The Tax System in Nigeria: A New & Updated Overview

by Counseal Team

Updated November 26, 2023

A tax is a compulsory contribution of a taxpayer to the government’s revenue. It is a levy placed by the government on workers’ income and business profits or added to the cost of some goods, services, and transactions. Where the government and the authorities manage taxation well, it filters back into society to aid social development.

An example is the education tax that is pooled into the tertiary fund (TETFUND). The government uses this pool of money for infrastructural developments and educational grants in Nigerian universities. Tax can be direct (e.g., company income tax) or indirect (e.g., Value Added Tax).

In analysing the Nigerian tax system, we need to consider the taxes in force presently and the reality in which they work, i.e., the various tax laws and their administration, and how they apply to you. Nigeria runs a decentralised tax system in which every tier of government handles its own administration.

The Federal Inland Revenue Service (FIRS) handles the taxes remittable to the federal government while each state has its own Internal Revenue Service, e.g., Kwara State Internal Revenue Service (KWIRS) and Lagos State Internal Revenue Service (LIRS). The local government revenue committees administer the taxes due to them.

Key Stakeholders in the Tax System in Nigeria

The Government

This includes the federal, state, and local governments with their respective ministries and agencies.

The government is obligated to:

- Implement and regularly review tax policies and laws

- Provide information on all revenue collected on a quarterly basis

- Ensure adequate funding, administrative and operational autonomy of tax authorities

The Taxpayer

A taxpayer is a person or group of persons or an entity that pays or is liable to tax. As a taxpayer, you are the primary focus of the tax system. It entitles you to:

- Relevant information for the discharge of tax obligations

- Receive prompt, courteous, and professional help in dealing with tax authorities.

- Raise objections to decisions and assessments

- Receipt of a response to objections within a reasonable time

- A fair appeal

- Self-representation or representation by any agent of your choice, provided that the agent charges for his services and is an accredited tax practitioner.

As a taxpayer, you are obligated to:

- Register and get a Tax Identification Number (TIN)

- File tax returns by the due dates

- Keep accounting books and records of transactions

- Cooperate with an officer of the FIRS while on official business at your business location

- Record keeping (manual and/or electronic formats). All documents should be properly and safely kept.

- Demand for, sight and verify Tax Clearance Certificate from potential vendors/contractors before you award contracts.

Revenue Agencies

The revenue agencies include the Federal Inland Revenue Service (FIRS), the various States Internal Revenue Service, including the FCT, and the Local Government Authorities. The agencies are obligated, alongside their statutory functions, to:

- Treat the taxpayer as a customer.

- Undertake tax awareness and taxpayers’ education

Professional Bodies and Tax Practitioners

These are the tax agents that act on your behalf in dealing with the tax agencies. This also includes tax consultants. They are bound by their professional duty of care in all their dealings with and on behalf of their clients.

Media and Advocacy Group

They are a vital stakeholder as they are close to the grassroot community. They are obligated and enjoined to:

- Promote tax education and awareness

- Articulate, protect, and advance taxpayers’ rights

- Advance accountability and transparency in the utilisation of tax revenue

Types of Taxes in Nigeria

Personal Income Tax (PIT)

The Personal Income Tax (Amendment) Act 2011 regulates it.

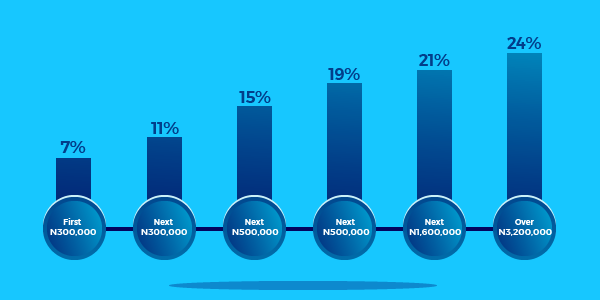

For the past 10 years, it has been capped at between 7% – 24% of an individual’s annual income derived from labour, pensions, interest, and dividends. The rates used by the FIRS to charge personal income tax are:

Value Added Tax (VAT)

This is a form of indirect tax on the supply of goods and services that is eventually borne by you as a consumer of goods and services. It is presently charged at a flat rate of 7.5%.

The Value Added Tax is regulated by the Value Added Tax Act. The Act provides that, when you begin a business, you must register with the FIRS within six months or be liable to a penalty of ₦10,000 for the first month and ₦5,000 for every subsequent month that you remain unregistered.

Goods and Services exempt from VAT

- Basic food items

- Books and educational materials

- All medical products

- All pharmaceutical products

- Baby products

- Plants and machineries imported for export processing

- Tractors, ploughs, and agricultural equipment purchased for utilisation of gas by downstream petroleum operators

- Locally produced fertilisers, agricultural and veterinary medicine, farming and transportation equipment

- Medical services

- Services rendered by community banks, people’s banks, and mortgage institutions

- Private transactions

- Edible salt

- House rent

- Water

- Hobby activities

- Salaries and wages

- Plays and performances conducted by educational institutions as part of learning activities

- All exported services

- Commercial vehicles and spare parts

- Water treatment chemicals

- Diplomatic goods

All the above items are based on a list which specifies the details and circumstances of exemption. You can find the list here.

Company Income Tax (CIT)

The Company Income Tax Act, Cap C21, LFN 2004 (as amended), governs it. It is imposed on the profit of a company from all sources, be it from business or investment. Companies paying dividends to their shareholders are to first pay tax on their profits before they distribute them as dividends.

CIT only applies to profits derived from trade/business activities carried out by the company. It is not applicable to profits that are subject to Capital Gains Tax, Petroleum Profits Tax, and Personal Income Tax.

As a company, you are to pay provisional tax not later than 3 months from the beginning of each year of assessment, which is an amount equal to the tax paid in the previous year of assessment. It is a payment on account of the year’s income tax assessment payable to the Federal government.

The FIRS has a set due date for the filing of CIT.

- Newly incorporated companies are to file within 18 months of incorporation or not later than 6 months after their accounting period, whichever is earlier.

- For existing companies, within 6 months from the end of the accounting year.

- You can apply to pay in instalments as a self-assessment filer. You will need to begin payment of an instalment before the due date, but such an instalment cannot extend beyond two months after the due date.

A company in operation for over four years is liable to a minimum tax/alternative tax, unless specifically exempted by the tax law. The minimum tax rate is 0.5% of the gross turnover of a company.

A minimum tax is applicable where;

- A company makes a loss

- A company has no tax payable

- Tax payable on assessable profits is less than the minimum tax

- The company’s profit for the year is not taxable

Minimum tax/alternative tax also applies to foreign digital companies deriving profits from Nigeria.

The minimum tax does not apply to companies in the first four calendar years of business, companies engaged in the agriculture business, or small companies.

For non-life insurance companies, the minimum tax is calculated as 0.5% of the gross premium. Life insurance companies’ minimum tax is calculated as 0.5% of gross income.

Resident companies are liable for CIT on their worldwide income, while foreign companies are subject to CIT on their Nigeria-sourced income. This includes foreign companies with a digital presence and Significant Economic Presence (SEP) in Nigeria. This applies where they derive an income of N25 million or its equivalent from Nigeria in a year. The taxable activities for foreign companies include:

- Streaming or downloading of digital content

- Transmission of data collected about users in Nigeria

- Provision of goods or services directly or through a digital platform

- Intermediation services that link suppliers and customers in Nigeria

The CIT rate is determined by the size of the company, which is measured by profits:.

- Small companies with a turnover of less than ₦25 Million are charged 0%

- Medium companies with a turnover of between ₦25 Million and ₦100 Million are charged 20%

- Companies with a turnover greater than ₦100 Million are charged 30%

Profits exempt from Company Income Tax

- Profits of a statutory or a registered friendly society. A friendly society is an association with a common financial or social purpose, which could be insurance, savings or co-operative banking;

- Profits of a registered co-operative society gotten only from co-operative activities;

- Company engaged in religious, charitable or educational activities of a public character

- Companies formed for the promotion of sporting activities and all its profits are spent for the same purpose;

- Profits of a company registered as a trade union under the Trade Union Act;

- Dividend distributed by unit trust

- Company established by an enactment with the purchasing authority to gain any commodity for export from Nigeria;

- Company established by the law of a state to foster the economic development of that state

- Dividend, interest, rent, or royalty derived by a company from a country outside Nigeria through Government approved channels;

- Interest on deposit accounts of a foreign non-resident company. This is where the deposits are only in foreign currencies transferred through Government approved channels.

- Interest on foreign currency domiciliary in Nigeria

- Profits of a small company

- Profits of a Nigerian company regarding goods exported from Nigeria repatriated to Nigeria and used for the purchase of raw materials, plant equipment, and spare parts.

- Profits of a company whose supplies are only inputs to the manufacturing of products for export. The exporter needs to give the company a certificate of purchase.

- Dividends and rental income received by Real Estate Investment Trust Schemes

- Franked Investment income

- Profit of a company established within an export processing zone or free trade zone

All exemptions apply only to profits gotten from the activities mentioned. Any other business activities different from the ones mentioned will be subject to tax.

Capital Gains Tax (CGT)

It is charged at 10% of accrued gains and governed by the Capital Gains Tax Act, Cap C1 LFN 2004 (as amended).

All chargeable assets, including all forms of property, whether or not in Nigeria, are subject to CGT when disposed of at a gain. CGT will apply to gains accruing from a property disposed of outside Nigeria.

For this to apply to you, you would have to bring the gains into Nigeria. The allowable expenses include fees, commissions, professional fees, and the cost of transfer. The due date for filing is the same as for CIT.

Exemptions

- Charities;

- Statutory or registered friendly societies;

- Registered co-operative society;

- Registered trade Union;

- Local government council;

- Statutory bodies established to buy products for export and those established to foster economic development;

- Retirement benefit scheme;

- Awards for valour or gallant conduct;

- Stocks and shares of the Nigerian government;

- Replacement of business assets;

- Exemptions from tax on gains arising from take-overs;

- Holders of unit trusts;

- Life assurance policies;

- Rights under other policies of insurance;

- Compensation received for personal injury;

- Disposal of a personal principal private residence;

- Movable property sold for less than N1000;

- Motor cars;

- Disposal of gifts.

Withholding Tax (WHT)

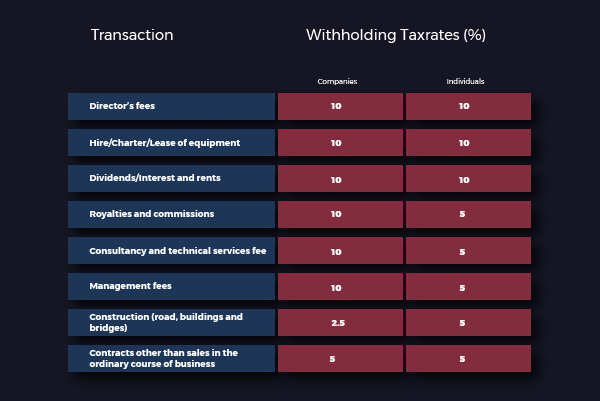

This tax is used to collect income tax in advance, offsetting or reducing tax liabilities. You can deduct this at varying rates, ranging from 5% to 10% for individuals and 2.5% to 10% for companies, depending on the transaction. It is to be deducted from payments made to contractors, suppliers, and providers of services. You remit the deductions to the tax authority before the 21st day of the month following the month in which you made the deduction. The penalty for failure to remit tax is 10% of the amount not deducted.

Companies are required to submit electronically a schedule of all their supplies for the month showing:

- Tax Identification Number (TIN) of the supplier

- Address of supplier

- The nature of the transaction

- Withholding Tax deducted

- Invoice number

WHT applies to the following specified transactions:

WHT deductions for individuals should be remitted to the State Board of Internal Revenue of the state where the contractor lives. You should remit it to the FIRS in the case of a foreigner (company or individual), incorporated company, individual, or enterprise resident in the Federal Capital Territory.

To avoid double taxation, Nigeria currently has tax treaties with 13 countries. Some of these treaties are being ratified while others have not yet been ratified. For other non-treaty countries, there is a fixed rate of 10%.

Transactions exempt from WHT

- Direct purchase across the counter

- Direct purchase of raw materials from suppliers as distinct from contract supply

- Sale in the ordinary course of business

- All imported goods

- Inter-bank interest

- Income exempted from income tax

- Claims in the insurance business

- Interest on bonds

- Dividends redistributed by holding companies

Stamp Duties

These are duties levied on written documents for transactions such as agreements, payment receipts, share capital, mortgages, land and property transactions, loans, etc. to give them legal recognition. Stamp duty can be in two forms:

- Fixed. This has a set standard fee for the transactions that fall under this category,

- Ad-valorem. You can calculate this by using the consideration paid for the transaction in question. It is usually in percentages.

The FIRS currently runs an Integrated Stamp Duty Service. It is an online platform that allows you to carry out stamp duty transactions. To use this platform, you must have your TIN. On completion, you can generate a stamp duty certificate and the platform will automatically send a copy to your email. To be on the safe side, we will advise you to use the same email address used while registering with the FIRS.

Banks and other financial institutions are mandated to charge stamp duty on certain eligible transactions. Transactions above ₦10,000 attract a fee of ₦50, except for transfers between accounts owned by the same person or a salary account.

The Stamp Duties Act, Cap S8, LFN 2004 (as amended), regulates Stamp Duty. Both the federal and States internal revenue service administer it. The FIRS administers stamp duty between a company and an individual, group or body of individuals. FCT and the States’ Internal Revenue Service administer transactions between individuals.

They are to be paid on documents before the parties sign them.

Customs and Excise

The rates vary from 5% to 35% depending on the item. It is an indirect tax paid by producers/importers of goods. The Customs and Excise Management Act (CEMA) regulates it.

Custom duty applies to goods imported into the country. Customs duty is determined based on the existing Harmonised Commodity and Coding System, also known as the HS code. Only items imported by the Nigerian President are exempt from the payment of duties or taxes.

Excise duties apply to locally manufactured goods. An excise licence has to be applied for by manufacturers and approved before they can manufacture excisable goods in Nigeria. You can make such applications to the Comptroller General of the Nigeria Customs Service through the area controller of your region.

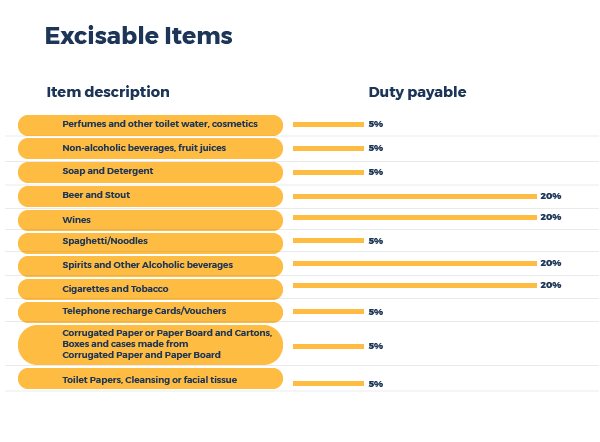

Excisable Items

Education Tax

Education tax is capped at 2.5% of a company’s assessable profit for each year of assessment. It is also known as the Tertiary Education Tax, which funds the Tertiary Education Fund (TETFUND). It is imposed on all companies.

The tax is payable within two months of an assessment notice from the FIRS. A company can pay on a self-assessment basis along with their company income tax. It is an allowable deduction for companies subject to the Petroleum Profit Tax.

Petroleum Profit Tax (PPT)

It applies to companies involved in upstream petroleum operations. They pay this in place of CIT. The Petroleum Profit Tax Act regulates it.

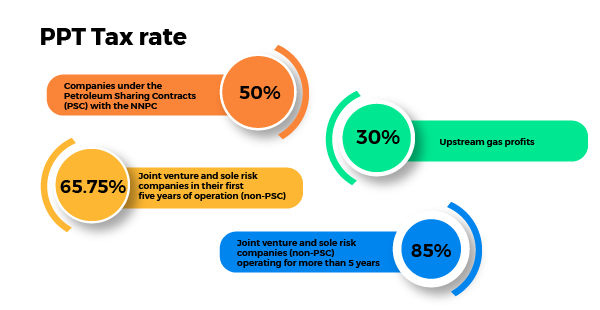

PPT Tax rates

Following the enactment of the Petroleum Industry Act 2021 (this applies to existing licence holders upon renewal of their licence), Hydrocarbon Tax (HT) was introduced. It applies to petroleum operations involving crude oil, condensates and natural gas liquids produced from associated gas in an oil field. The Act further provides that holders of a Petroleum Prospecting Licence (PPL) and Petroleum Mining Lease (PML) will be subject to both the Company Income Tax and the Hydrocarbon Tax (HT). The HT rates are:

- PML – 30%

- PPL – 15%

Company Income Tax applies at 20% or 30% depending on the turnover of the company. HT will not be deductible from the Company Income Tax payable by the company.

Deep offshore companies are exempt from HT.

Current oil mining licence and oil prospecting licence holders will continue to be taxed in line with the PPT Act unless they execute a conversion contract in line with the Petroleum Industry Act 2021.

The penalty for late filing of a PPT return is ₦10,000 and ₦2,000 for every day the failure continues. If you do not pay an instalment by the due date, it will attract a penalty of 10%.

E-FILING

The FIRS now has an online platform for filing tax returns. You can make payments via the platform or through the FIRS designated banks.

Taxes Applicable (E-filing)

- Petroleum Profits Tax

- Companies Income Tax

- Value Added Tax

- Education Tax

- Capital Gains Tax

- National Information Technology Development Levy

The e-filing platform requires an access form to be filled out by the CEO or the officer in charge of a company to determine the level of access you will have on the platform. The access options provided are:

- View only

- Declaration, i.e., to file tax returns

- TIN validation

- Submission and upload of supporting documents (tax and non-tax related)

- TCC validation

The Joint Tax Board (JTB)

The Personal Income Tax Act 2004 created the JTB and charged it with ensuring uniformity of standards and the application of Personal Income Tax administration in Nigeria.

Membership

- The Chairman of FIRS who would also be the Chairman of JTB

- An experienced person in income tax matters is nominated by and from each state of the Federation

- The representative of:

- Federal Road Safety Commission (FRSC)

- Revenue Mobilisation Allocation and Fiscal Commission (RMAFC)

- Federal Capital Territory Administration (FCTA)

- Federal Ministry of Finance

- FIRS

- A secretary experienced in income tax matters to be appointed by the board.

- A legal adviser (also serves as legal adviser to FIRS)

Functions

- Advise all tiers of government on tax matters.

- Conflict Resolution on Tax Jurisdiction among States

- Promote uniformity in both the application of the tax laws and in the incidence of a tax on individuals throughout the country

- Ensure adherence to its decisions on procedure and interpretation of income tax matters in all the States

The Challenges of the Nigerian Tax System

- Lack of robust framework for the taxation of informal sector and high network individuals, thus limiting the revenue base and creating inequity

- Revenue leakage – The database of taxpayers is in fragments, leading to a weak structure for the exchange of information by and with tax authorities, which results in revenue leakage

- The uncoordinated drive by all tiers of government to increase internally generated revenue has led to the arbitrary exercise of regulatory powers for revenue purpose

- Lack of clarity on the taxation powers of each level of government on the powers of one level of government by another

- Information available to taxpayers on tax compliance requirements is insufficient, which creates uncertainty and non-compliance

- Poor accountability for tax revenue

- Insufficient capacity, which has led to the delegation of powers of revenue officials to third parties, creating complications in the tax system

- Use of aggressive and unorthodox methods for tax collection

- Failure by tax authorities to honour refund obligations to taxpayers

- The irregular review of tax legislation, which has led to obsolete laws that do not reflect current economic realities; and

- Lack of strict adherence to tax policy direction and procedural guidelines by the tax authorities

Tax Refunds in Nigeria

You have a right to a tax refund in the event of tax overpayment or wrong payment from the FIRS or the States’ Internal Revenue Service. You can make a request in writing, stating the relevant details such as the period in question, type of tax, reason for refund, and amount of refund. On request, the FIRS or the affected State Internal Revenue Service will conduct a special audit into your account to find out your claim.

On audit, they will check all your tax accounts, and if there is an underpayment in other tax areas, they will set the excess off against them.

In some circumstances, taxpayers end up owing the government when an audit is conducted and they discover underpayment in other tax areas. To prevent this, ensure proper documentation and up-to-date payment of tax returns.

The government is liable to pay within 90 days after a tax refund request goes through.

You can claim a tax refund in two ways;

- Credit method

Here, you may decide to set off the tax refund balance resulting in your favour against the tax to be paid in subsequent months by making the outstanding refund from the previous month the first charge in the current month’s tax payments. This is a popular refund approach in many tax systems, and the FIRS encourages it since it saves time and unnecessary paperwork.

- Direct cash refund method

There are some companies that perpetually have tax refund claims. We cannot reasonably expect such a company to set–off by credit because the need for a refund is repetitive. It is for this category of companies that regular cash refunds may be necessary.

You can also make a refund using both methods at once, depending on the amount of the refund.

In this guide, we have reviewed the Nigerian tax system, its administration, challenges, and how it applies to you as a taxpayer. Nigeria’s tax system can be complex. Get a free personalised session with an expert to review your specific tax needs and review next steps.