Tax Compliance for Nigerian Businesses: The Complete Guide 2024

Navigate Nigeria’s tax landscape confidently with our comprehensive guide. From startup founders to established enterprises, discover practical strategies for compliance, tax optimization, and adapting to new digital economy regulations.

Navigating the Nigerian Foreign Exchange Market

Dive into the dynamic world of the Nigerian foreign exchange market! Discover how to navigate its complexities, seize opportunities, and achieve long-term stability in your forex ventures. Gain valuable insights and strategies for success.

Understanding Foreign Investment Regulations in Nigeria

Unlock the secrets to navigating Nigeria’s foreign investment landscape. From legal frameworks to success stories, this comprehensive guide empowers entrepreneurs and investors to seize opportunities and thrive in this dynamic economy.

The Impact of Taxation on Foreign Investments in Nigeria

Navigating Nigeria’s tax landscape is crucial for attracting foreign investments. Discover key tax changes, incentives, and regulatory considerations that shape the dynamics of FDI in Nigeria. Learn how to position your business for success in this dynamic market.

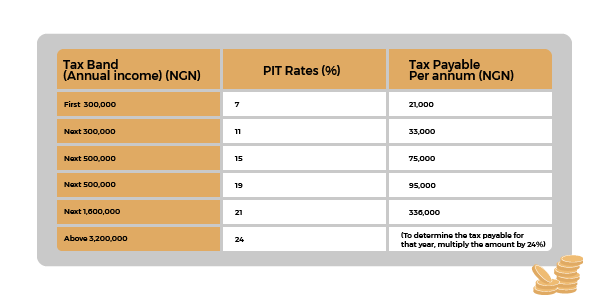

Definitive Guide: Personal Income Tax in Nigeria

What is personal income tax? Personal Income Tax (PIT) is a levy imposed by the federal or state government of Nigeria, on the income of certain individuals such as employees, partners in partnership, families or communities, which they are liable to pay to the relevant federal or state agencies where they reside in Nigeria. Personal…

Nigeria Social Insurance Trust Fund (NSITF): An Expert Guide

A Brief History of the Nigeria Social Insurance Trust Fund (NSITF) The NSITF was established in 1961 as the National Provident Fund (NPF) to provide a poverty alleviation measure as required by convention No.102 of the International Labour Organization (ILO). The scheme is targeted at protecting private sector employees (whose employers were then mostly multinationals)…

The Ultimate Guide to Trademark Registration in Nigeria

Understanding Trademarks A trademark is a word, phrase, design, sign, or symbol that distinguishes your goods or brand from that of another. The look, spelling, or pronunciation of your trademark must be distinctive and easily identified with your business. When you register a trademark, laws protect the articles (word, phrase, design, sign, or symbol) preventing…

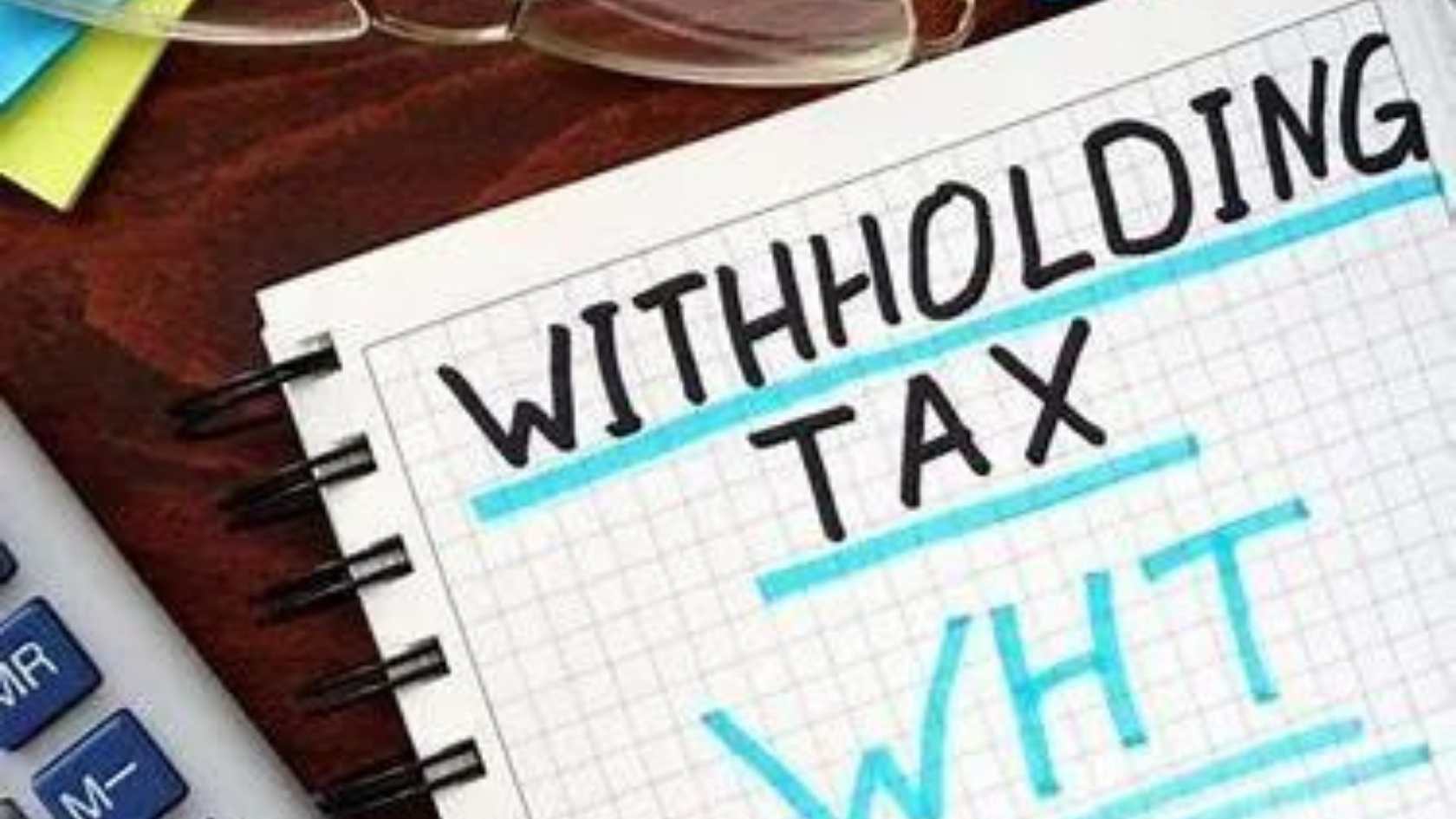

Withholding Tax Rates in Nigeria: A Practical Guide

Withholding Tax (WHT) is an advance payment on income tax. In practical terms, it’s a small percentage of your income that’s held back (or “withheld”) by the entity paying you, whether that be a business or an individual. Let’s help you understand your WHT obligations and rates as a resident or non-resident company doing business in Nigeria.

The Nigeria Money Laundering Act 2011/2022: An In-depth Guide for SMEs

What is Money Laundering? The term “laundering” means cleaning. This translates money laundering literally to “money cleaning.” Money laundering is, however, broadly defined as concealing the origin of illegally earned money by converting it into a legitimate source. The perpetrators get most of these funds from illegal activities; for example, embezzlement, corruption, drug trafficking, kidnapping,…

Tax Exemption for New Companies in Nigeria: A Concise Guide

What are Tax Incentives? By lowering the amount of tax paid to the government, a tax incentive is a policy the government adopts with the goal of motivating people and businesses to invest more money in their operations. Who is Entitled to Tax Incentives in Nigeria? For ease of reference, we will classify companies into…