Leveraging Technology to Drive Growth in Your Nigerian Startup

Picture this: Two Nigerian startups, both with brilliant ideas and passionate teams. One embraces technology wholeheartedly, while the other hesitates. Fast forward a year, and the tech-savvy startup has skyrocketed, leaving its counterpart in the dust. The difference? Harnessing the power of technology. In today’s fast-paced world, technology is the ultimate game-changer. It’s the secret…

How to Conduct an Intellectual Property Audit for Your Business

Unlock the hidden value in your business with our comprehensive guide to intellectual property audits. Learn how to identify, protect, and leverage your IP assets for sustainable growth in Nigeria’s competitive market.

Protecting Your Trade Secrets in Nigeria: A Comprehensive Guide

Discover how to effectively protect your business secrets in Nigeria’s competitive market. From legal frameworks to practical security measures, this comprehensive guide helps Nigerian entrepreneurs safeguard their intellectual assets.

Enforcing Your Intellectual Property Rights in Nigeria: A Comprehensive Guide

Securing your intellectual property in Nigeria’s dynamic market requires knowledge and strategy. Discover the essential steps, legal frameworks, and enforcement mechanisms to protect your innovations and creative assets effectively.

Hiring and Managing a Rockstar Team for Your Nigerian Startup

Unlock the secrets to assembling a rockstar team for your Nigerian startup. From defining roles to leveraging remote work, discover proven strategies to attract, retain, and nurture top talent in Nigeria’s dynamic business landscape.

Building a Strong Brand Identity for Your Nigerian Startup

Discover how to build a powerful brand identity for your Nigerian startup. Learn to stand out in a competitive market, build trust, and foster customer loyalty. Uncover strategies used by successful Nigerian brands and practical steps to create a lasting impression.

Strategies for Acquiring Your First 100 Customers in Nigeria

Unlock the secrets to acquiring your first 100 customers in Nigeria’s thriving market. From understanding your target audience to leveraging digital marketing and networking, we share proven strategies to help you reach this crucial milestone.

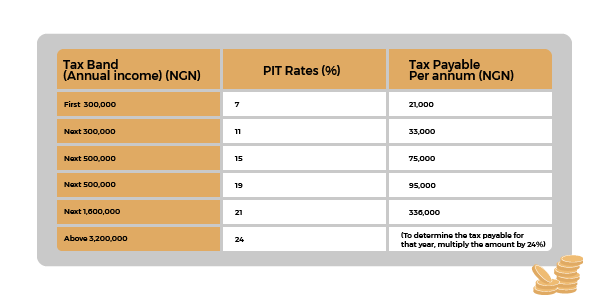

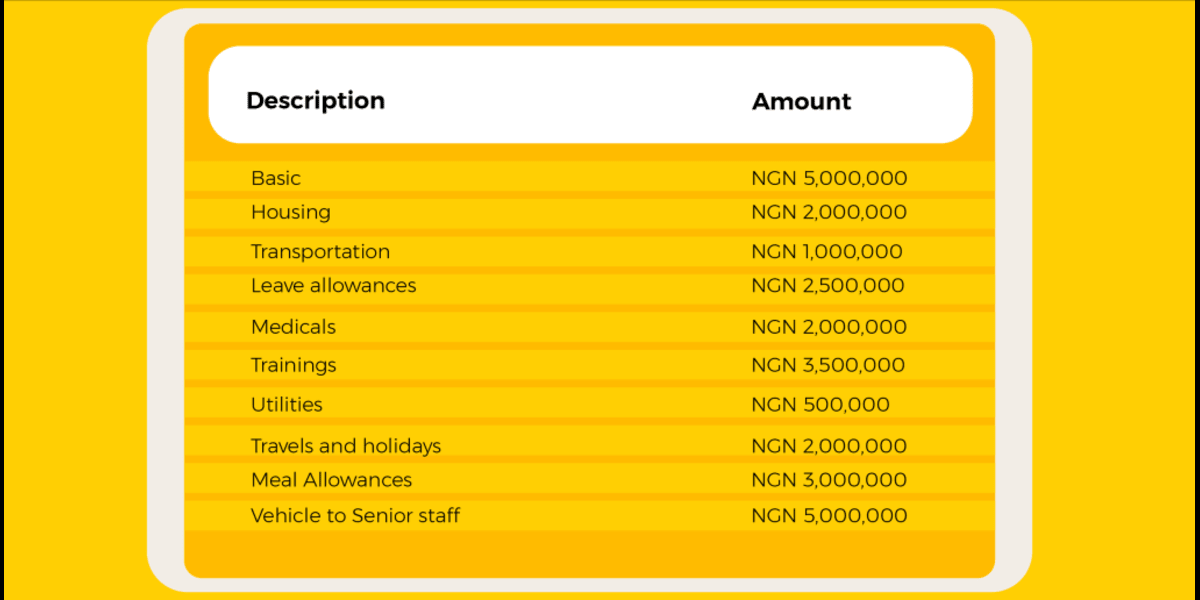

Definitive Guide: Personal Income Tax in Nigeria

What is personal income tax? Personal Income Tax (PIT) is a levy imposed by the federal or state government of Nigeria, on the income of certain individuals such as employees, partners in partnership, families or communities, which they are liable to pay to the relevant federal or state agencies where they reside in Nigeria. Personal…

Nigeria Social Insurance Trust Fund (NSITF): An Expert Guide

A Brief History of the Nigeria Social Insurance Trust Fund (NSITF) The NSITF was established in 1961 as the National Provident Fund (NPF) to provide a poverty alleviation measure as required by convention No.102 of the International Labour Organization (ILO). The scheme is targeted at protecting private sector employees (whose employers were then mostly multinationals)…

The Nigeria Money Laundering Act 2011/2022: An In-depth Guide for SMEs

What is Money Laundering? The term “laundering” means cleaning. This translates money laundering literally to “money cleaning.” Money laundering is, however, broadly defined as concealing the origin of illegally earned money by converting it into a legitimate source. The perpetrators get most of these funds from illegal activities; for example, embezzlement, corruption, drug trafficking, kidnapping,…