Tax Implications for Nigerian Entrepreneurs Running a Business from Abroad

by Counseal Team

Updated May 30, 2025

Running a business across international borders presents unique challenges, particularly when it comes to taxation. For Nigerian entrepreneurs operating from abroad, understanding these implications is crucial for both compliance and profitability.

- Navigating Tax Implications for Nigerian Entrepreneurs Abroad

- Why Tax Implications Matter

- Understanding Tax Residency

- Tax Obligations for Nigerian Entrepreneurs Abroad

- Registering a Foreign Company in Nigeria

- Filing Tax Returns: Tutorial for Non-Resident Companies

- Expert Insights

- Summary of Key Points

Navigating Tax Implications for Nigerian Entrepreneurs Abroad

Running a business across international borders presents unique challenges, particularly when it comes to taxation. For Nigerian entrepreneurs operating from abroad, understanding these implications is crucial for both compliance and profitability.

Why Tax Implications Matter

Managing international tax obligations isn’t merely about compliance—it’s fundamental to your business’s sustainability and growth. Consider this scenario: You’re managing your thriving business from London when an unexpected tax notice arrives from Nigeria. Understanding your tax obligations beforehand can help you avoid such surprises and maintain smooth operations.

Understanding Tax Residency

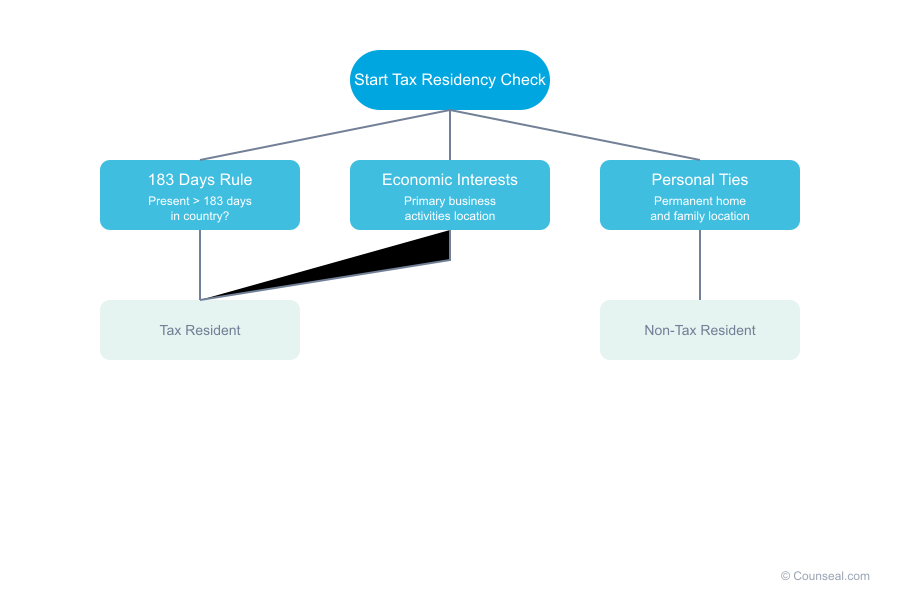

Definition of Tax Residency

Tax residency determines where you’re obligated to pay taxes. It’s not simply about your physical location; it encompasses your significant economic and personal ties. For businesses, it often relates to incorporation location and management base.

Criteria for Determining Tax Residency

For Individuals:

- The 183-day rule: Spending more than 183 days in a country typically establishes tax residency

- Economic interests: Where your primary business activities occur

- Personal ties: Location of permanent home and family

For Businesses:

- Place of incorporation

- Central management and control location

- Permanent establishment considerations

Companies Income Tax Act (CITA)

CITA serves as the foundation for corporate taxation in Nigeria. For entrepreneurs operating from abroad, understanding its provisions is essential.

Key Provisions Affecting Non-Resident Companies

- Tax obligations for Nigeria-sourced income

- Filing requirements and deadlines

- Permanent establishment implications

- Transfer pricing considerations

Finance Act, 2020

Recent amendments have introduced significant changes affecting international businesses:

- Revised definition of Significant Economic Presence (SEP)

- Digital transaction taxation

- Modified compliance requirements

- Updated filing obligations

Personal Income Tax Act (PITA)

PITA governs individual taxation, including entrepreneurs operating internationally. Key considerations include:

- Worldwide income reporting requirements

- Tax residency implications

- Digital service provisions

- Personal income documentation

Tax Obligations for Nigerian Entrepreneurs Abroad

Corporate Tax Obligations

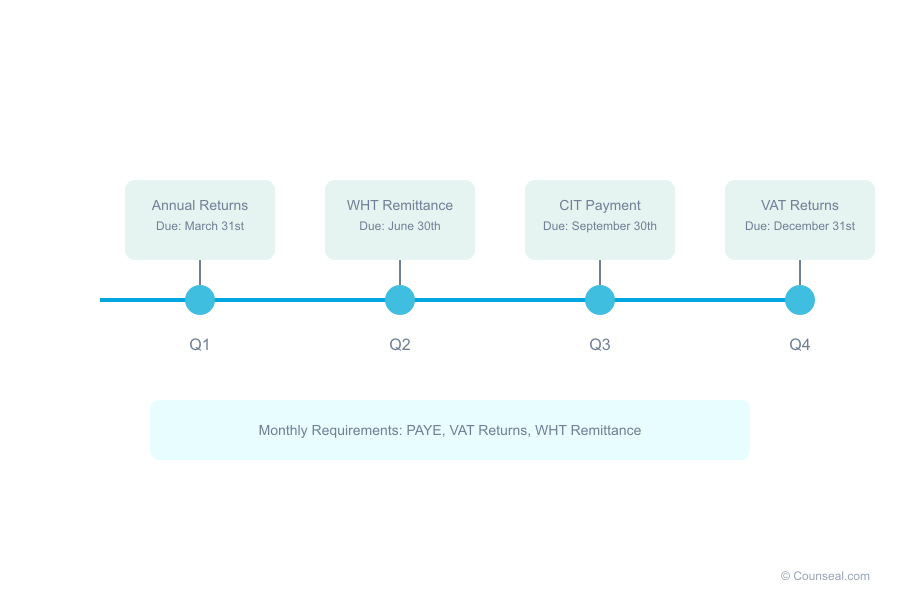

Filing Requirements for Non-Resident Companies

Non-resident companies earning income from Nigeria must:

- File annual tax returns

- Maintain proper documentation

- Report significant transactions

- Comply with digital economy regulations

Withholding Tax Obligations

- Standard 10% rate for most transactions

- Variations based on transaction type

- Treaty considerations

- Filing and payment schedules

Personal Tax Obligations

Nigerian individuals earning abroad must consider:

- Worldwide income declaration

- Double taxation agreements

- Foreign income exclusions

- Proper documentation requirements

Registering a Foreign Company in Nigeria

Step-by-Step Guide

- Company Name Reservation

- CAC portal registration

- Name availability check

- Reservation confirmation

- Documentation Preparation

- Memorandum and Articles of Association

- Share capital statement

- Director identification documents

- Application Submission

- Digital portal filing

- Document verification

- Processing requirements

- Certificate Acquisition

- Final approval process

- Documentation collection

- Registration completion

Filing Tax Returns: Tutorial for Non-Resident Companies

Understanding Your Tax Obligations

Non-resident companies must comply with:

- Company Income Tax (CIT)

- Value Added Tax (VAT)

- Digital service taxes

- Withholding tax requirements

Step-by-Step Filing Process

- FIRS Registration

- TIN acquisition

- Portal access setup

- Documentation requirements

- Financial Statement Preparation

- Profit and loss statements

- Balance sheets

- Supporting documentation

- Return Submission

- Online filing procedures

- Payment processes

- Compliance verification

Expert Insights

Future Trends in International Taxation

- Digital Economy Taxation

- OECD guidelines implementation

- Digital presence regulations

- Cross-border transaction requirements

- Environmental Considerations

- Sustainability incentives

- Carbon taxation

- Green business benefits

- Transparency Requirements

- Information exchange protocols

- Reporting standards

- Compliance documentation

Summary of Key Points

- Maintain accurate financial records

- Understand residency implications

- Comply with filing requirements

- Seek professional guidance

- Monitor regulatory changes

This guide reflects current regulations as of February 2025. For specific advice tailored to your business situation, consult with qualified tax professionals.