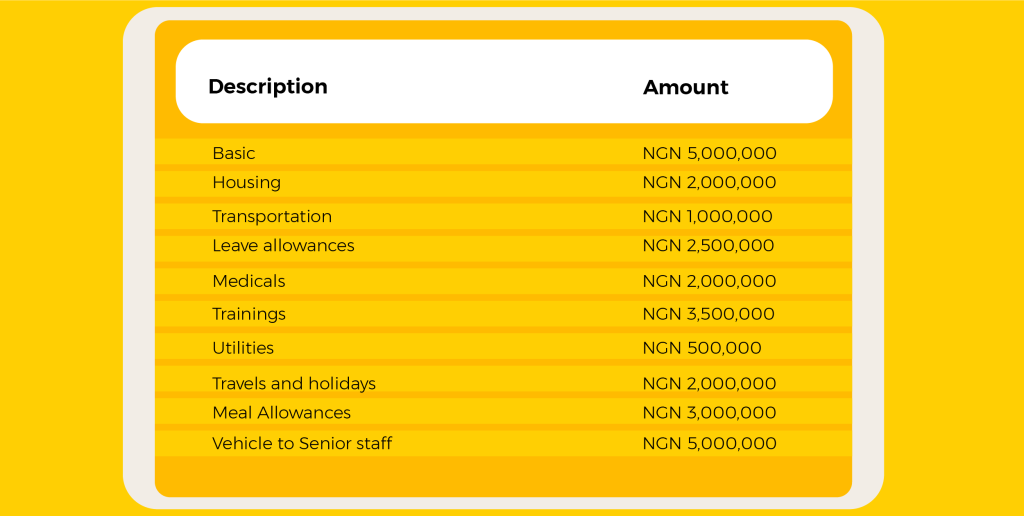

The total emolument is defined as the summation of basic salary, transport, and housing allowances. For example, let’s assume that Mr. John’s organisation’ payroll breakdown is contained in the table below:

The above will give us a total of NGN 26,500,000

Therefore, the company will only contribute:

Basic (N5,000,000) + Housing (N2,000,000) + Transport (N1,000,000) × 1% = N80,000.

What are your benefits as a contributor who satisfies the requirements of the NSITF?

The following are the benefits payable to you as a contributor for satisfying the applicable conditions prescribed by regulations made under the NSITF act:

- Retirement pension benefit or

- Retirement grant;

- Survivors benefit; or

- Death grant; or

- Invalidity benefit or

- Invalidity grant or such other benefits as may be approved from time to time by the Board. (Provided in section 16 of the NSITF Act)

Due date for your company to remit employees’ contribution to NSITF

As an employer, you must pay the contributions provided under the NSITF act on a monthly basis, precisely on the last day of the month. It is usually computed by reference to the wages of the employees concerned.

What is the penalty for failure to remit contribution to NSITF?

The Act provides that if any of the above stated contributions has not being paid within the time prescribed above, a sum equal to 5% of the amount unpaid, shall be added for each month or part of the month after the date when payment should have been made but was not paid and any amount added will be recoverable as a debt owed to the NSITF Board by the employer (provided in section 14 of Act).

What are the procedures for registering a company with NSITF?

The following are the steps for NSITF employee Registration

- Get an NSITF ECS RE01 Form from the NSITF office nearer to the location of your office address.

- The form contains the following information, which must be filled by you and they are: the details of business for public and private companies; the details of owners of the organization for sole proprietorship and partnership; the details of the business sector categories.

- Upon the completion of the form, you should take the form back to the NSITF within your company location.

- A Form ECS RE03 (Employer Schedule of Payment) is issued to you for completion.

- Next, you will make the requisite payment and then proceed with the payment receipt to NSITF within the company’s location.

- Finally, a certificate of registration will be issued as evidence of due registration with the scheme.

Conclusion

If you own a private company, incorporated under the Companies and Allied Matters Act (CAMA) in Nigeria, with not less than five employees, you should register your employees with the NSITF to affirm compliance with Employees Compensation Act 2010

This is important as it enables you as an employer to contribute to employees compensation scheme, to secure your employees against work-related injuries or diseases or against other work related contingencies, as stated under the NSITF Act.

For more guidance on how to register with the NSITF, consult a legal expert.