Developing an Effective Compliance Program for Your Nigerian Business

by Counseal Team

Updated January 27, 2025

In Nigeria’s dynamic business environment, a robust compliance program isn’t just about avoiding penalties—it’s a strategic advantage that can set your business apart. As regulations evolve and business practices become more sophisticated, staying compliant has become more crucial than ever.

Understanding the Nigerian Compliance Landscape

In Nigeria’s dynamic business environment, a robust compliance program isn’t just about avoiding penalties—it’s a strategic advantage that can set your business apart. As regulations evolve and business practices become more sophisticated, staying compliant has become more crucial than ever.

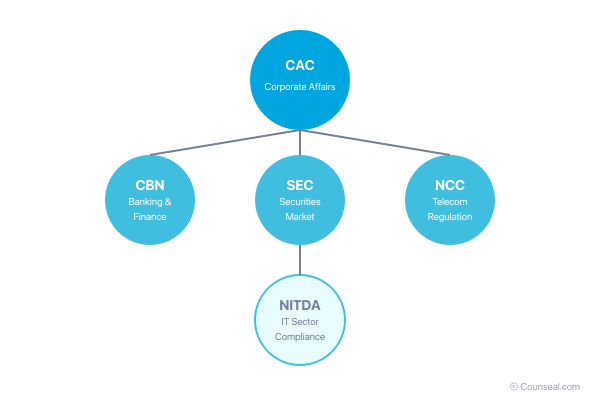

Key Regulatory Bodies in Nigeria

- Corporate Affairs Commission (CAC): Oversees company registration and corporate compliance

- Central Bank of Nigeria (CBN): Regulates financial institutions and monetary policy

- Securities and Exchange Commission (SEC): Monitors securities market operations

- Nigerian Communications Commission (NCC): Regulates telecommunications

- National Information Technology Development Agency (NITDA): Oversees IT sector compliance

Building Your Compliance Framework

1. Risk Assessment and Analysis

Before implementing any compliance program, conduct a thorough risk assessment:

- Identify industry-specific regulations

- Evaluate current compliance gaps

- Assess potential financial and reputational impacts

- Prioritise risks based on likelihood and severity

2. Policy Development

Create clear, actionable policies that address:

- Anti-corruption and ethical business practices

- Data protection and privacy

- Financial reporting and transparency

- Employee conduct and responsibilities

- Environmental compliance (if applicable)

3. Implementation Strategy

Documentation Requirements

- Standard Operating Procedures (SOPs)

- Compliance manuals

- Reporting templates

- Audit checklists

Training Programme

- Regular compliance workshops

- Role-specific training modules

- Assessment and certification

- Refresher courses

Monitoring and Enforcement

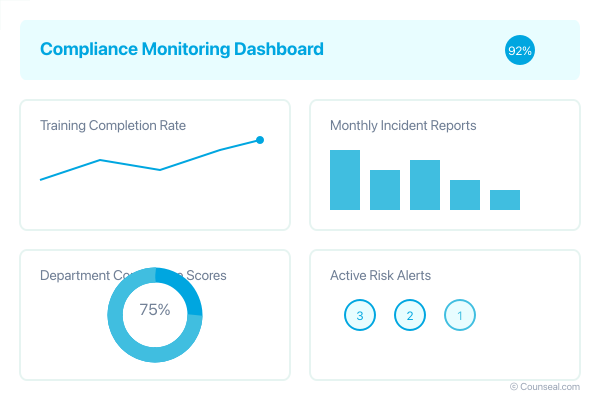

Effective monitoring and enforcement are the backbone of any successful compliance program. Without proper oversight, even the best-designed policies can fail to protect your business. This section outlines key components of a robust monitoring system and enforcement mechanisms that ensure your compliance program remains effective and adaptable.

1. Compliance Metrics

Track key performance indicators:

- Incident reporting rates

- Training completion rates

- Audit findings

- Resolution timelines

2. Reporting Mechanisms

Establish clear channels for:

- Whistleblower protection

- Anonymous reporting

- Regular compliance updates

- Stakeholder communications

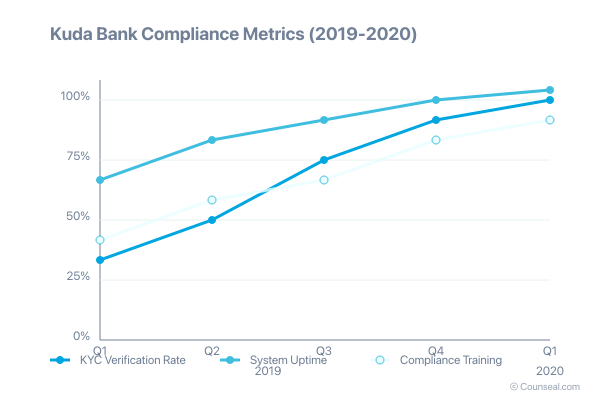

Case Study: Nigerian FinTech Success Story

Kuda Bank’s journey to compliance excellence demonstrates how a structured approach to regulatory requirements can drive business success. In 2019–2020, as Nigeria’s digital banking sector faced increasing scrutiny, Kuda implemented a comprehensive compliance program that became a benchmark for the industry.

Challenge

- Rapid customer growth requiring robust KYC processes

- Complex regulatory requirements from multiple bodies (CBN, NDPR)

- Need for real-time transaction monitoring

- Integration of international best practices with local requirements

Solution Implementation

- Digital Compliance Infrastructure

- Automated KYC verification system

- Real-time transaction monitoring

- Regular staff training programs

- Clear reporting mechanisms

- Regulatory Engagement

- Proactive communication with CBN

- Regular compliance audits

- Transparent reporting structure

Results

- Successfully processed over 2.5 million customer verifications

- Achieved 99.9% uptime for compliance systems

- Secured additional licensing for expanded services

- Attracted significant international investment

Key Learnings

- Early investment in compliance infrastructure pays off

- Regular engagement with regulators builds trust

- Employee training is crucial for program success

- Technology can streamline compliance processes

Expert Tips for Nigerian Businesses

- Start with a gap analysis of your current compliance status

- Invest in compliance management software

- Build relationships with regulatory bodies

- Create a culture of compliance through regular communication

- Document everything and maintain clear audit trails

Resources and Tools

Recommended Compliance Tools

1. Digital Documentation Systems

- Microsoft SharePoint: Enterprise-level document management

- Box for Business: Secure cloud storage with compliance features

- DocuWare: Specialized for Nigerian business documentation

- OpenText: Comprehensive content management system

2. Training Platforms

- Teachable: Custom compliance training courses

- TalentLMS: Employee training management

- Docebo: AI-powered learning platform

- 360Learning: Collaborative learning environment

3. Audit Management Software

- AuditBoard: Comprehensive audit management

- MetricStream: Risk and compliance management

- TeamMate+: Internal audit management

- SAP Audit Management: Enterprise-level solution

4. Reporting Systems

- Power BI: Data visualization and reporting

- Tableau: Advanced analytics and reporting

- QlikView: Business intelligence platform

- IBM Cognos: Enterprise reporting solution

5. Integrated Compliance Solutions

- LogicGate: Risk and compliance automation

- OneTrust: Privacy and compliance management

- Navex Global: Ethics and compliance software

- Workiva: Regulatory reporting platform

Note: Tool selection should be based on your business size, industry requirements, and budget. Many providers offer free trials or demonstrations.

Visit counseal.com/start for expert compliance guidance

Conclusion

An effective compliance program is an investment in your business’s future. By following these guidelines and maintaining consistent monitoring, Nigerian businesses can build robust compliance frameworks that support growth while managing risks.