Understanding Key Regulatory Bodies in Nigeria: A Complete Guide for Business Leaders

by Counseal Team

Updated January 27, 2025

Nigerian businesses must navigate multiple regulatory frameworks to operate successfully. This comprehensive guide explains the crucial regulatory bodies, their roles, and practical strategies for ensuring compliance while growing your business.

- Introduction

- Recent Regulatory Evolution in Nigeria

- Core Regulatory Bodies and Their Functions

- Real-World Compliance Success Stories

- Understanding Compliance Costs

- Industry-Specific Compliance Frameworks

- Common Violations and Prevention Strategies

- Technology Solutions for Compliance

- Practical Compliance Checklists

- Conclusion and Action Steps

Introduction

Nigerian businesses must navigate multiple regulatory frameworks to operate successfully. This comprehensive guide explains the crucial regulatory bodies, their roles, and practical strategies for ensuring compliance while growing your business.

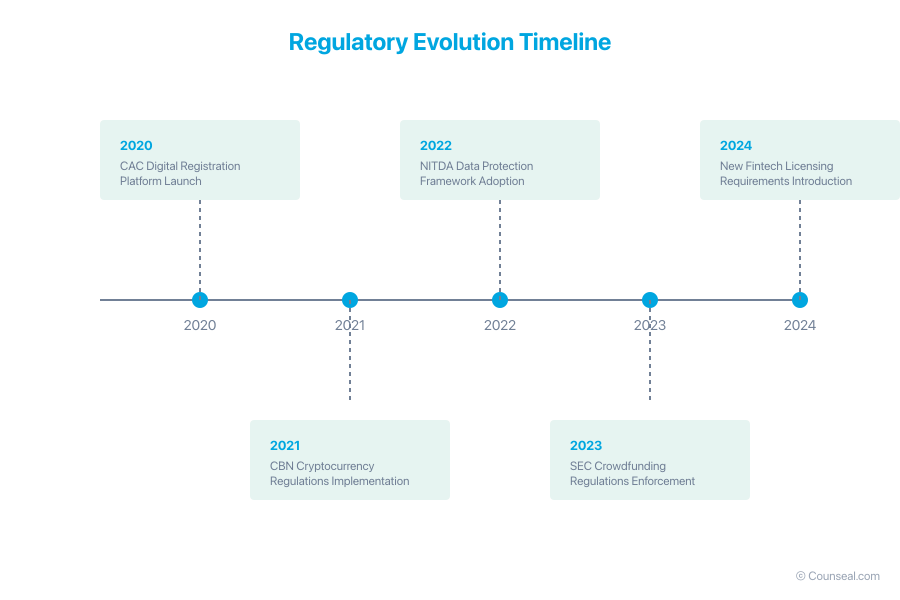

Recent Regulatory Evolution in Nigeria

Significant Changes (2020–2024)

- 2020: CAC digital registration platform launch

- 2021: CBN cryptocurrency regulations implementation

- 2022: NITDA’s data protection framework adoption

- 2023: SEC crowdfunding regulations enforcement

- 2024: New fintech licensing requirements introduction

Core Regulatory Bodies and Their Functions

Central Bank of Nigeria (CBN)

- Primary Role: Monetary policy regulation and banking sector oversight

- Key Areas:

- Financial stability

- Banking supervision

- Payment systems regulation

- Foreign exchange management

Business Impact: Recent CBN policies have transformed business operations:

- Cashless policy implementation

- Payment service bank regulations

- Foreign exchange management guidelines

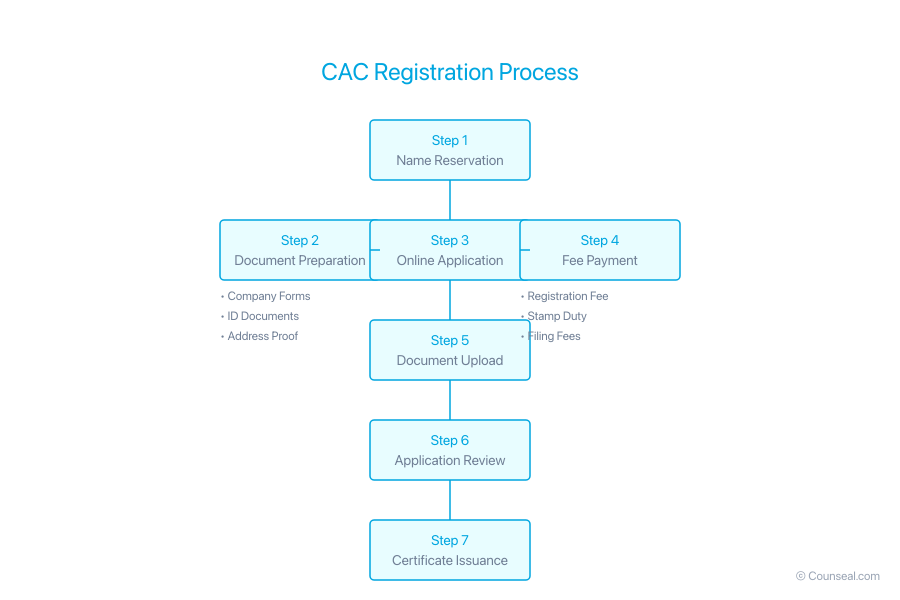

Corporate Affairs Commission (CAC)

- Primary Role: Business registration and corporate regulation

- Key Requirements:

- Company registration

- Annual returns filing

- Corporate compliance monitoring

Securities and Exchange Commission (SEC)

- Primary Role: Capital market regulation

- Key Functions:

- Investment protection

- Market efficiency maintenance

- Securities trading oversight

National Agency for Food and Drug Administration and Control (NAFDAC)

- Primary Role: Food and drug quality control

- Key Areas:

- Product registration

- Quality standards enforcement

- Consumer protection

Real-World Compliance Success Stories

Case Study 1: FinTech Compliance Success

- Challenge: Meeting new PSB regulations

- Approach: Implemented comprehensive compliance framework

- Timeline: 6-month implementation

- Result: Successful PSB license acquisition

- Key Learnings: Early preparation and systematic approach crucial

Case Study 2: Manufacturing Sector Excellence

- Challenge: Multiple regulatory requirements

- Solution: Integrated compliance management system

- Impact: 40% reduction in compliance issues

- Cost Savings: ₦15 million annually in prevented penalties

Understanding Compliance Costs

Direct Costs Breakdown

- Registration Fees

- Initial registration

- Annual renewals

- Certification costs

- Professional Services

- Legal consultation

- Audit fees

- Compliance officers

Indirect Costs

- Operational Expenses

- Staff training programmes

- Documentation systems

- Compliance software

- Regular audits

- Resource Allocation

- Dedicated compliance team

- Technology infrastructure

- Ongoing monitoring systems

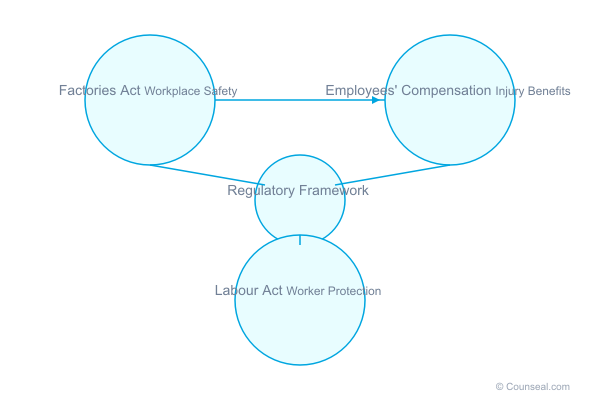

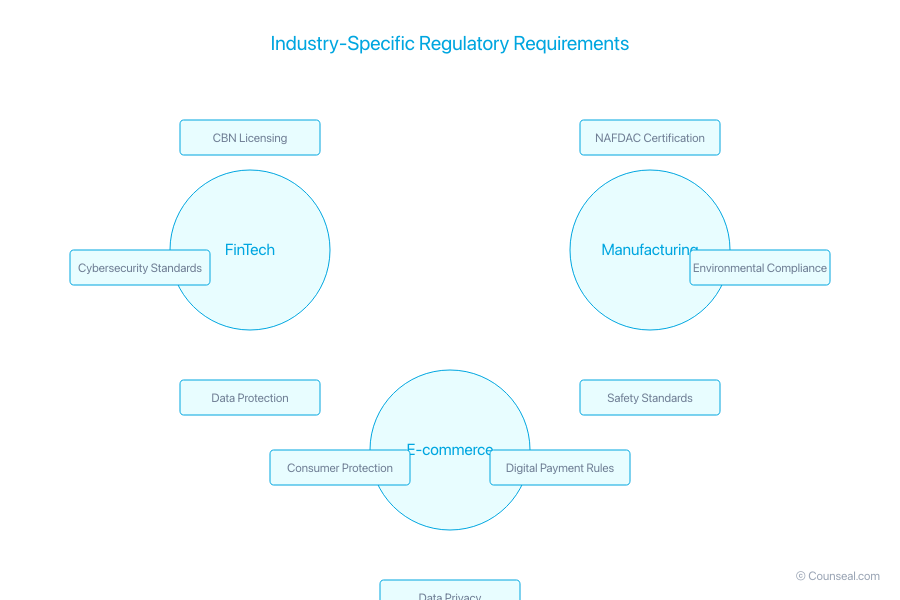

Industry-Specific Compliance Frameworks

FinTech Sector

- CBN licensing requirements

- Cybersecurity standards

- Data protection compliance

Manufacturing Sector

- NAFDAC certifications

- Environmental compliance

- Safety standards

E-commerce Operations

- Consumer protection requirements

- Digital payment regulations

- Data privacy compliance

Common Violations and Prevention Strategies

Frequent Compliance Issues

- Documentation Failures

- Missing records

- Incomplete filings

- Outdated permits

- Operational Violations

- Unauthorized practices

- Missed deadlines

- Inadequate monitoring

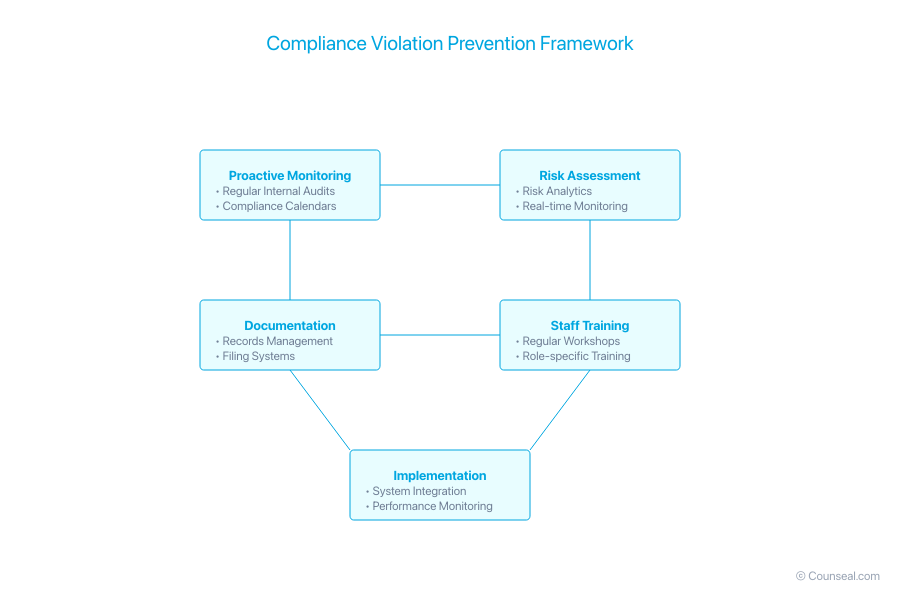

Prevention Framework

- Proactive Monitoring

- Regular internal audits

- Compliance calendars

- Update tracking systems

- Staff Training

- Regular workshops

- Compliance updates

- Role-specific training

Technology Solutions for Compliance

Essential RegTech Tools

- Compliance Management Systems

- Document tracking

- Deadline monitoring

- Automated reporting

- Risk Assessment Tools

- Real-time monitoring

- Risk analytics

- Compliance scoring

Implementation Guide

- Assessment Phase

- Current system evaluation

- Requirements analysis

- Solution selection

- Integration Phase

- System setup

- Staff training

- Performance monitoring

Practical Compliance Checklists

Startup Compliance Checklist

- Business registration (CAC)

- Tax registration (FIRS)

- Industry-specific licenses

- Employment documentation

Ongoing Compliance Checklist

- Annual returns filing

- License renewals

- Regulatory updates monitoring

- Staff training records

Conclusion and Action Steps

Understanding and maintaining regulatory compliance is crucial for business success in Nigeria. Take these immediate steps:

- Assess Your Current Position

- Identify applicable regulations

- Review compliance status

- Document gaps

- Develop Your Strategy

- Create compliance calendar

- Allocate resources

- Implement monitoring systems

- Seek Professional Support

- Legal consultation

- Compliance expertise

- Regular audits

Need expert guidance on regulatory compliance? Visit counseal.com/start for professional support.