Withholding Tax Rates in Nigeria: A Practical Guide

by Counseal Team

Updated July 26, 2024

Diving right in, let’s talk about Withholding Tax (WHT). Now, you might be thinking, “Another tax to worry about?” But bear with me, because understanding WHT could save you a lot of headaches as you navigate the Nigerian business landscape.

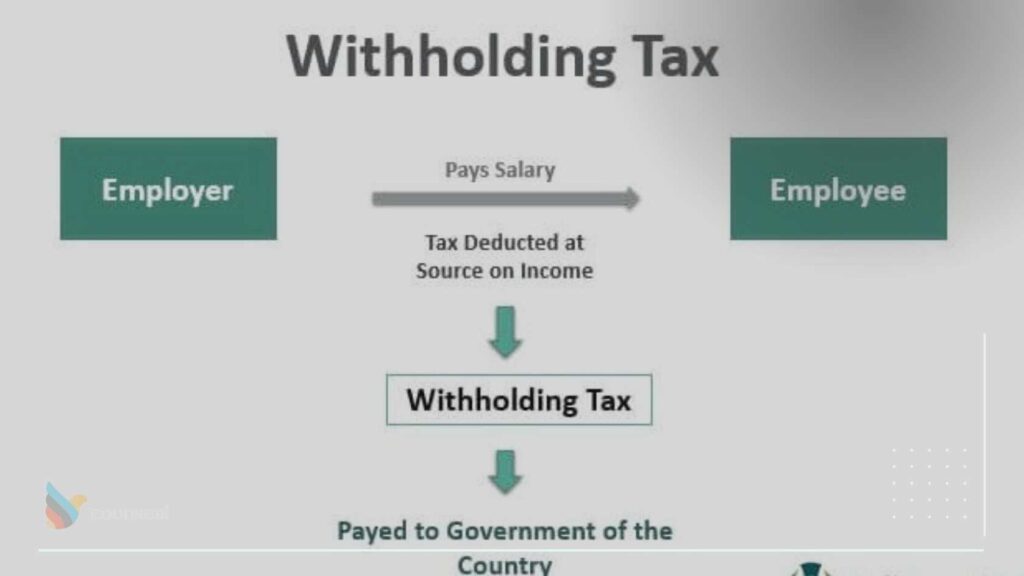

At its core, WHT is an advance payment on income tax. In practical terms, it’s a small percentage of your income that’s held back (or “withheld”) by the entity paying you, whether that be a business or an individual. You then paid directly this amount to the government.

Sounds simple enough, right?

But here’s where it gets interesting: WHT applies to both resident and non-resident companies and individuals in Nigeria. That means whether you’re a local business owner or an international company doing business in Nigeria, you need to understand your WHT obligations.

Why is Withholding Tax (WHT) Important?

Now, you might be thinking, “why is WHT so important?” Well, WHT has several benefits for both the government and taxpayers like you and me. For the government, WHT provides a steady stream of revenue, which is crucial for funding public services. For taxpayers, WHT reduces the burden of a lump sum tax payment at the end of the year, as it’s deducted from your income throughout the year.

Let’s make this a bit more concrete with a few examples: If you’re a resident company providing professional services, rent, dividends, interest, or royalties, you’re going to be subject to WHT. Non-resident companies, on the other hand, will see WHT applied to fees for technical services, rents, royalties, dividends, and interest earned within Nigeria.

So, as you can see, understanding WHT is crucial for any entrepreneur doing business in Nigeria. It’s not just about compliance; it’s about smart business.

Decoding Withholding Tax Rates in Nigeria

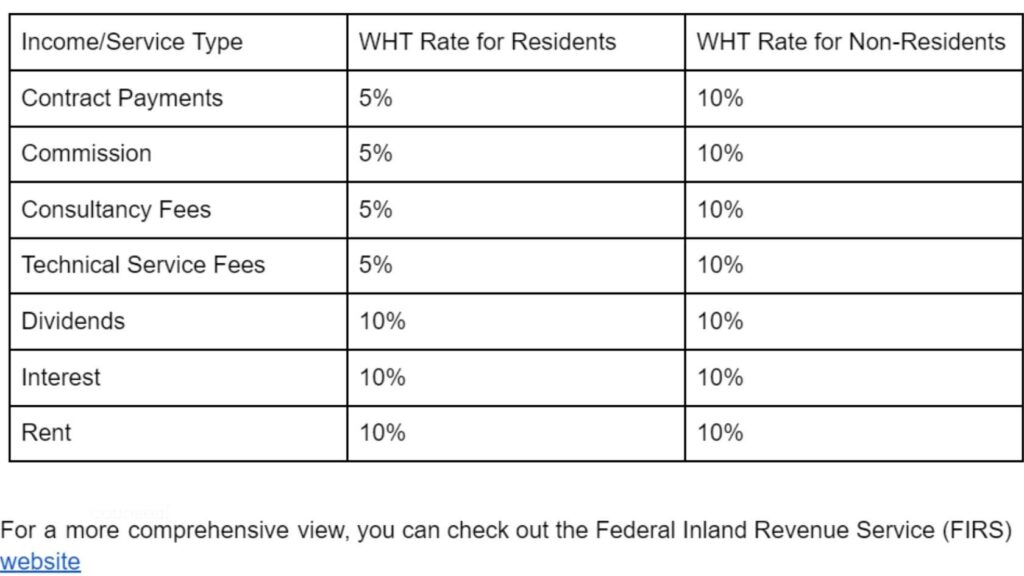

You might be wondering, “What exactly are the withholding tax (WHT) rates in Nigeria?” Well, let’s break it down. Different Types of Income and Services – Different Withholding Tax Rates. The WHT rates in Nigeria vary based on the type of income or service. For instance, contract payments, commission, consultancy fees, technical service fees, management fees, and investment income are subject to a 10% WHT rate. On the other hand, rents, dividends, and interests attract a 10% WHT rate for corporate bodies and 10% for individuals. The WHT Rate Matrix – Resident versus Non-resident Companies & Individuals Ever thought about how WHT rates differ for resident and non-resident companies, or individuals? Here’s a clear-cut table to make this crystal clear:

What Determines the Applicable Withholding Tax Rate?

Now, you must be thinking, “what determines which WHT rate applies?” The applicable WHT rate is determined by various factors, such as

- the nature of the income,

- the status of the payer and payee, and

- the existence of any tax treaty.

For instance, if a Nigerian company pays a dividend to a non-resident individual, the WHT rate will be 10%. However, if Nigeria has a tax treaty with the non-resident’s country, the rate could be reduced.

Cracking the WHT Calculation Code – Examples

If you’re scratching your head figuring out how to calculate the WHT, don’t worry, I’ve got you covered!

It’s about the details. The nature of the income or service, the status of the payer (whether an individual or a company), the payee’s status (resident or non-resident), and any existing tax treaty are pivotal in determining the WHT rate.

Let’s look at some examples:

- For a contract payment of NGN 1,000,000, the WHT would be NGN 100,000 (10% of NGN 1,000,000).

- In the case of rent income of NGN 500,000 for a corporate body, the WHT would be NGN 50,000 (10% of NGN 500,000).

To give you a practical understanding, consider this scenario:

If you’re a resident company providing consultancy services, the WHT rate will be 5%. So, if you charge N100,000 for your services, N5,000 will be withheld as tax. But if you’re a non-resident company offering the same service, the WHT rate will be 10%. This means if you charge N100,000, N10,000 will be withheld as tax.

Understanding these rates is crucial to planning your finances and ensuring compliance with the Nigerian tax laws. Remember, when it comes to tax matters, it’s always best to seek expert advice. Now, you’re one step closer to mastering your business’s financial landscape. Keep going!

Master the WHT Remittance Process

Starting a business in Nigeria comes with its fair share of responsibilities. One crucial aspect you shouldn’t overlook is the remittance of Withholding Tax (WHT) to the Federal Inland Revenue Service (FIRS). It can be a bit of a maze if you’re new to it, but don’t worry, I’ve got you covered!

The WHT Remittance Process and Timeline

The process of remitting WHT to the FIRS starts with the payer deducting the tax at source from the invoice of the payee. This deduction is then remitted to the FIRS within 21 days from the end of the month in which the deduction was made.

Remember, the key here is to ensure prompt remittance. Why? Because delays could attract penalties. So, the earlier you get it done, the better.

Roles and Responsibilities: The Payer and the Payee

As a payer, your role is to deduct the tax at source and remit it to the FIRS. It’s also your responsibility to issue a WHT credit note to the payee within the stipulated time frame. This note serves as proof of the deduction and is important for the payee’s tax records.

On the flip side, the payee, after receiving the WHT credit note, can claim a tax credit from the FIRS. It’s crucial to keep these credit notes safe as they help to offset future tax liabilities.

Non-compliance with WHT Rules: The Penalties

Failure to remit WHT within the 21-day period post each month-end could lead to a 10% penalty and interest at the Central Bank of Nigeria’s minimum re-discount rate plus 5%. Not a pleasant scenario, right?

Official Guidelines on WHT Collection Procedure

To get a detailed look into the collection procedure for WHT, it’s a great idea to refer to the official guidelines provided by the FIRS. You can access the guidelines by visiting the FIRS website.

Remitting WHT in Nigeria: Tips and Best Practices

1. Ensure to remit your WHT within the stipulated time to avoid penalties.

2. Keep a record of all your transactions and WHT deductions.

3. Regularly update your knowledge of WHT as tax laws can change.

4. Seek professional advice when in doubt.

Remember, as an entrepreneur, understanding your tax obligations is key to running your business smoothly!

Let’s start with mastering the remittance of WHT?

Understanding Withholding Tax Credit

Are you familiar with the concept of Withholding Tax (WHT) credit? Simply put, WHT is an advance payment of income tax that’s deducted at source. It’s a mechanism used to capture as many taxpayers as possible and prevent tax evasion. The tax withheld is considered a credit against the income taxes the recipient must pay.

The purpose of WHT credit is to provide relief for the payee. You see, the tax is deducted at source and remitted to the Federal Inland Revenue Service (FIRS) on behalf of the payee. So, when the payee calculates his tax liability at the end of the year, the WHT credit is deducted from the total tax payable.

Claiming WHT Credit: The Conditions and Requirements

Now, let’s get to the meat of the matter – claiming your WHT credit in Nigeria. There are specific conditions and requirements that you need to meet. Firstly, you must have suffered WHT deduction at source. Secondly, you must have the relevant credit notes as evidence of the deduction.

Sounds straightforward, right? But remember, you must ensure that the company or person who deducted the tax remitted it to FIRS. If they failed to remit the tax, you wouldn’t be able to claim the credit.

The WHT Credit Claim Process

Here’s how the process works in a nutshell:

1. Obtain a credit note from the company or person who deducted the tax.

2. Submit your annual tax returns to the FIRS.

3. Attach the credit notes to your tax returns.

4. The FIRS will then process your claim and issue a WHT credit note.

This process can take anywhere from a few weeks to several months, depending on the workload of the FIRS.

Understanding Your Role in the WHT Credit Claim Process

As the payee, it’s your responsibility to obtain the WHT credit note from the payer (the company or person who deducted the tax). You’ll also need to submit your tax returns and the credit notes to FIRS.

The payer, on the other hand, is required to remit the tax to the FIRS and provide you with the credit note. If the payer fails to remit the tax, they could face penalties.

Here’s a handy link to the official WHT credit note template from FIRS for your convenience.

Examples of WHT Credit Claims

Let’s take a look at a couple of scenarios to illustrate how to claim WHT credit.

Scenario 1: You’re a supplier, and your client deducts 5% WHT from your invoice. You’ll receive a credit note from your client. When you’re filing your annual tax returns, you’ll deduct that 5% from your total tax liability.

Scenario 2: You’re a landlord, and your tenant deducts 10% WHT from your rent. Again, you’ll receive a credit note from your tenant. When filing your annual tax returns, you’ll deduct that 10% from your total tax liability.

In a nutshell, claiming WHT credit in Nigeria is all about keeping track of your credit notes and ensuring that the payer remits the tax to the FIRS. It might seem like a lot of legwork, but it’s a crucial part of managing your tax liabilities.

Cracking the Withholding Tax Code: Tips and Strategies

Have you ever taken a peek at your financial statements and found yourself wondering how you can reduce that pesky Withholding Tax (WHT) that seems to take a significant chunk of your earnings? If so, you’re not alone. Many Nigerian entrepreneurs find themselves in the same boat, and it’s time we navigate these waters together.

Playing the WHT Game: Applying for a Lower Rate

Did you know that you can apply for a lower WHT rate for certain services or contracts? Yes, you read that right. You can get the Federal Inland Revenue Service (FIRS) to take a smaller bite out of your earnings. While this process can be a bit of a bureaucratic maze, the potential savings make it worth the effort.

How do you go about it? It’s quite straightforward. You just must submit an application to the FIRS, detailing the nature of your services or contracts and making a case for why a lower rate should apply. It’s essential here to provide accurate and comprehensive information, as any discrepancies could lead to a denial of your application.

International Tax Treaties: Your Secret WHT Weapon

Nigeria has tax treaties with several countries. These agreements are designed to prevent double taxation and often include provisions that can help reduce your WHT. So, if you’re doing business with companies in these countries, it’s worth digging into the details of these treaties. You might just find a golden nugget of tax-saving information.

For your convenience, here’s a link to the official list of tax treaties between Nigeria and other countries, as provided by the FIRS. See if any of these could apply to your business.

Your WHT Lifeline: Professional Advice

Let’s face it, tax matters can complicate things. While it’s possible to navigate these waters on your own, it’s often more efficient (and less stressful) to seek professional advice. A tax consultant or accountant can provide invaluable insights and strategies to help you reduce your WHT. They know the tax landscape like the back of their hands and can help you find savings that you might have missed.

WHT Reduction in Action: Scenarios and Examples

To provide you with a clearer understanding, let’s explore some scenarios where these strategies can be effectively applied.

A Nigerian contractor, for instance, could reduce his WHT from 10% to 5% by applying for a lower rate for his construction services. He successfully argued that his services did not fall under the categories that attracted a higher WHT rate.

Another company, an import-export business, can leverage the tax treaty between Nigeria and the UK to reduce their WHT. They can show that the taxes they paid in the UK should be credited against their Nigerian tax liability, resulting in significant savings.

As you can see, reducing your WHT is not only possible but can also lead to significant financial gains. It just takes a little bit of knowledge, a dash of strategy, and the will to take action. So, are you ready to tackle your WHT?

The WHT Puzzle: What You Need to Know

In Nigeria, Withholding Tax (WHT) is a source of worry for many entrepreneurs, but it doesn’t have to be your nightmare. WHT is an advance payment of income tax that is deducted at source from the payments due to a taxpayer. It’s mandatory, and non-compliance can result in penalties.

The potential challenges of WHT for your business can be mitigated through effective tax planning and compliance. For instance, you can leverage the WHT credit notes as evidence of tax already paid. Additionally, the Federal Inland Revenue Service (FIRS) provides an Integrated Tax Administration System (ITAS) to assist taxpayers in fulfilling their tax obligations.

As an entrepreneur in Nigeria, understanding and complying with these rules and regulations is paramount. It’s also advisable to seek professional advice or guidance from tax consultants or the relevant authorities.

Now, over to you. Are you ready to start your business journey in Nigeria? Remember, the road to entrepreneurial success is paved with knowledge and compliance. Don’t hesitate to seek help when you need it. After all, as the old saying goes, “He who asks a question is a fool for five minutes; he who does not ask a question remains a fool forever.”

Frequently Asked Questions

What is withholding tax?

Withholding tax (WHT) is a form of advance payment of income tax that is deducted at source from certain payments made to a taxpayer. The payer of the income is required to withhold or deduct the tax a nd remit it to the relevant tax authority within a specified period. The withheld amount can be used by the taxpayer to offset its income tax liability for the year of assessment.

What are the rates of withholding tax in Nigeria?

The rates of withholding tax in Nigeria vary depending on the payment and the status of the recipient. The rates range from 5% to 10% for resident companies and individuals, and from 10% to 20% for non-resident companies and individuals. Some of the common rates are:

| Nature of Payment | Resident Company | Resident Individual | Non-resident Company | Non-resident Individual |

| Dividend | 10% | 10% | 10% | 10% |

| Interest | 10% | 10% | 10% | 10% |

| Royalty | 10% | 5% | 10% | 10% |

| Rent | 10% | 10% | 10% | 10% |

| Commission | 10% | 5% | 10% | 10% |

| Contract | 5% | 5% | 10% | 10% |

| Construction | 2.5% | 5% | 5% | 5% |

| Professional fees | 10% | 5% | 10% | 10% |

What are the benefits of withholding tax?

Withholding tax has several benefits for both the tax authorities and the taxpayers. Some of the benefits are:

- It ensures a steady source of revenue for the government throughout the year.

- It reduces tax evasion and avoidance by ensuring that some tax is paid on income that may otherwise escape taxation.

- It reduces the administrative burden and cost of tax collection by shifting the responsibility to the payers of the income.

- It provides a relief for the taxpayers by allowing them to offset the withheld amount against their final tax liability.

- It encourages voluntary compliance and tax education by making the taxpayers aware of their tax obligations.

How is withholding tax remitted to the tax authority?

The payer of the income is required to remit the withheld amount to the relevant tax authority within 21 days after the end of the month in which the deduction was made. The payer must also file a monthly return of withholding tax deductions and remittances with the tax authority, attaching the relevant withholding tax credit notes or receipts issued by the tax authority.

How can a taxpayer claim withholding tax credit?

A taxpayer can claim withholding tax credit by presenting the withholding tax credit notes or receipts issued by the tax authority to the payer of the income. The credit notes or receipts must show the name, address and tax identification number of the taxpayer, the nature and amount of the income, the rate and amount of the withholding tax, and the date of remittance. The taxpayer can use the credit notes or receipts to offset its income tax liability for the year of assessment.

What are the penalties for non-compliance with withholding tax obligations?

Non-compliance with withholding tax obligations can attract various penalties and sanctions from the tax authority. Some of the penalties are:

- Failure to deduct or remit withholding tax within the stipulated time can attract a penalty of 10% of the amount not deducted or remitted, plus interest at the prevailing commercial rate.

- Failure to file monthly returns of withholding tax deductions and remittances can attract a penalty of N500,000 for the first month and N50,000 for every subsequent month of default.

- Failure to issue withholding tax credit notes or receipts to the taxpayer can attract a penalty of 200% of the amount of tax involved, plus interest at the prevailing commercial rate.

- Making false statements or declarations in relation to withholding tax can attract a penalty of N100,000 or imprisonment for a term not exceeding six months, or both.

How can a taxpayer avoid double taxation on withholding tax?

A taxpayer can avoid double taxation on withholding tax by applying for a tax treaty relief, if you derived the income from a country that has a double taxation agreement (DTA) with Nigeria. A DTA is a bilateral or multilateral agreement between two or more countries that provides for the avoidance of double taxation on the same income, profits or gains. Nigeria has DTAs with several countries, such as South Africa, France, United Kingdom, Canada, China, etc.

The rates of withholding tax under the DTAs may be lower than the domestic rates, depending on the income and the status of the recipient. A taxpayer can claim the benefit of a DTA by presenting a certificate of residence from the tax authority of the other country, and a certificate of tax remittance from the payer of the income.