Success Stories of Foreign Investors in Nigeria

by Counseal Team

Updated September 2, 2024

Ever wondered why Nigeria is often in the spotlight for economic discussions in Africa? Well, it’s no coincidence. Nigeria holds the title of Africa’ s largest economy, and for good reasons. In this guide we will be highlighting, sharing and detailing notable success stories of foreign investors and why you should be interested in keying into Africa’s largest economy. Let’s delve in.

Nigeria’s Position as Africa’s Largest Economy

The country’s GDP hit a staggering $432 billion in 2020, according to the World Bank. This places it not just as a giant in Africa, but also as a formidable player on the global stage. It’s no wonder that foreign investors are increasingly setting their sights on this West African nation.

One might ask, “What makes the country’s economy so strong?” The answer lies in its diversity. From oil and gas to agriculture, telecommunications, and fintech, Nigeria boasts a wide array of sectors that contribute to its economic prowess.

Oil remains a major player, contributing roughly 9% to it’s GDP and accounting for nearly 90% of its export revenues. However, the non-oil sectors are swiftly catching up. The tech industry, for instance, has seen explosive growth with companies like Flutterwave and Paystack making headlines.

The Role of Foreign Investment in Nigeria’s Growth

Foreign investment has played a crucial role in Nigeria’s economic narrative. In 2020, the country attracted $2.6 billion in foreign direct investment (FDI), despite the global economic downturn caused by the COVID-19 pandemic. Impressive, right?

But it’s not just about the money. Foreign investment brings in technology, expertise, and international best practices, all of which are essential for sustainable growth. For example, the entry of multinational companies like Google and Facebook into the country’s market has not only created jobs but also fostered a culture of innovation and entrepreneurship. So, what makes Nigeria a magnet for foreign investors? Let’s dive into the specifics.

The Appeal of Nigeria to Foreign Investors

Nigeria’s economic landscape is like a buffet of opportunities. Here are some sectors that are particularly appealing:

- Agriculture: Nigeria has over 84 million hectares of arable land, yet only 40% is cultivated. With a population expected to reach 400 million by 2050, the demand for food is set to soar. Investing in modern farming techniques, agro-processing, and supply chain logistics could yield significant returns.

- Technology: Nigeria’s tech scene is booming. Lagos is often dubbed the “Silicon Valley of Africa.” Startups like Flutterwave and Paystack have gained international recognition, attracting millions in foreign investment. There’s a growing appetite for fintech, e-commerce, and health tech solutions.

- Renewable Energy: With an estimated 93 million Nigerians lacking access to electricity, there’s a massive market for renewable energy solutions. Solar power, in particular, offers a sustainable and scalable option. Companies like Lumos and Azuri Technologies are already making headway.

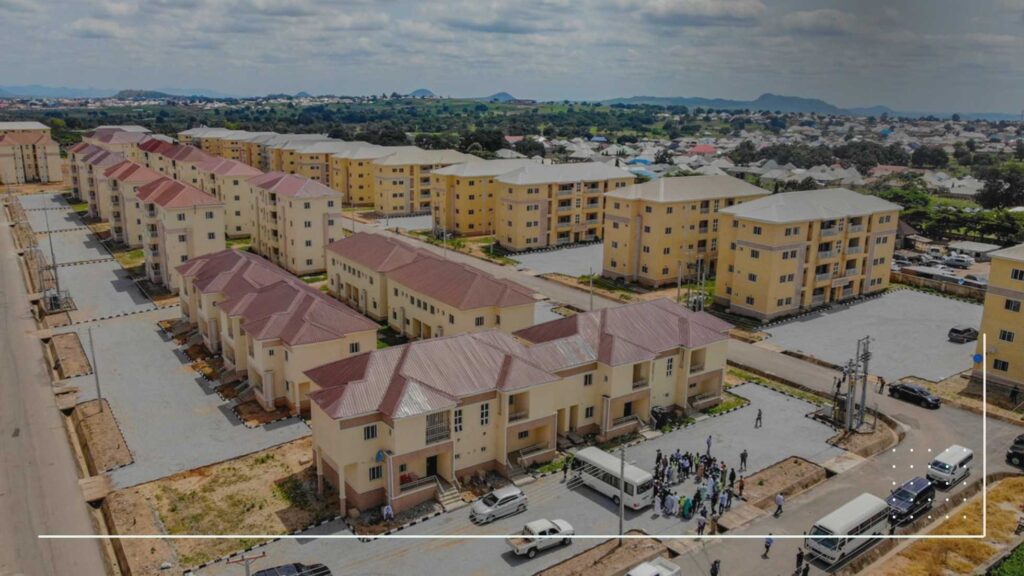

- Real Estate: Urbanisation is driving the demand for residential and commercial properties. Cities like Lagos, Abuja, and Port Harcourt are expanding rapidly. Smart investments in real estate development, affordable housing, and commercial properties can be highly lucrative.

- Healthcare: The COVID-19 pandemic highlighted the urgent need for robust healthcare infrastructure. Investments in medical facilities, telemedicine, and pharmaceutical manufacturing can fill this gap. The government is also open to public-private partnerships in this sector.

Government Initiatives to Attract Foreign Capital

The Nigerian government isn’t sitting idly by; it’s actively courting foreign investors with a slew of initiatives.

The Pioneer Status Incentive (PSI) offers tax holidays of up to five years for qualifying industries. This has been a game-changer for sectors like manufacturing and information technology.

Additionally, the Nigerian Investment Promotion Commission (NIPC) serves as a one-stop shop for foreign investors, streamlining the process of setting up businesses in Nigeria. The NIPC’s efforts have been instrumental in improving Nigeria’s ranking in the World Bank’s Ease of Doing Business Index, where it moved up 15 places in 2020.

Moreover, the Central Bank of Nigeria (CBN) has introduced policies to stabilise the currency and make foreign exchange more accessible. This has alleviated some of the concerns investors have about currency risk.

In summary, Nigeria’s economic potential is undeniable. With its diverse sectors and proactive government initiatives, it’s no wonder that foreign investors are flocking to the country. If you’re considering investing in Nigeria, now is the time to dive in. The opportunities are vast, and the rewards could be substantial.

Success Stories of Foreign Investment in Nigeria

FinTech’s Rise to Prominence

Nigeria’s FinTech sector has been a magnet for foreign investment, and two companies stand out: Flutterwave and Kuda Bank.

Flutterwave’s Funding Success

Flutterwave, a Nigerian FinTech company, has made waves with its impressive funding rounds. In early 2021, the company raised $170 million in a Series C round, pushing its valuation to over $1 billion. This funding success is not just a win for Flutterwave but a testament to the lucrative potential of Nigeria’s FinTech ecosystem.

Why is Flutterwave so attractive to foreign investors? It’s all about the market. Nigeria has a burgeoning online payment sector, driven by a young, tech-savvy population. Flutterwave has capitalised on this by offering seamless payment solutions that cater to both local and international markets.

Kuda Bank’s Growth Through Foreign Investment

Kuda Bank, a digital-only bank, has also attracted significant foreign investment. In March 2021, Kuda raised $25 million in a Series A round led by Valar Ventures. This investment helped Kuda scale its operations and expand its customer base, which exceeded 1 million users by mid-2021.

Kuda’s unique selling point? It’s the first mobile-only bank in Nigeria, offering zero-fee banking services. This innovative approach appeals to users fed up with traditional banking fees, making Kuda a darling for both consumers and investors.

The Tech Boom and Serena Williams’ Investment

Nigeria’s tech sector has seen remarkable growth, attracting high-profile investors like Serena Williams. But what makes this sector so appealing?

Analysis of the Tech Sector’s Attractiveness

Nigeria’s tech scene is buzzing with activity. From e-commerce to health tech, the sector is diverse and dynamic. According to the National Bureau of Statistics, Nigeria’s ICT sector contributed 15.05% to the GDP in Q1 2021. This is driven by a combination of factors, including a large, youthful population and increasing internet penetration.

Foreign investors are drawn to Nigeria’s tech sector due to its prospects for high returns. The country’s youthful demographic is not just large but also increasingly connected. With over 100 million internet users, Nigeria offers a vast market for tech products and services.

Tutorial: How to Navigate Nigeria’s Tech Investment Opportunities

So, you’re interested in investing in Nigeria’s tech sector? Here’s a step-by-step guide to get you started:

- Research the Market: Understand the landscape. Tools like Statista and the National Bureau of Statistics can provide valuable insights.

- Identify Key Players: Look for companies with strong growth potential. Besides Flutterwave and Kuda, other notable mentions are Paystack, Andela, and Jumia.

- Engage with Local Partners: Local knowledge is crucial. Partnering with local firms or consultants can help you navigate regulatory and cultural nuances.

- Attend Tech Events: Events like Techpoint Build and Lagos Startup Week are excellent for networking and gaining firsthand insights.

- Leverage Government Initiatives: The government offers various incentives for tech investments, such as tax holidays and grants. Familiarise yourself with these to maximise your investment.

In summary, Nigeria’s tech and FinTech sectors offer exciting opportunities for foreign investors. With success stories like Flutterwave and Kuda Bank, and high-profile investments from personalities like Serena Williams, the potential is clear. So why wait? Dive in and explore the lucrative world of Nigerian tech investments. Now let’s further explore the agricultural sector.

Agriculture Sector’s Attraction of Foreign Funds

Shettima’s Initiative to Woo Foreign Investors

Nigeria’s agriculture sector has recently attracted significant foreign investment, largely because of Vice President Kashim Shettima’s groundbreaking initiatives. Shettima has showcased the country’s vast arable land, favorable climate, and growing food demand, making it an ideal investment destination. His efforts are: organizing investor forums, agricultural expos, and engaging directly with international stakeholders, effectively removing barriers that previously deterred foreign investments.

Case in point: Shettima’s efforts ushered a successful partnership with Olam International, a top agri-business operating from seed to shelf. Olam International invested over $150 million in Nigeria’s rice farming and milling sector, creating thousands of jobs and significantly boosting local production.

Steps for Investing in Nigeria’s Agriculture

So, you’re convinced that Nigeria’s agriculture sector is ripe for investment. But where do you start? Here are some practical steps to guide you:

- Conduct Market Research: Understand the market dynamics, demand trends, and key players. Resources like the Nigeria Agribusiness Report from Business Monitor International can provide valuable insights.

- Identify Target Crops or Products: Focus on high-demand crops such as rice, cassava, cocoa, and maize. Each of these has a strong domestic demand and export potential.

- Understand Legal and Regulatory Framework: Familiarise yourself with Nigeria’s agricultural policies, land acquisition laws, and investment incentives. The Nigerian Investment Promotion Commission (NIPC) is a good starting point.

- Engage Local Partners: Collaborate with local farmers, cooperatives, and agribusinesses. This not only eases entry but also ensures compliance with local practices and regulations.

- Access to Finance: Explore funding options such as the Central Bank of Nigeria’s (CBN) Anchor Borrowers’ Programme, which provides loans to agricultural producers.

Mining Sector’s Untapped Potential

Adegbite’s Call for Increased Foreign Investment

While agriculture has been a focal point, Nigeria’s mining sector remains vastly untapped. The Honourable Minister of Mines and Steel Development, Olamilekan Adegbite, has been vocal about the immense opportunities in this sector. Adegbite’s call for increased foreign investment highlights the government’s commitment to transforming mining into a major economic pillar.

“Think about it,” Adegbite often says, “Nigeria is blessed with over 44 different types of minerals in commercial quantities.” From gold and lead to zinc and rare earth metals, the potential is staggering. Yet, the sector contributes less than 1% to Nigeria’s GDP. This is a golden opportunity for savvy investors.

Case study: Australian mining firm, “Symbol Mining”, successfully invested in Nigeria’s zinc and lead mines, generating significant returns. Their success story is a testament to the sector’s viability.

Exploring Investment Opportunities in Mining

Ready to dive into Nigeria’s mining sector? Here’s how you can get started:

- Initial Research and Feasibility Study: Assess the mineral resources, geological data, and market demand. The Ministry of Mines and Steel Development offers extensive resources and reports.

- Regulatory Compliance: Obtain the necessary licences and permits. The Mining Cadastre Office (MCO) is responsible for issuing exploration and mining licences.

- Local Partnerships: Engage with local mining companies and communities. This not only facilitates smoother operations but also aligns with Nigeria’s local content policies.

- Investment Incentives: Take advantage of fiscal incentives such as tax holidays, duty waivers on mining equipment, and expatriate quota approvals. These incentives are designed to attract and retain foreign investors.

- Sustainable Practices: Emphasise environmental sustainability and corporate social responsibility. This not only ensures compliance with regulations but also fosters goodwill with local communities.

In retrospect, both the agriculture and mining sectors in Nigeria offer immense opportunities for foreign investors. By leveraging the initiatives and opportunities highlighted, investors can navigate these sectors effectively and reap substantial rewards, but it’s not without its hurdles. Let’s dive into some of the common obstacles and how to effectively tackle them.

Challenges and Solutions for Foreign Investors

Common Challenges Faced by Foreign Investors

- Regulatory Hurdles: Navigating the country’s regulatory landscape can be daunting. It has a plethora of laws and regulations that can vary by state. According to the Nigerian Investment Promotion Commission (NIPC), investors often find the regulatory environment cumbersome and confusing.

- Corruption: Unfortunately, corruption remains a significant issue. Transparency International ranks Nigeria 149th out of 180 countries in its Corruption Perceptions Index. This can create an unstable business environment and lead to unexpected costs.

- Infrastructure Deficiency: Poor infrastructure, including unreliable power supply and inadequate transportation networks, can pose significant challenges. The World Bank reports that Nigeria loses around $29 billion annually due to power shortages alone.

- Security Concerns: Security issues, particularly in the northern regions, can deter investment. The Global Terrorism Index places Nigeria as one of the top ten countries most affected by terrorism.

- Market Volatility: Fluctuations in the Naira and economic instability can make financial planning difficult. The Central Bank of Nigeria (CBN) has implemented several measures to stabilise the currency, but challenges remain.

Effective Strategies for Overcoming Obstacles

So, how do you navigate these challenges? Here are some practical strategies:

- Thorough Due Diligence: Before diving in, conduct extensive research. Use resources like the NIPC and counseal.com to understand the regulatory environment. Engage local legal and financial experts to help you navigate these complexities.

- Building Strong Local Partnerships: Partnering with reputable local businesses can help mitigate risks. These partners can offer valuable insights and help you navigate the local landscape. For instance, a partnership with Dangote Group, one of Africa’s largest conglomerates, can provide a solid foothold in the market.

- Leverage Technology: Use technology to overcome infrastructure deficiencies. For example, solar power solutions can mitigate electricity issues, and e-commerce platforms like Jumia can help you reach customers despite transportation challenges.

- Risk Mitigation Strategies: Invest in comprehensive insurance policies to protect against unforeseen events. Companies like AXA Mansard offer tailored insurance solutions for foreign investors.

- Engage with Government Bodies: Regularly engage with government bodies like the NIPC and the CBN. They offer various incentives and support programmes for foreign investors.

The Role of Government and Policy in Facilitating Investment

Government policies can significantly impact foreign investment. Let’s explore how Nigerian government policies shape the investment landscape and look at some successful collaborations.

Impact of Government Policies on Foreign Investment

Government policies can either facilitate or hinder foreign investment. In Nigeria, several policies have been implemented to attract foreign investors:

- Investment Incentives: The NIPC offers numerous incentives, including tax holidays, duty exemptions, and investment allowances. These incentives aim to make Nigeria an attractive destination for foreign investors.

- Ease of Doing Business Reforms: Nigeria has made strides in improving its business environment. The World Bank’s Doing Business Report 2020 ranks Nigeria 131st out of 190 countries, a significant improvement from previous years. Reforms include simplifying business registration processes and improving access to credit.

- Special Economic Zones (SEZs): The government has established SEZs to attract foreign investment. These zones offer various benefits, including tax breaks and simplified customs procedures.

- Anti-Corruption Measures: The government has launched several initiatives to combat corruption, such as the Treasury Single Account (TSA) and the Whistleblower Policy. These measures aim to create a more transparent and stable business environment.

Successful Government-Investor Collaborations

Several successful collaborations between the Nigerian government and foreign investors highlight the positive impact of supportive policies:

- LNG Projects: The Nigerian Liquefied Natural Gas (NLNG) project is a prime example. A joint venture between the Nigerian government and multinational companies like Shell, Total, and ENI, it has been a resounding success. The project has attracted over $15 billion in foreign investment and significantly boosted Nigeria’s export earnings.

- Dangote Refinery: The Dangote Refinery, a $15 billion project, is another success story. Supported by various government incentives, this project is set to transform Nigeria’s oil industry and reduce the country’s dependence on imported fuel.

- Telecommunications Sector: The liberalisation of Nigeria’s telecommunications sector has attracted significant foreign investment. Companies like MTN and Airtel have thrived, thanks to supportive government policies and a growing consumer base.

By understanding and leveraging government policies, foreign investors can navigate the Nigerian market more effectively, unlock significant opportunities and maximise their returns. So, gear up, do your homework, and take the plunge into one of Africa’s most promising markets.

Predictions and Trends for the Coming Years

Forecast: Nigeria’s Investment Climate in the Near Future

Nigeria’s investment climate is undergoing a transformation. In the next few years, we can expect a mix of challenges and promising opportunities. According to the World Bank, the country’s GDP growth is projected to accelerate to 2.9% in 2023. This is driven by improvements in the oil sector, increased government spending on infrastructure, and a surge in non-oil sectors.

But it’s not all smooth sailing. Inflation remains a concern, hovering around 16%. Additionally, the Central Bank of Nigeria’s tight monetary policy could pose hurdles for new investors. However, these challenges are not insurmountable. With strategic planning and a keen eye on market trends, foreign investors can navigate these waters successfully.

Key Takeaways on the Importance of Foreign Investment for Nigeria’s Growth

Foreign investment is crucial for the country’s economic growth. It brings in not just capital, but also technology, expertise, and global best practices. According to the National Bureau of Statistics, the country attracted $2.6 billion in Foreign Direct Investment (FDI) in 2021. This inflow supports job creation, boosts productivity, and enhances competitiveness.

Foreign investors also play a pivotal role in diversifying the economy. Reliance on oil has been a double-edged sword for Nigeria. Diversification into sectors like agriculture, technology, and renewable energy can reduce vulnerability to oil price shocks and foster sustainable growth.

Moreover, successful foreign investments can catalyse further investments. When investors see positive returns and efficient business environments, it creates a virtuous cycle of confidence and investment.

Call to Action

Ready to dive into the Nigerian market? At Counseal, we provide tailored advice and support to help you navigate the complexities of investing in Nigeria. Visit counseal.com for more information and expert assistance. Let’s turn challenges into opportunities and make your investment journey a success!